Attorney-Approved Promissory Note Form

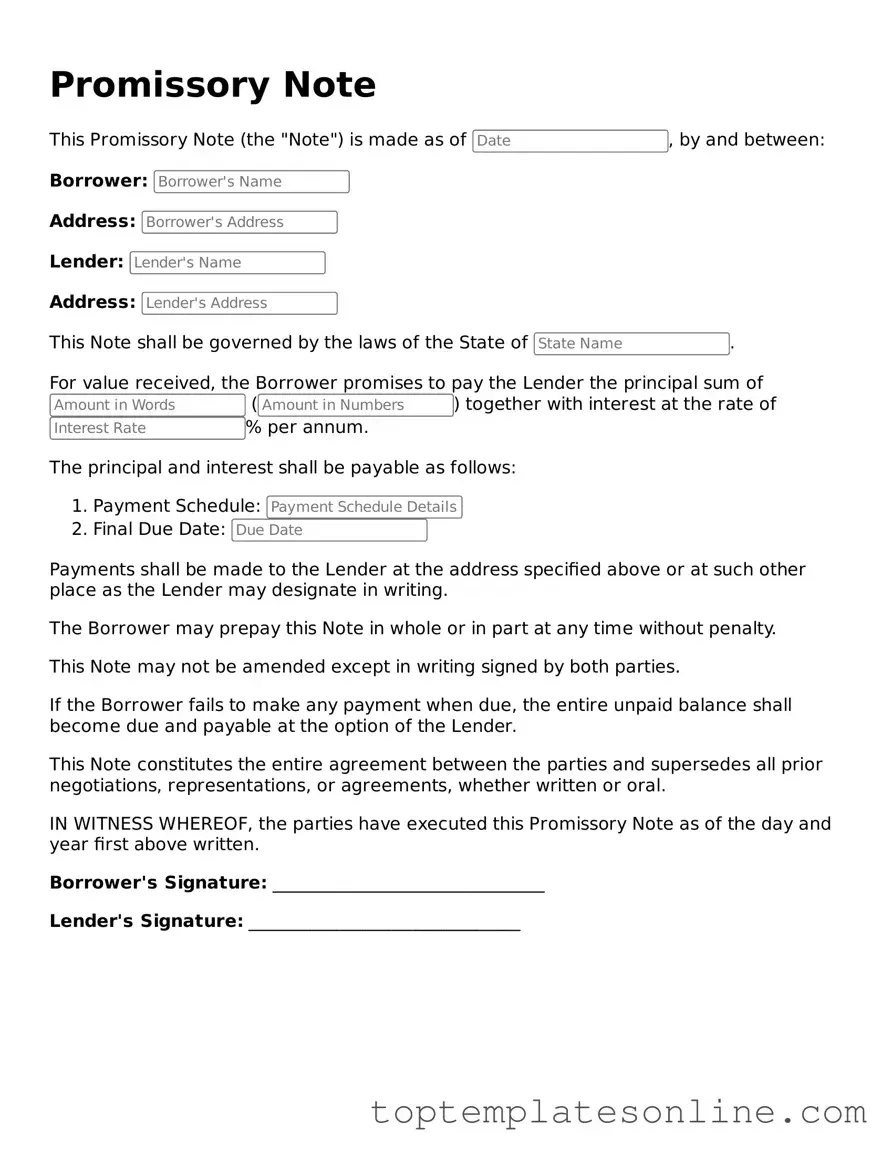

When it comes to personal and business financing, a Promissory Note serves as a crucial document that outlines the terms of a loan agreement between a lender and a borrower. This form not only establishes a clear understanding of the amount borrowed but also specifies the repayment schedule, interest rate, and any applicable fees. By detailing these essential elements, the Promissory Note helps protect the interests of both parties involved. Additionally, it often includes provisions regarding default, which can outline the consequences if the borrower fails to make timely payments. The simplicity and clarity of this document make it a popular choice for various lending scenarios, whether it’s for a personal loan between friends or a formal business transaction. Understanding the major aspects of a Promissory Note is vital for anyone considering borrowing or lending money, as it sets the foundation for a transparent financial relationship.

