Attorney-Approved Owner Financing Contract Form

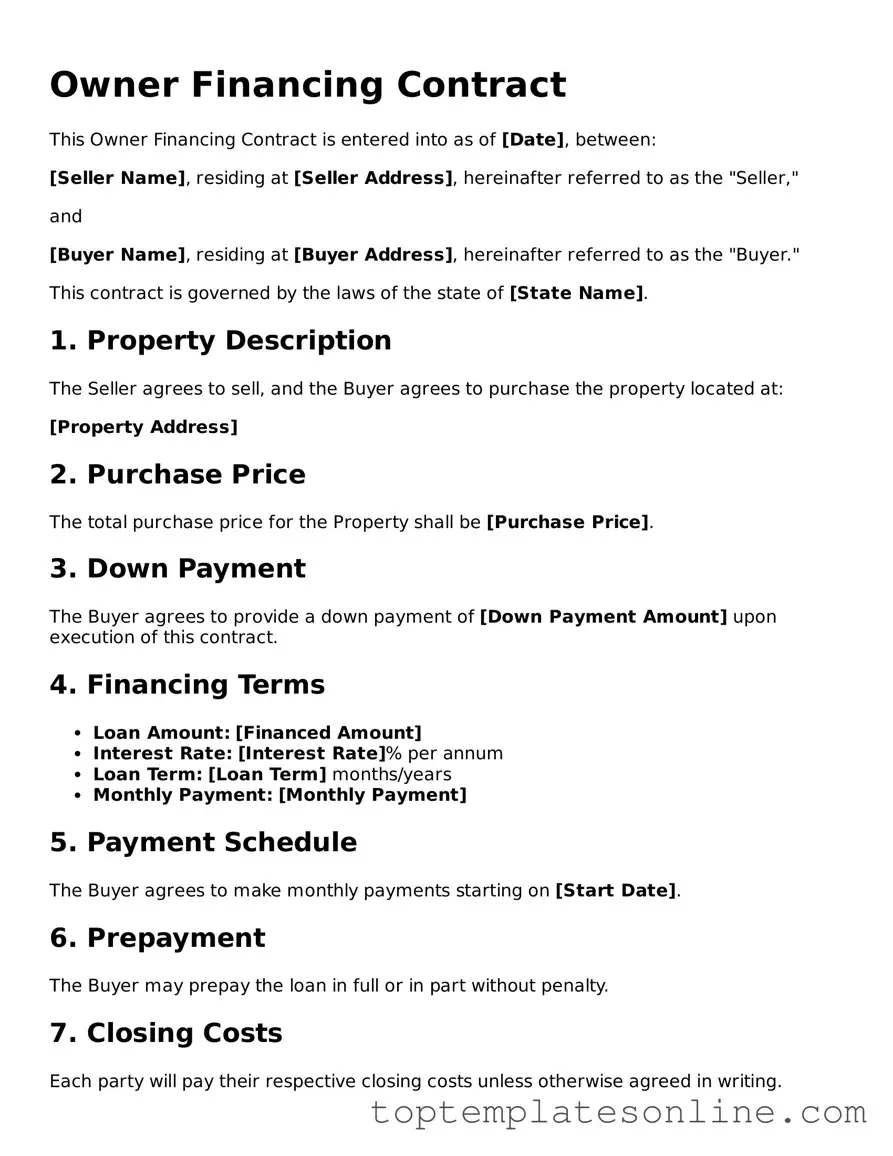

Owner financing has emerged as a popular alternative for buyers and sellers in real estate transactions, especially when traditional financing options may not be available or suitable. This method allows sellers to provide financing directly to buyers, facilitating a smoother transaction process. The Owner Financing Contract form serves as a crucial document in this arrangement, outlining the terms and conditions agreed upon by both parties. Key elements of the form typically include the purchase price, down payment amount, interest rate, repayment schedule, and any contingencies that may apply. Additionally, it addresses important aspects such as the responsibilities of both the buyer and seller, the process for default, and the rights to the property during the financing period. By clearly defining these components, the Owner Financing Contract helps protect both parties' interests and ensures a transparent transaction. Understanding this form is essential for anyone considering owner financing, as it lays the groundwork for a successful and legally sound agreement.

Find More Types of Owner Financing Contract Templates

Purchase Agreement Addendum - Can facilitate smoother negotiations for all parties involved.

