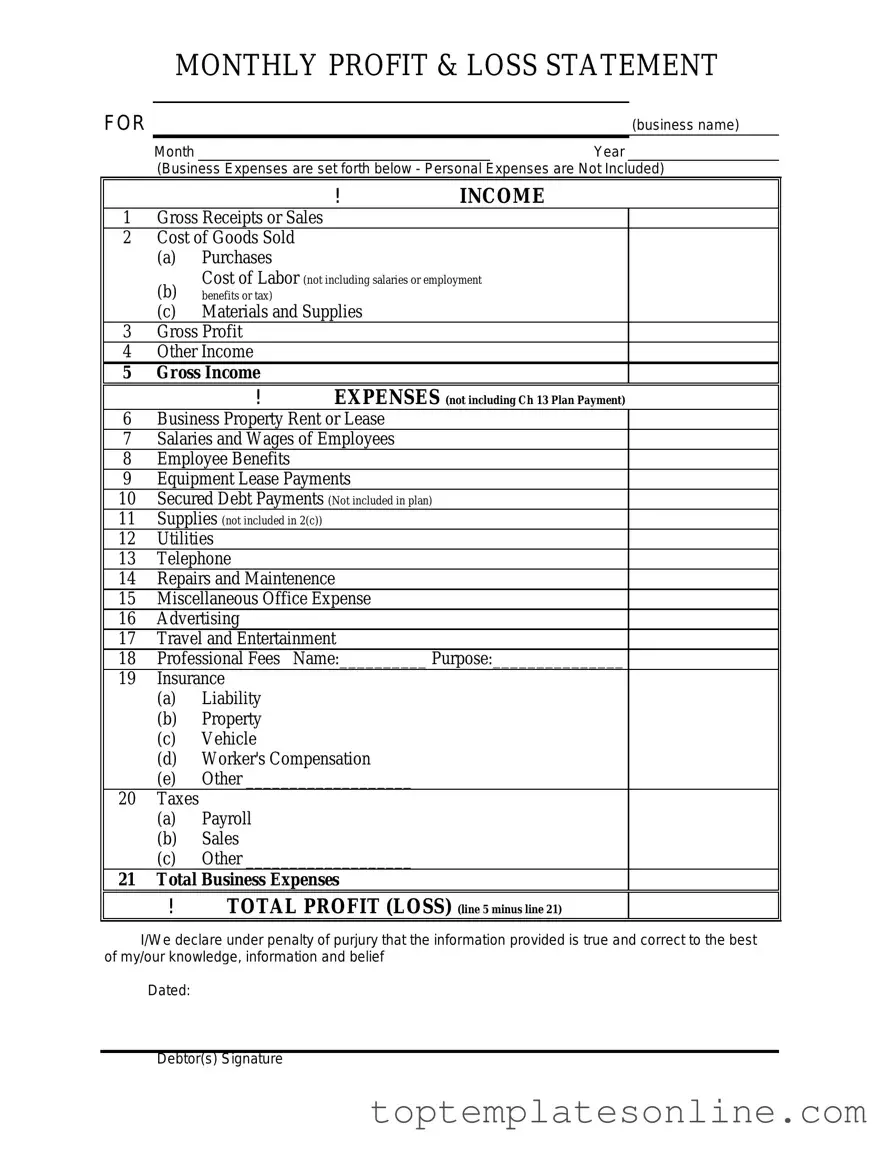

Fillable Profit And Loss Form

The Profit and Loss form, often referred to as the income statement, serves as a crucial financial tool for businesses of all sizes. This document provides a comprehensive overview of a company's revenues, costs, and expenses over a specific period, allowing stakeholders to assess the organization’s financial performance. Key components of the form include total revenue, which reflects all income generated from sales, and the cost of goods sold, which accounts for direct costs associated with producing those goods. Operating expenses, such as salaries, rent, and utilities, are also detailed, giving insight into the ongoing costs of running the business. The form culminates in the net profit or loss, a critical figure that indicates whether the company has earned more than it has spent during the reporting period. By analyzing this form, business owners and investors can make informed decisions regarding budgeting, forecasting, and strategic planning.

