Attorney-Approved Prenuptial Agreement Form

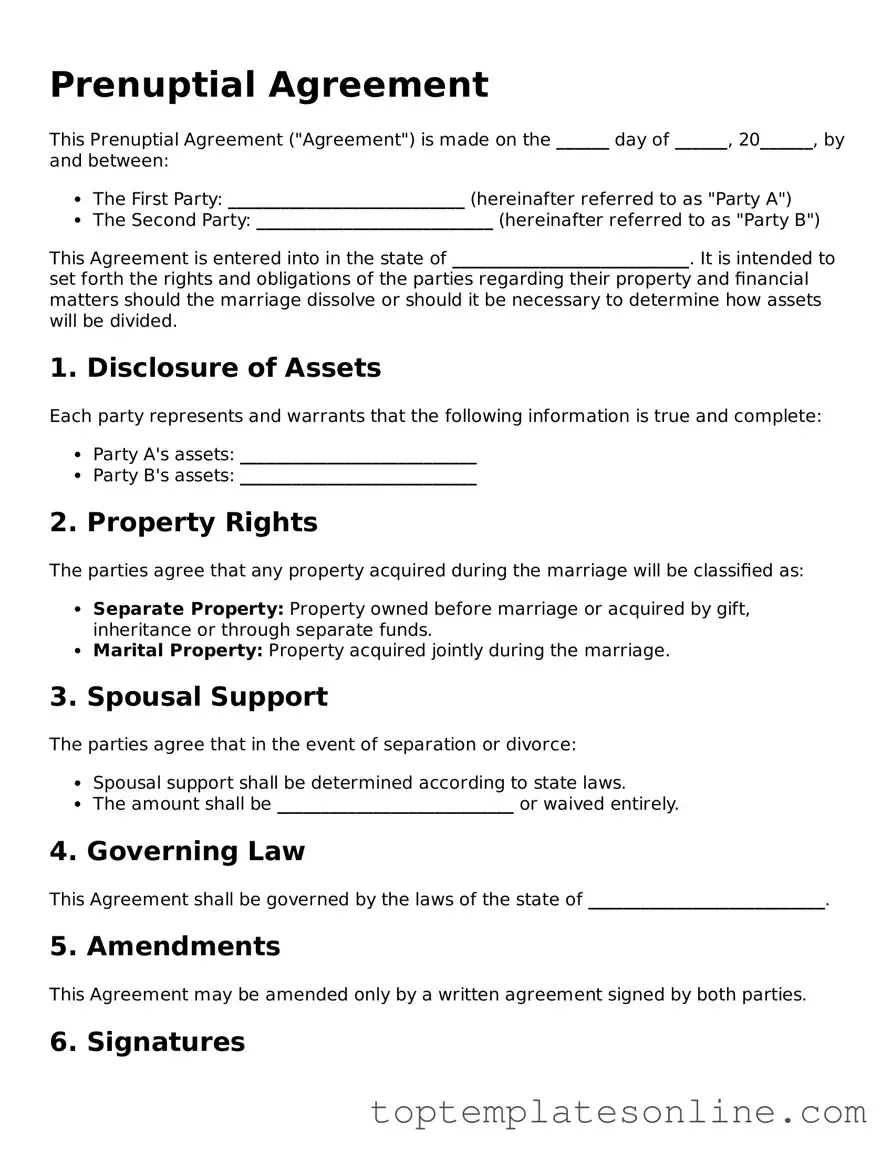

When couples consider marriage, discussions about finances and property often arise, making a prenuptial agreement an important tool for many. This legal document outlines how assets and debts will be managed during the marriage and what will happen in the event of a divorce or separation. A prenuptial agreement typically includes provisions regarding the division of property, spousal support, and the handling of debts acquired before and during the marriage. It serves to protect individual interests and can provide clarity and peace of mind for both parties. In addition, the agreement can address issues such as the treatment of inheritances and gifts received during the marriage. By establishing clear expectations, couples can foster open communication about their financial situations, which may help to strengthen their relationship. Understanding the major aspects of a prenuptial agreement form is essential for those looking to navigate the complexities of marital finances effectively.