In addition to its importance, obtaining a Texas Real Estate Purchase Agreement form online can greatly simplify the process for both parties involved. By following the guidelines provided, you can ensure that all necessary information is correctly documented. For quick access to the form, visit https://texasformspdf.com and begin your transaction with confidence.

Terminate Real Estate Agent Contract Letter - The form can be customized to include specific terms related to the termination.

Common mistakes

-

Not Clearly Identifying the Parties: One common mistake is failing to accurately identify all parties involved in the contract. This includes the seller, buyer, and any co-signers. Ensuring that full names and contact information are provided is crucial.

-

Omitting Property Details: Some individuals neglect to include complete information about the property being financed. This includes the address, legal description, and any relevant details about the property’s condition or features.

-

Improperly Stating the Purchase Price: It's essential to clearly state the purchase price of the property. Mistakes can occur when the price is written incorrectly or when additional costs, such as closing fees, are not included.

-

Not Specifying the Down Payment: A common oversight is failing to specify the amount of the down payment. This figure is critical as it impacts the financing terms and the buyer’s commitment to the purchase.

-

Ignoring Interest Rate Details: The interest rate should be clearly defined. Some people forget to include whether it is fixed or variable, which can lead to confusion and potential disputes later on.

-

Neglecting to Outline Payment Terms: Payment terms must be specified, including the frequency of payments and the duration of the loan. Without this information, both parties may have different expectations.

-

Failing to Include Default Terms: It's vital to outline what happens in the event of a default. Not addressing this can leave both parties vulnerable and uncertain about their rights and obligations.

-

Overlooking Signatures: A contract is not valid without the appropriate signatures. Some individuals forget to sign or have all parties sign, which can invalidate the agreement.

-

Not Seeking Legal Advice: Lastly, many people skip the step of consulting with a legal professional. This can lead to misunderstandings or errors that could have been avoided with proper guidance.

Guide to Writing Owner Financing Contract

Filling out the Owner Financing Contract form is an important step in establishing the terms of a real estate transaction. This process involves providing specific information about the buyer, seller, and property. Following these steps will help ensure that the form is completed accurately.

- Gather necessary information: Collect details about the buyer, seller, and property involved in the transaction.

- Fill in the date: Write the date on which the contract is being completed at the top of the form.

- Enter buyer information: Provide the full name, address, and contact information of the buyer.

- Enter seller information: Include the full name, address, and contact information of the seller.

- Describe the property: Clearly outline the property’s address, legal description, and any relevant details.

- Specify financing terms: Detail the purchase price, down payment, interest rate, and repayment schedule.

- Outline additional terms: Include any specific conditions or agreements between the buyer and seller.

- Review the form: Double-check all information for accuracy and completeness.

- Sign and date: Both the buyer and seller must sign and date the form to make it legally binding.

After completing the form, it is advisable to keep copies for both parties and consider consulting with a legal expert to ensure that all terms are clearly understood and enforceable.

Documents used along the form

When entering into an owner financing agreement, several other documents may be essential to ensure clarity and protect the interests of both parties involved. These documents help outline terms, responsibilities, and legal protections. Below are four commonly used forms that accompany an Owner Financing Contract.

- Promissory Note: This document serves as a written promise from the buyer to repay the loan under the terms agreed upon in the owner financing contract. It details the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

- Deed of Trust: A deed of trust secures the loan by placing a lien on the property. It involves three parties: the borrower, the lender (seller), and a trustee. If the borrower defaults, the trustee has the authority to sell the property to recover the owed amount.

- Real Estate Purchase Agreement: Essential for any property transaction in Minnesota, it sets forth the terms between buyers and sellers. For more information, you can find the Minnesota PDF Forms.

- Disclosure Statement: This document provides important information about the property and the financing terms. It typically includes details about the property’s condition, any existing liens, and the buyer's rights. Transparency is key, and this statement helps ensure both parties are informed.

- Purchase Agreement: This agreement outlines the terms of the sale, including the purchase price, closing date, and any contingencies. It is crucial for establishing the framework of the transaction and ensuring that both parties agree to the same terms before finalizing the deal.

Each of these documents plays a vital role in the owner financing process. They help clarify expectations and protect the rights of both the buyer and the seller, ensuring a smoother transaction overall.