Blank Tractor Bill of Sale Template for Ohio State

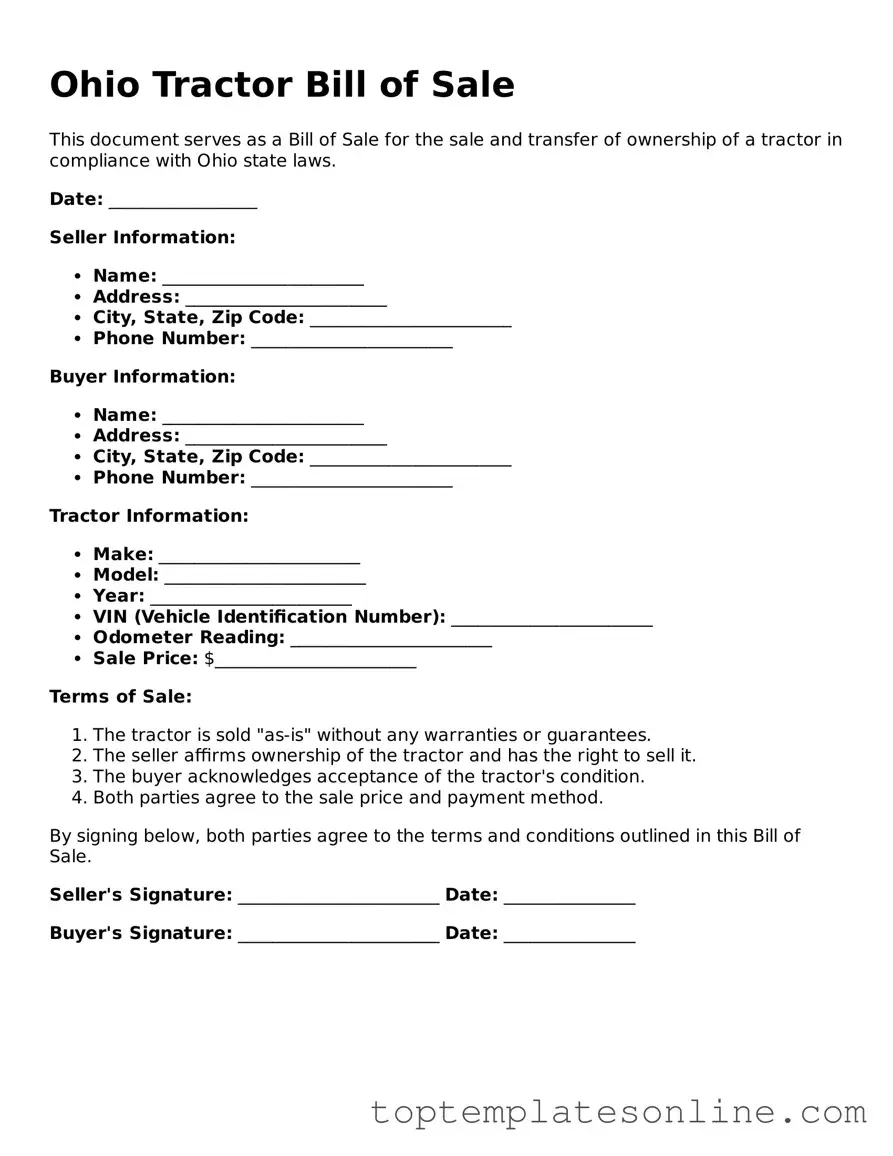

When buying or selling a tractor in Ohio, having the right documentation is essential to ensure a smooth transaction. The Ohio Tractor Bill of Sale form serves as a vital record, providing important details about the sale, including the names and addresses of both the buyer and seller, the tractor's make, model, and identification number, and the sale price. This form not only protects both parties by outlining the terms of the sale but also serves as proof of ownership transfer. Additionally, it can help prevent future disputes by clearly stating any conditions related to the sale, such as warranties or "as-is" agreements. Completing this form accurately is crucial, as it may be required for registration and titling purposes with the Ohio Bureau of Motor Vehicles. Understanding the key components of the Tractor Bill of Sale can streamline the process and ensure compliance with state regulations, making it an indispensable tool for anyone involved in the agricultural machinery market in Ohio.

Some Other State-specific Tractor Bill of Sale Templates

Farm Equipment Bill of Sale - Document the sale process to keep everything clear and organized.

