Attorney-Approved Operating Agreement Form

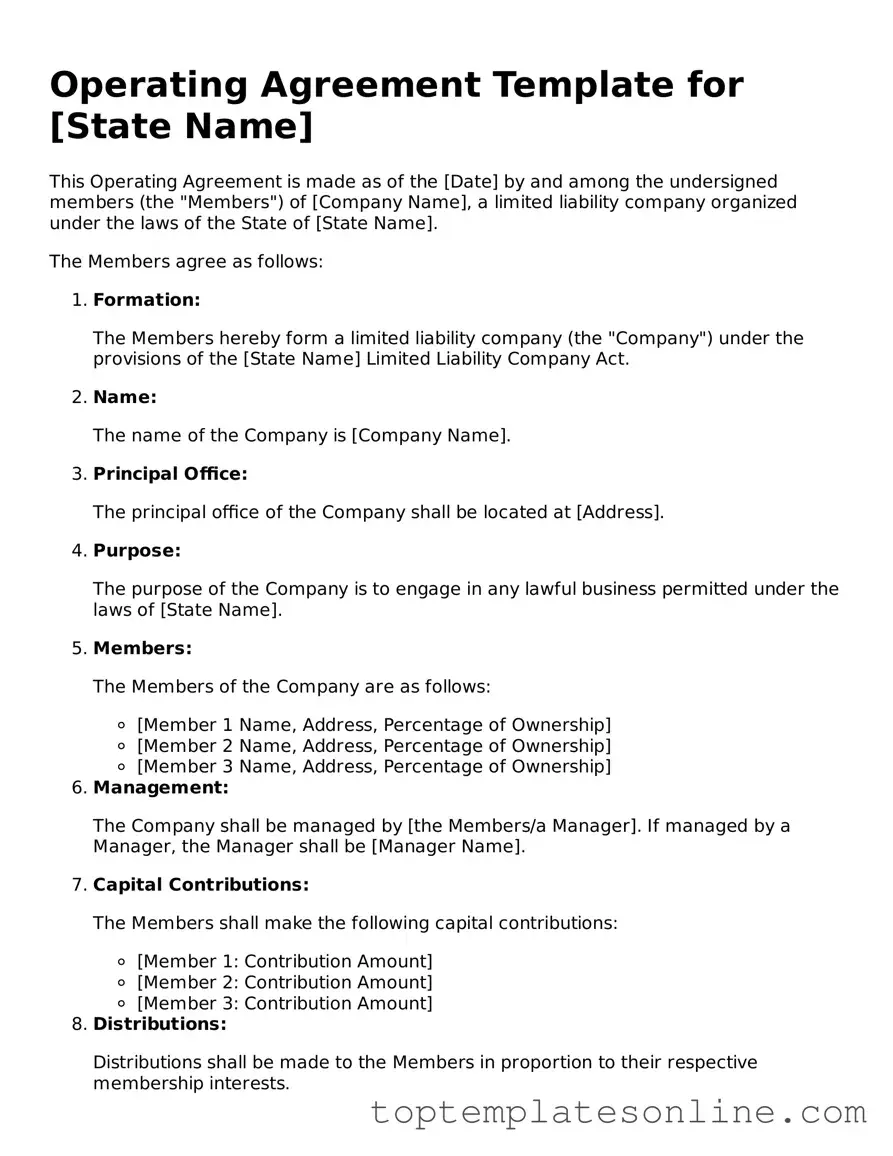

When embarking on the journey of forming a limited liability company (LLC), one of the most pivotal documents you will encounter is the Operating Agreement. This essential form serves as the backbone of your business, outlining the internal structure and operational guidelines that govern the LLC. It addresses key aspects such as ownership percentages, member responsibilities, and decision-making processes, ensuring that all parties are on the same page from the outset. Additionally, the Operating Agreement can detail procedures for adding or removing members, how profits and losses will be distributed, and the steps to take in the event of dissolution. By clearly articulating these elements, the Operating Agreement not only helps prevent disputes among members but also provides a framework that can adapt as the business evolves. In essence, this document is more than just a formality; it is a crucial tool that fosters transparency and accountability, allowing your LLC to thrive in a competitive landscape.