State-specific Information for Promissory Note Documents

Promissory Note Categories

Common Templates

Custody Affidavit - The affidavit addresses the best interests of the child in the decision-making process.

A New York Non-disclosure Agreement form, often referred to as an NDA, is a legally binding document aimed at protecting proprietary and confidential information. When signed, it restricts the sharing of sensitive details to unauthorized parties. This tool is vital for individuals and companies looking to safeguard their intellectual property or trade secrets in New York. For those in need of a template, you can find one at newyorkform.com/free-non-disclosure-agreement-template.

What Does It Mean to Not Be Bbb Accredited - Customer service was unresponsive to my inquiries.

Common mistakes

-

Incomplete Information: One common mistake is leaving out essential details. Borrowers often forget to include their full name, address, or the date. Each piece of information is crucial for the note’s validity.

-

Incorrect Loan Amount: It's vital to ensure that the loan amount is accurate. A simple typo can lead to disputes later on. Double-checking this figure can save a lot of headaches.

-

Missing Signatures: Both the borrower and the lender must sign the note. Failing to do so can render the document unenforceable. Always confirm that all required signatures are present.

-

Not Specifying the Interest Rate: If the loan includes interest, it should be clearly stated. Leaving this out can create confusion about repayment terms. Clarity in this area is essential.

-

Ignoring Repayment Terms: It's important to outline how and when payments will be made. Vague terms can lead to misunderstandings. Clearly defined repayment schedules help both parties know what to expect.

-

Failure to Include Default Terms: What happens if the borrower fails to repay? This should be clearly defined in the note. Having these terms helps protect the lender’s interests.

-

Not Keeping a Copy: After filling out the note, some individuals forget to keep a copy for themselves. This can be problematic if disputes arise later. Always retain a copy for your records.

-

Neglecting to Review: Finally, rushing through the form without a thorough review can lead to errors. Taking the time to carefully read through the document can help catch mistakes before they become issues.

Guide to Writing Promissory Note

After you have gathered the necessary information, you can proceed to fill out the Promissory Note form. This document will outline the terms of a loan agreement between a borrower and a lender. Accuracy is crucial, as it ensures that both parties clearly understand their obligations.

- Begin by entering the date at the top of the form. This date signifies when the agreement is made.

- Clearly state the names of both the borrower and the lender. Include their full legal names to avoid any confusion.

- In the next section, specify the principal amount being borrowed. This is the total sum of money that the borrower is agreeing to repay.

- Indicate the interest rate. This should be a percentage that reflects the cost of borrowing the money.

- Detail the repayment terms. This includes the schedule of payments, such as monthly or bi-weekly, and the duration of the loan.

- Include any late fees or penalties for missed payments. Clearly outline the consequences of failing to make payments on time.

- Sign the document. Both the borrower and the lender must sign the Promissory Note to make it legally binding.

- Finally, date the signatures. This ensures that the agreement is complete and reflects the date of execution.

Documents used along the form

A Promissory Note is a financial instrument that outlines a borrower's promise to repay a specified sum of money to a lender under agreed-upon terms. In addition to the Promissory Note, several other forms and documents may be used in conjunction with it to ensure clarity and legality in the transaction. Below are some common documents often associated with a Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive outline of the obligations of both the borrower and the lender.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged as security. It outlines the lender's rights to the collateral in the event of default.

- Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and terms. It ensures that the borrower fully understands the financial implications of the loan.

- ATV Bill of Sale: This document is essential for recording the transfer of ownership of an all-terrain vehicle (ATV) from one party to another, ensuring all necessary details are included for a smooth transaction. For a comprehensive template, you can refer to NY Templates.

- Personal Guarantee: A personal guarantee may be required from a third party, such as a business owner, ensuring that they will repay the loan if the borrower defaults. This adds an additional layer of security for the lender.

- Amortization Schedule: This schedule outlines the repayment plan, showing how much of each payment will go toward interest and principal over the life of the loan. It helps borrowers understand their payment obligations.

- Loan Payment Receipts: These receipts document each payment made by the borrower. They serve as proof of payment and can be important for record-keeping purposes.

Each of these documents plays a crucial role in the lending process, ensuring that both parties are aware of their rights and responsibilities. Proper documentation helps to mitigate risks and provides a clear framework for the financial transaction.