In addition to understanding the intricacies of the New York Lease Agreement form, landlords and tenants can benefit from utilizing available resources, such as the template found at https://newyorkform.com/free-lease-agreement-template/, which can help streamline the preparation of this important legal document.

Farm Equipment Bill of Sale - Facilitates the transfer of ownership for legal and financing purposes.

Can You Hand Write a Bill of Sale - May be required for registering the tractor in the new owner's name.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This includes missing the seller's or buyer's name, address, or contact information. Each section must be fully filled out to avoid delays in processing.

-

Incorrect Vehicle Identification Number (VIN): Some people mistakenly write down the wrong VIN. This number is crucial for identifying the tractor. Double-checking the VIN against the title can prevent future issues.

-

Failure to Sign: It is common for sellers or buyers to forget to sign the document. Both parties must sign the bill of sale for it to be legally binding. Without signatures, the sale may not be recognized.

-

Omitting Sale Price: Some individuals neglect to include the sale price. This information is necessary for tax purposes and to establish the value of the transaction. Always list the agreed-upon price clearly.

-

Not Keeping a Copy: After completing the form, many people fail to keep a copy for their records. Retaining a copy is important for future reference, especially in case of disputes or questions about the sale.

Guide to Writing Ohio Tractor Bill of Sale

Once you have the Ohio Tractor Bill of Sale form in hand, you’ll need to fill it out carefully to ensure all necessary information is included. This document will help you complete the sale of a tractor legally and protect both the buyer and seller. Follow these steps to fill out the form accurately.

- Start with the date: Write the date of the transaction at the top of the form.

- Enter seller information: Provide the full name and address of the seller. Make sure to include the city, state, and ZIP code.

- Provide buyer information: Fill in the buyer's full name and address, including city, state, and ZIP code.

- Describe the tractor: Include details such as the make, model, year, and Vehicle Identification Number (VIN) of the tractor.

- State the sale price: Clearly write the agreed-upon sale price for the tractor.

- Include any additional terms: If there are specific terms or conditions related to the sale, note them in this section.

- Sign the form: Both the seller and the buyer must sign and date the form to validate the transaction.

After completing the form, make sure both parties keep a copy for their records. This will be important for any future reference or legal requirements related to the sale.

Documents used along the form

When buying or selling a tractor in Ohio, the Tractor Bill of Sale form is essential for documenting the transaction. However, several other forms and documents may also be necessary to ensure that the process is smooth and legally compliant. Below is a list of commonly used documents that complement the Tractor Bill of Sale.

- Title Transfer Form: This document is crucial for transferring ownership of the tractor. It provides proof that the seller has relinquished ownership and that the buyer is now the rightful owner.

- Odometer Disclosure Statement: Required for certain vehicles, this form verifies the tractor's mileage at the time of sale. It helps prevent fraud and ensures accurate record-keeping.

- Power of Attorney: In some cases, sellers may not be able to appear in person for the sale. A Power of Attorney allows someone else to sign documents on the seller's behalf, making the transaction possible. For more information, you can refer to Florida Forms.

- Affidavit of Ownership: If the seller cannot provide a title, this affidavit can help establish ownership. It serves as a sworn statement affirming that the seller has the right to sell the tractor.

- Sales Tax Exemption Certificate: If the buyer is exempt from sales tax, this certificate allows them to purchase the tractor without paying sales tax. It is important for both parties to keep accurate records.

- Bill of Sale for Equipment: Similar to the Tractor Bill of Sale, this document is used for other types of agricultural or construction equipment. It provides a detailed account of the transaction.

- Insurance Policy Documentation: Before taking possession of the tractor, buyers should have insurance in place. This document proves that the tractor is covered in case of accidents or theft.

- Maintenance Records: Providing maintenance records can enhance the tractor's value. This documentation shows that the tractor has been well cared for and is in good working condition.

- Inspection Certificate: An inspection certificate verifies that the tractor meets safety and operational standards. Buyers may request this document to ensure they are making a safe purchase.

- Financing Agreement: If the buyer is financing the tractor, this agreement outlines the terms of the loan, including payment amounts and interest rates. It is essential for both parties to understand their financial obligations.

By gathering these documents, both buyers and sellers can navigate the transaction with confidence. Ensuring that all necessary paperwork is completed helps protect everyone involved and fosters a transparent exchange. Always consult with a legal expert if you have questions about specific forms or requirements in your situation.