Blank Transfer-on-Death Deed Template for Ohio State

When planning for the future, many individuals in Ohio seek effective ways to manage the transfer of their property upon their passing. The Ohio Transfer-on-Death Deed (TOD Deed) offers a straightforward solution, allowing property owners to designate beneficiaries who will inherit their real estate without the need for probate. This form not only simplifies the transfer process but also provides peace of mind, as it ensures that your property will be passed on to your chosen heirs quickly and efficiently. By completing a TOD Deed, you retain full control of your property during your lifetime, including the ability to sell or modify it as you see fit. Importantly, this deed is revocable, meaning you can change your mind about the beneficiaries at any time before your death. Understanding the nuances of the Ohio Transfer-on-Death Deed is crucial for anyone looking to secure their legacy and streamline the transfer of their assets, making it a valuable tool in estate planning.

Some Other State-specific Transfer-on-Death Deed Templates

How to Avoid Probate in Georgia - Understanding the limitations and benefits of this deed can guide property owners in their decision-making.

A Florida Power of Attorney form is a legal document that allows one person, known as the principal, to designate another individual, referred to as the agent, to make decisions on their behalf. This form can cover a variety of matters, including financial transactions and healthcare decisions, ensuring that the principal's wishes are honored when they are unable to act for themselves. For those looking to understand their options better, resources such as Florida Forms can provide valuable guidance. Understanding the nuances of this document is essential for anyone considering granting authority to another individual.

Tod Title - Some states may have specific forms or requirements for implementing this deed.

Problems With Transfer on Death Deeds - The Transfer-on-Death Deed can include multiple beneficiaries as desired.

Common mistakes

-

Not including all required information. When filling out the Ohio Transfer-on-Death Deed form, it’s essential to provide complete details. Missing information can lead to delays or even rejection of the deed.

-

Failing to sign the deed properly. The deed must be signed by the property owner. If it’s not signed correctly, it may not be valid. Make sure to follow the signature requirements outlined in the form.

-

Not having the deed notarized. In Ohio, a Transfer-on-Death Deed needs to be notarized to be legally binding. Skipping this step can invalidate the deed.

-

Neglecting to record the deed. After completing the form, it’s important to file it with the county recorder’s office. If the deed isn’t recorded, it won’t take effect upon the owner’s passing.

-

Overlooking the importance of clarity. Ensure that the beneficiaries are clearly identified. Ambiguities can lead to confusion and disputes later on. Be specific about names and relationships.