State-specific Information for Operating Agreement Documents

Operating Agreement Categories

Common Templates

High School Transcript - Transcripts can be crucial during the college admissions process.

If you're seeking to formalize your transaction, a well-prepared document is vital. Consider using this resource for a helpful guide on how to draft an essential bill of sale template, which ensures all necessary details are correctly captured. For more information, visit the detailed bill of sale template guide.

Purchase Agreement Addendum - A document outlining changes to a purchase agreement.

Common mistakes

-

Not Clearly Defining Roles and Responsibilities: One common mistake is failing to specify the roles of each member within the company. This can lead to confusion and disputes down the line. Clearly outlining who is responsible for what can help prevent misunderstandings.

-

Ignoring State Laws: Each state has its own regulations regarding operating agreements. Some people overlook the importance of ensuring their agreement complies with local laws. This oversight can result in legal issues that could have been easily avoided.

-

Neglecting to Include a Buy-Sell Agreement: A buy-sell agreement outlines what happens if a member wants to leave the business or passes away. Failing to include this provision can create complications and financial strain for remaining members.

-

Overlooking Voting Rights: Many individuals forget to specify how decisions will be made and what voting rights each member holds. Without clear voting procedures, disagreements can escalate and hinder the company’s operations.

-

Not Addressing Profit Distribution: Another frequent error is not detailing how profits and losses will be shared among members. This can lead to disputes over finances, which can damage relationships and the business itself.

-

Failing to Update the Agreement: An operating agreement is not a one-time task. Many people make the mistake of thinking it’s set in stone. As the business evolves, it’s crucial to revisit and revise the agreement to reflect changes in membership, structure, or goals.

Guide to Writing Operating Agreement

Filling out the Operating Agreement form is an important step in establishing your business structure. This document outlines the management and operational procedures of your company. Follow these steps to ensure you complete the form accurately.

- Gather Information: Collect all necessary details about your business, including the name, address, and purpose of the company.

- Identify Members: List all members or owners of the business. Include their names, addresses, and ownership percentages.

- Define Management Structure: Decide how the business will be managed. Will it be member-managed or manager-managed? Indicate this clearly on the form.

- Outline Voting Rights: Specify how voting will occur among members. Note the voting rights of each member based on their ownership percentage.

- Detail Profit and Loss Distribution: Describe how profits and losses will be allocated among members. Be clear about the distribution method.

- Include Additional Provisions: Add any other important clauses, such as dispute resolution, buyout procedures, or amendments to the agreement.

- Review the Form: Carefully check all the information for accuracy. Ensure that all members agree with the terms outlined.

- Sign and Date: Have all members sign and date the document to make it official.

Once the form is completed and signed, keep a copy for your records. You may also want to provide copies to all members involved. This document will serve as a guiding framework for your business operations moving forward.

Documents used along the form

An Operating Agreement is a crucial document for any Limited Liability Company (LLC) as it outlines the management structure and operating procedures. However, there are several other forms and documents that often accompany the Operating Agreement to ensure comprehensive governance and compliance. Below are some of the commonly used documents.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes essential information such as the company name, address, and the names of the members. Without this document, the LLC does not legally exist.

- Member Resolution: This document records decisions made by the members of the LLC. It serves as a formal acknowledgment of specific actions, such as the admission of new members or approval of significant financial transactions. This ensures that all members are in agreement and helps prevent disputes.

- Bylaws: While not always required, bylaws can be beneficial for outlining the internal rules and procedures of the LLC. They typically cover aspects like meeting schedules, voting procedures, and roles of members, providing a clear framework for operations.

- Aaa International Driving Permit Application: If you plan to drive abroad, having the right documentation is crucial. The Document Templates Hub offers templates that can facilitate the application process for your permit, making it easier for you to drive legally in foreign countries.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They are issued to members to signify their investment and ownership stake in the company. Having these certificates can help clarify ownership rights and responsibilities.

Incorporating these documents alongside the Operating Agreement can provide a solid foundation for your LLC. They help clarify roles, responsibilities, and operational procedures, fostering a more organized and efficient business environment.