Common PDF Templates

Da - Can be linked with other documentation for tracing asset history.

A Last Will and Testament form is a legal document that outlines how a person's assets and affairs should be managed after their death. In New York, this form serves as a crucial tool for individuals to express their final wishes clearly and ensure that their intentions are honored. To facilitate this process, resources such as NY Templates can provide valuable guidance and templates for individuals navigating the complexities of estate planning effectively.

U.S. Corporation Income Tax Return - Non-profit organizations typically do not use the IRS 1120 form for reporting.

Common mistakes

-

Neglecting to keep accurate records: One of the most common mistakes is failing to maintain precise records of income and expenses. Without accurate data, your Profit and Loss statement will not reflect the true financial health of your business.

-

Mixing personal and business expenses: It’s crucial to separate personal expenses from business expenses. Mixing these can lead to confusion and inaccuracies in your Profit and Loss form.

-

Not categorizing expenses correctly: Proper categorization of expenses is vital. Misclassifying expenses can distort your financial picture and lead to incorrect conclusions about profitability.

-

Overlooking income sources: Sometimes, individuals forget to include all sources of income. Ensure you account for every revenue stream to get a complete view of your financial situation.

-

Ignoring non-operating income and expenses: Non-operating income and expenses, such as interest or investment income, should not be overlooked. They can significantly impact your overall profit and loss.

-

Failing to update the form regularly: A Profit and Loss form should be a living document. Regular updates are essential for maintaining accuracy and reflecting current financial conditions.

-

Not reviewing for errors: Before finalizing your Profit and Loss statement, always review for mistakes. Simple errors can lead to significant misunderstandings about your business's performance.

Guide to Writing Profit And Loss

Filling out the Profit and Loss form is an essential step in assessing the financial performance of a business. By accurately completing this form, you can gain insights into revenue, expenses, and overall profitability. Follow these steps to ensure you provide all necessary information.

- Begin by entering the business name at the top of the form. Make sure it matches the name used for tax purposes.

- Next, indicate the reporting period. Specify the start and end dates for the period you are reporting on.

- In the revenue section, list all sources of income. Include details like sales revenue, service income, and any other earnings.

- Calculate the total revenue by adding all income sources together. Write this total in the designated space.

- Move to the expenses section. Here, categorize your costs into fixed and variable expenses. Common categories include rent, utilities, salaries, and marketing.

- For each expense category, provide the corresponding amounts. Be thorough to ensure all costs are accounted for.

- Add up all the expenses to determine the total expenses. This figure should be recorded in the appropriate area on the form.

- Now, subtract the total expenses from the total revenue. This calculation will give you the net profit or loss for the period.

- Finally, review all entries for accuracy. Make any necessary corrections before submitting the form.

Documents used along the form

The Profit and Loss form is a crucial document for understanding a business's financial performance over a specific period. However, it is often used in conjunction with other forms and documents that provide a more comprehensive view of the company's financial health. Below are some commonly used documents that complement the Profit and Loss form.

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the company owns and owes, offering insight into its financial stability.

- Room Rental Agreement: For renting a room in New York, be sure to review the essential Room Rental Agreement documentation to understand your rights and responsibilities.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business during a specific period. It highlights how well the company generates cash to pay its debts and fund its operating expenses.

- Statement of Retained Earnings: This document shows the changes in retained earnings over a period. It reflects how much profit has been reinvested in the business rather than distributed to shareholders as dividends.

- Budget: A budget outlines the expected income and expenses for a future period. It serves as a financial plan, helping businesses set targets and manage resources effectively.

These documents, when used alongside the Profit and Loss form, provide a clearer picture of a business's financial situation. Together, they enable informed decision-making and strategic planning.