Guide to Writing Ohio Transfer-on-Death Deed

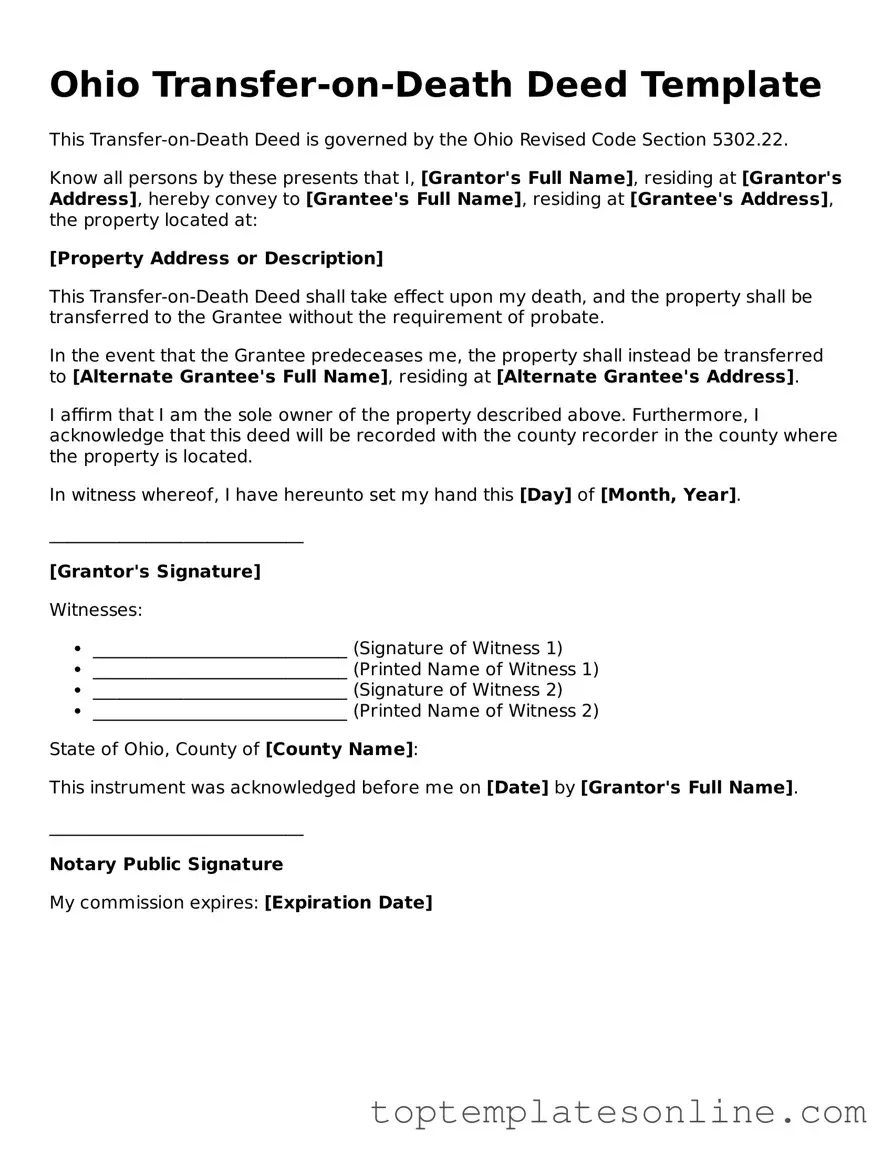

Once you have the Ohio Transfer-on-Death Deed form in hand, it's time to carefully fill it out to ensure your intentions are clearly documented. Completing this form correctly is essential for it to be legally recognized. Follow these steps to navigate the process smoothly.

- Begin by entering your name as the current owner of the property in the designated space.

- Next, provide your address, ensuring it matches the property’s location.

- Identify the property you wish to transfer by including a complete legal description. This may involve referencing the property deed or tax records.

- Designate the beneficiary or beneficiaries who will receive the property upon your passing. Include their full names and addresses.

- Sign the form in the presence of a notary public. Your signature must be notarized for the deed to be valid.

- After signing, ensure the notary completes their section, which typically includes their signature and seal.

- Finally, file the completed deed with the appropriate county recorder’s office. This step is crucial for the transfer to take effect.

Documents used along the form

When preparing to execute a Transfer-on-Death Deed in Ohio, it is important to consider additional forms and documents that may be necessary for a smooth transition of property ownership. Each of these documents plays a vital role in ensuring that the transfer is legally recognized and that the wishes of the property owner are honored.

- Last Will and Testament: This document outlines how a person's assets should be distributed upon their death. While a Transfer-on-Death Deed allows for direct transfer of property, a will can address other assets and provide additional instructions for the estate.

- Affidavit of Heirship: This document can help establish the heirs of a deceased person. It may be used in conjunction with the Transfer-on-Death Deed to clarify ownership and provide proof of the rightful heirs.

- Lease Agreement: A legally binding document that specifies the terms and conditions for renting property, crucial for protecting both landlord and tenant rights. For a comprehensive template, visit newyorkform.com/free-lease-agreement-template.

- Property Deed: The original property deed is essential to verify ownership. It contains the legal description of the property and must be referenced when completing the Transfer-on-Death Deed.

- Notice of Death: This form may be required to officially notify interested parties of the death of the property owner. It serves to inform others of the impending transfer and can help prevent disputes.

- Change of Ownership Form: Some counties may require a form to officially record the change in ownership after the Transfer-on-Death Deed is executed. This ensures that public records reflect the new ownership status.

- Tax Identification Forms: Depending on the situation, tax identification forms may be needed for the estate or property. These documents help ensure compliance with tax obligations following the transfer.

Each of these documents supports the Transfer-on-Death Deed process and helps facilitate a clear and respectful transition of property. By preparing these forms, individuals can ensure that their intentions are honored and that their loved ones are protected during a challenging time.