Fillable P 45 It Form

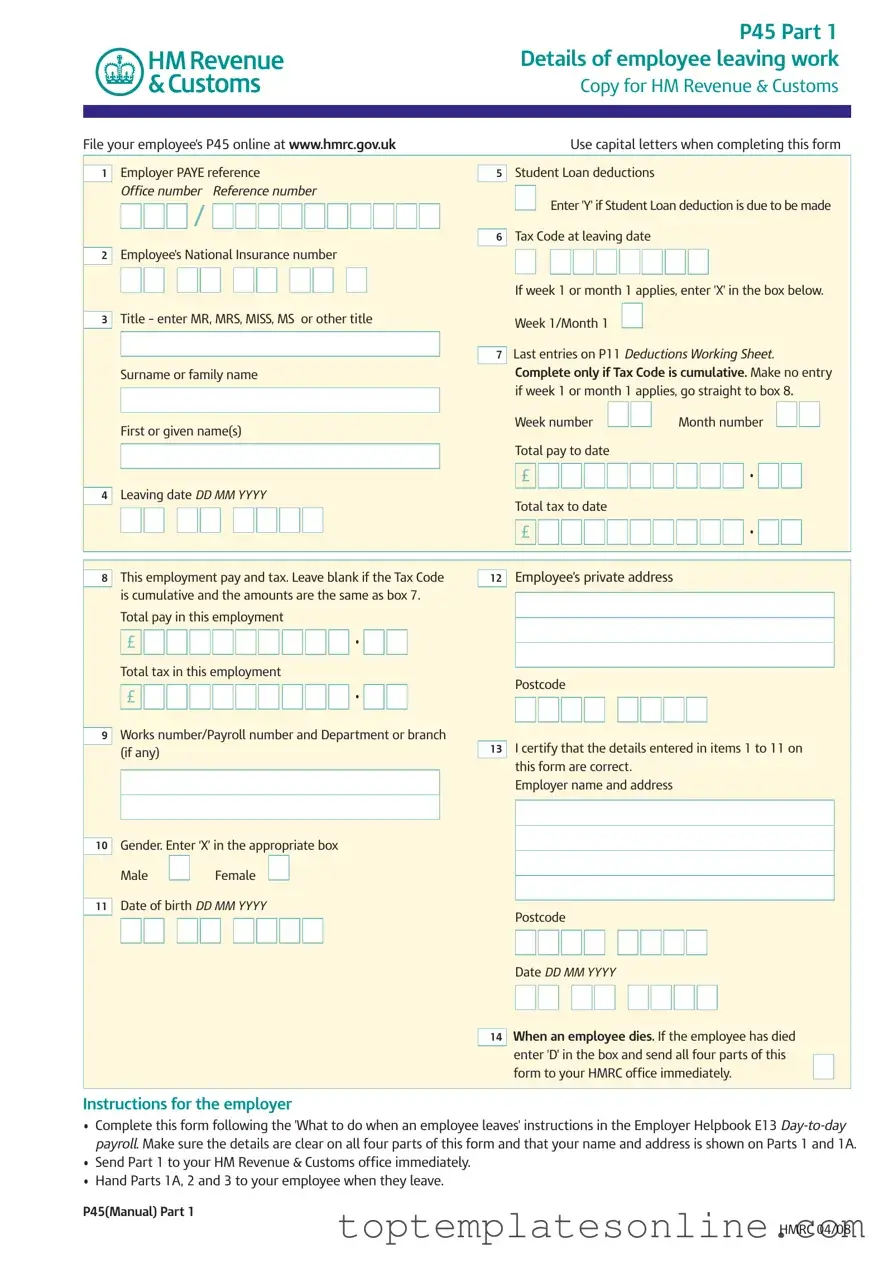

The P45 form plays a crucial role in the employment landscape in the UK, specifically when an employee leaves a job. This document is divided into three parts, each serving distinct purposes for the employer, the employee, and the new employer. The first part, known as Part 1, is sent to HM Revenue & Customs (HMRC) and contains essential details about the employee's departure, including their PAYE reference, National Insurance number, and tax code at the time of leaving. Part 1A is for the employee's records, providing information that may be necessary for future tax returns. It is important for the employee to keep this part safe, as copies are not available. Part 2 is intended for the new employer and includes similar details to ensure a smooth transition in the employee's tax situation. Additionally, the form addresses specific scenarios, such as student loan deductions and the protocol if the employee has passed away. Proper completion and timely submission of the P45 are essential for compliance with tax regulations and to avoid unnecessary tax complications for the employee.

