Fillable Payroll Check Form

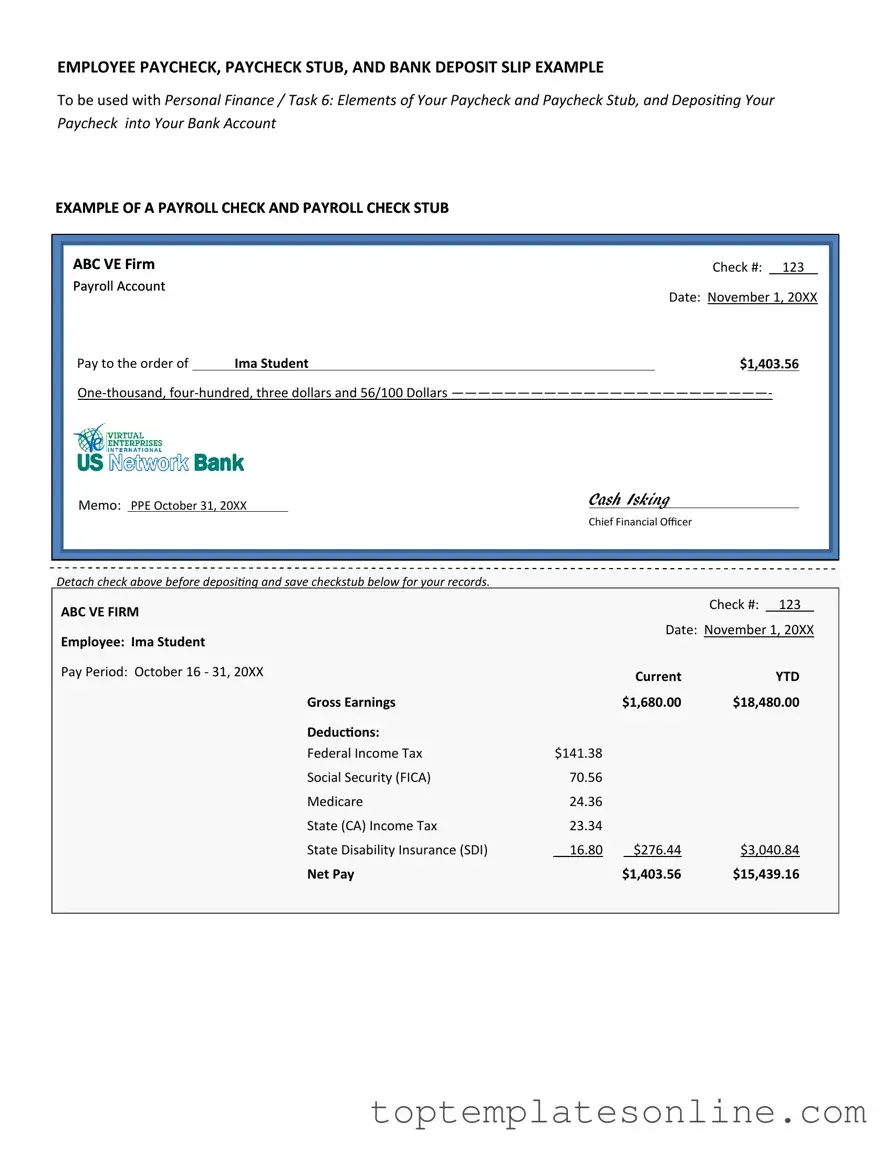

The Payroll Check form plays a crucial role in the management of employee compensation within any organization. This form is designed to provide essential details regarding the payment process, ensuring that employees receive their earnings accurately and on time. Typically, it includes information such as the employee's name, identification number, and the amount being paid. Additionally, the form may outline deductions for taxes, benefits, or other withholdings, which are important for both the employer and the employee to understand. The layout of the form is structured to facilitate easy comprehension, allowing payroll staff to input and verify data efficiently. Furthermore, it serves as a record that can be referenced in case of any discrepancies or audits. By streamlining the payroll process, this form helps maintain transparency and trust between employers and their employees.

Common PDF Templates

Aphis 7001 - Provide the place where the certification is completed for a complete record.

To facilitate the ownership transfer process, it is advisable for both buyers and sellers to utilize the Dirt Bike Bill of Sale form, which can be sourced from resources like NY Templates. This ensures that all necessary details are accurately documented, thereby preventing potential disputes in the future.

Da - Covers a range of property types including expendables and non-expendables.

Common mistakes

-

Incorrect Employee Information: Failing to provide accurate details such as the employee's name, Social Security number, or address can lead to significant issues. Always double-check this information for accuracy.

-

Wrong Pay Period Dates: Entering the wrong start and end dates for the pay period can result in incorrect payment amounts. Make sure to verify the dates before submitting.

-

Miscalculating Hours Worked: It's easy to miscount hours, especially if overtime is involved. Always confirm that the total hours worked are calculated correctly.

-

Omitting Deductions: Failing to include necessary deductions, such as taxes or benefits, can lead to overpayment. Review the deductions carefully to ensure they are all accounted for.

-

Not Signing the Form: Forgetting to sign the Payroll Check form can delay processing. Always remember to provide your signature before submission.

-

Using Incorrect Payment Method: Selecting the wrong payment method, such as check instead of direct deposit, can create complications. Be sure to choose the preferred method accurately.

-

Missing Supervisor Approval: Some forms require supervisor approval before processing. Ensure that you have obtained the necessary signatures to avoid delays.

-

Not Keeping a Copy: Failing to keep a copy of the submitted form can lead to confusion later. Always retain a copy for your records.

Guide to Writing Payroll Check

Filling out the Payroll Check form is a straightforward process that ensures employees receive their due compensation accurately. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form. This date should reflect the pay period end date.

- Next, write the employee's name in the designated space. Ensure the name is spelled correctly to avoid any confusion.

- Fill in the employee's identification number. This number is usually assigned by the employer and helps in tracking payroll records.

- In the next section, indicate the amount to be paid. Write this amount clearly in both numerical and written form to eliminate any discrepancies.

- Specify the pay period for which this check is issued. This could be weekly, bi-weekly, or monthly, depending on the employer’s payroll schedule.

- Include any deductions or withholdings in the appropriate sections. This may involve taxes or other deductions that apply to the employee.

- Finally, sign the form at the bottom. The signature should be that of the authorized individual responsible for payroll.

Once the form is filled out, it can be processed for payment. Ensure all information is accurate to facilitate timely and correct payroll distribution.

Documents used along the form

When managing payroll, several forms and documents work alongside the Payroll Check form. Each of these documents serves a specific purpose and helps ensure that payroll processes run smoothly.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. It helps employers determine how much federal income tax to withhold from an employee's paycheck.

- Direct Deposit Authorization Form: Employees complete this form to authorize their employer to deposit their paychecks directly into their bank accounts. It streamlines the payment process and provides convenience for employees.

- Power of Attorney Form: Important for individuals who wish to delegate decision-making authority to another person in their absence. For more information, you can access this resource: https://newyorkform.com/free-power-of-attorney-template.

- Time Sheet: A time sheet records the hours worked by an employee during a pay period. This document is crucial for calculating wages accurately, especially for hourly employees.

- Pay Stub: This document accompanies the payroll check and provides a breakdown of earnings, deductions, and net pay. It helps employees understand their pay and any deductions taken.

- Employment Agreement: This document outlines the terms of employment, including salary, benefits, and job responsibilities. It serves as a reference for both the employer and employee regarding their working relationship.

These documents collectively support the payroll process, ensuring clarity and compliance for both employers and employees. Proper management of these forms can help avoid misunderstandings and errors in payroll administration.