State-specific Information for Prenuptial Agreement Documents

Common Templates

Storage Lease Agreement Template - The agreement outlines the length of the rental period for the storage unit.

When purchasing or selling a trailer in Florida, it's crucial to have the proper documentation to protect both parties involved. The Florida Trailer Bill of Sale form clearly outlines the terms of the sale, ensuring a smooth transaction. For more information and to access essential paperwork, visit Florida Forms, where you can find the necessary forms to facilitate your trailer sale efficiently.

Purchase Agreement Addendum - Provides a framework for renegotiating certain terms.

California Bill of Sale Pdf - Useful for private sales where a traditional dealer receipt is not available.

Common mistakes

-

Not Being Honest About Assets: One of the most common mistakes is failing to fully disclose all assets. When filling out a prenuptial agreement, it’s crucial to be transparent. Hiding or undervaluing assets can lead to legal issues later on.

-

Ignoring Debts: Many people focus solely on their assets and forget about debts. It’s important to include any debts, like student loans or credit card balances. Failing to address these can create complications during divorce proceedings.

-

Using Legal Jargon: Sometimes, individuals attempt to draft their own agreements without legal help, leading to confusion. Using overly complex language or legal terms can make the document difficult to understand. Clear and straightforward language is essential.

-

Not Considering Future Changes: Life changes, and so do financial situations. Failing to account for potential future changes, like having children or career shifts, can render the agreement less effective. It’s wise to include provisions for these possibilities.

Guide to Writing Prenuptial Agreement

Filling out a Prenuptial Agreement form is an important step for couples considering marriage. It allows both parties to outline their financial rights and responsibilities, providing clarity and protection for the future. By following these steps, you can ensure that the form is completed accurately and effectively.

- Begin by gathering all necessary personal information for both parties, including full names, addresses, and contact details.

- Identify and list all assets owned by each individual. This may include real estate, bank accounts, investments, and personal property.

- Detail any debts that each party has, such as loans, credit card balances, or mortgages.

- Discuss and agree upon how you wish to handle property acquired during the marriage. Specify whether it will be considered joint or separate property.

- Include provisions for spousal support or alimony, if applicable. Decide if either party will receive support in the event of a divorce.

- Review any state-specific laws that may impact the agreement. Ensure that the form complies with local regulations.

- Both parties should read through the completed form carefully. Make sure all information is accurate and reflects your mutual understanding.

- Sign the document in the presence of a notary public to ensure its legal validity.

- Keep copies of the signed agreement in a safe place. Each party should retain a copy for their records.

Documents used along the form

A prenuptial agreement is an important document for couples planning to marry. It outlines how assets and debts will be handled in the event of a divorce or separation. Along with this agreement, several other forms and documents are commonly used to ensure clarity and protection for both parties. Below are some of these documents.

- Financial Disclosure Statement: This document provides a detailed overview of each party's financial situation. It includes information about income, assets, debts, and liabilities. Transparency in financial matters helps both individuals make informed decisions.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after the marriage has taken place. It can address changes in circumstances or clarify asset division in case of divorce.

- Hold Harmless Agreement: This form is crucial for protecting parties from liability during specific activities. For more details, visit https://newyorkform.com/free-hold-harmless-agreement-template/.

- Separation Agreement: This document outlines the terms of a couple's separation. It covers issues such as property division, child custody, and support obligations. A separation agreement can serve as a framework for future divorce proceedings.

- Marriage Certificate: This official document is issued by the state and confirms the legal union of two individuals. It is necessary for various legal and financial matters that may arise during the marriage.

Understanding these documents can help couples navigate their financial and legal responsibilities. Each serves a specific purpose and contributes to a clearer understanding of rights and obligations in a marriage.