Common PDF Templates

How to Make a Rental Lease Agreement - It holds all parties accountable to adhere to the agreed-upon terms to uphold the lease integrity.

Puppy Health Guarantee Template - The buyer must notify the breeder in writing about any severe health issues within two business days.

This vital document plays an important role in managing transactions, and understanding how to fill it out is critical for both parties involved. For guidance, consider reviewing this informative resource on the comprehensive Dirt Bike Bill of Sale process.

Girlfriend Application Form Funny - Searching for a partner with a great sense of humor and a love for laughter.

Common mistakes

-

Not using capital letters: The form requires all entries to be in capital letters. Failing to do this can lead to confusion and processing delays.

-

Incorrect National Insurance number: Entering the wrong National Insurance number can create issues with tax records. Double-check this information before submission.

-

Missing the leaving date: The leaving date is crucial. If this is omitted, it can result in complications with tax calculations.

-

Ignoring the Tax Code: Make sure to enter the correct Tax Code at the time of leaving. An incorrect code can lead to incorrect tax deductions.

-

Forgetting to certify the details: Certifying that the details are correct is essential. Without this, the form may not be accepted by HMRC.

-

Not providing a complete address: Ensure that the employee's private address is fully filled out. Incomplete addresses can hinder communication and processing.

-

Neglecting to check for Student Loan deductions: If applicable, enter 'Y' for Student Loan deductions. Missing this can lead to tax issues later on.

Guide to Writing P 45 It

Filling out the P45 It form is a crucial task when an employee leaves a job. Completing this form accurately ensures that the employee's tax information is properly recorded and passed on to their new employer or HM Revenue & Customs (HMRC). Below are the steps to guide you through the process of filling out the form.

- Begin with Part 1 of the form. Write the employer's PAYE reference in the designated box.

- Fill in the office number and reference number as required.

- Enter the employee's National Insurance number.

- Indicate the title of the employee (MR, MRS, MISS, MS, or other).

- Provide the employee's surname or family name.

- Write the employee's first or given name(s).

- Input the leaving date in the format DD MM YYYY.

- State the total pay to date and total tax to date in the respective boxes.

- Complete the employee’s private address, including the postcode.

- Mark the gender by entering ‘X’ in the appropriate box (Male or Female).

- Fill in the employee's date of birth in the format DD MM YYYY.

- Sign and date the declaration to certify that the details entered are correct.

- If applicable, indicate if the employee has a student loan and whether deductions will continue.

- For week 1 or month 1 tax codes, enter ‘X’ in the specified box.

- Send Part 1 to HMRC immediately and provide Parts 1A, 2, and 3 to the employee.

After completing the form, ensure that all parts are clear and legible. The employee should keep their copy safe, as it may be needed for future tax purposes. If there are any questions or uncertainties during the process, reaching out to HMRC or a payroll professional can provide valuable assistance.

Documents used along the form

The P45 form is an essential document for employees leaving a job in the UK, detailing their earnings and tax contributions. Alongside the P45, several other forms and documents may be needed during the transition to a new job or for tax purposes. Below is a list of related forms that are commonly used.

- P60: This form summarizes an employee's total pay and deductions for the tax year. It is provided by the employer at the end of each tax year and is crucial for tax returns.

- Non-disclosure Agreement (NDA): A crucial document for protecting sensitive information, you can learn more about it through Florida Forms.

- P11D: Employers use this form to report expenses and benefits provided to employees. It helps ensure that any taxable benefits are accounted for in the employee's tax assessment.

- P50: This form is used to claim a tax refund after stopping work. Employees who have overpaid tax can request a refund using this form.

- P85: If an employee is leaving the UK, this form is necessary to inform HM Revenue & Customs (HMRC) about their departure. It helps in claiming any tax refunds due while living abroad.

- Jobseeker’s Allowance (JSA) Claim Form: Individuals who are unemployed may need to fill out this form to claim JSA. It helps provide financial support while looking for a new job.

- Tax Return (Self Assessment): Self-employed individuals or those with additional income must complete this annual form to report their earnings and calculate any tax owed.

- Student Loan Repayment Form: If an employee has a student loan, they may need to complete this form to ensure proper deductions are made from their salary.

- Registration for Self-Employment: Individuals planning to work for themselves must register with HMRC. This registration is crucial to avoid penalties and ensure compliance with tax obligations.

Understanding these forms can make the transition smoother for employees leaving a job. Each document serves a specific purpose, helping to manage tax obligations and ensure that financial matters are handled correctly during employment changes.