Attorney-Approved Promissory Note for a Car Form

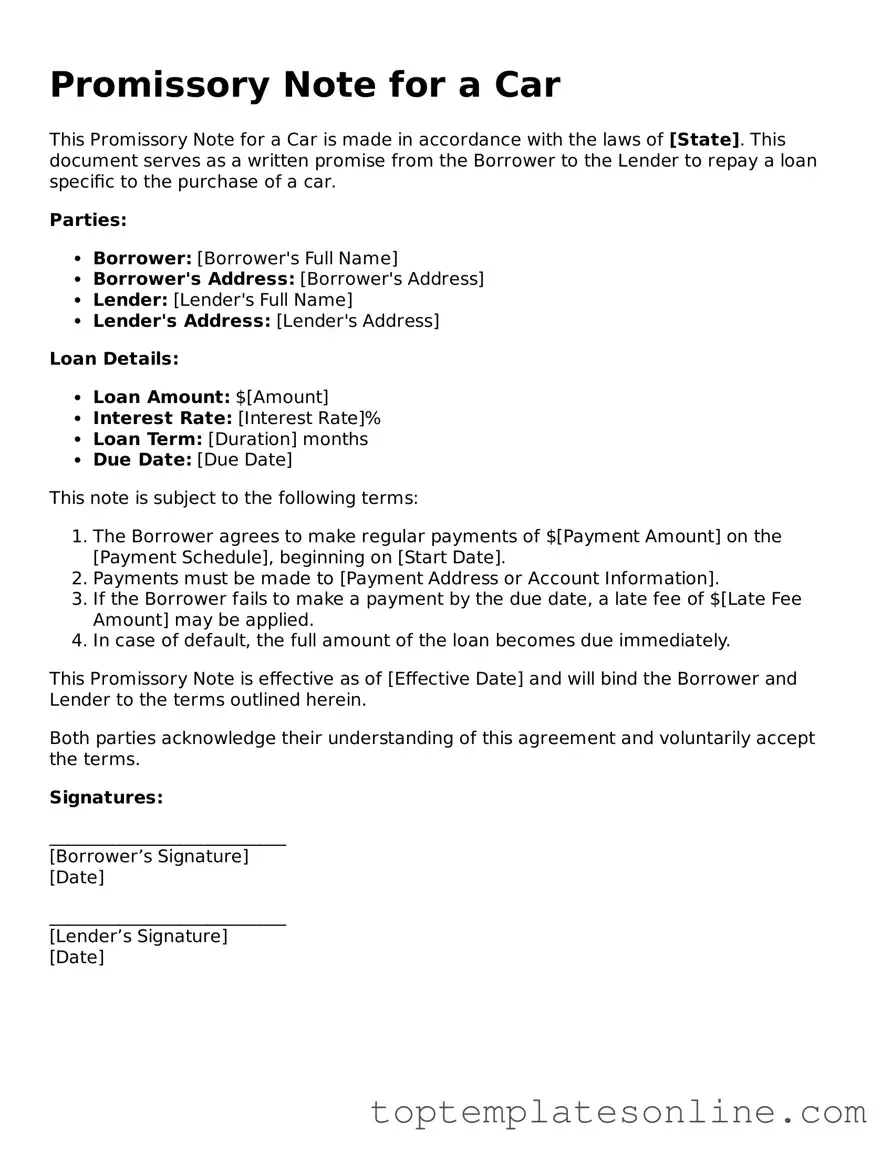

The Promissory Note for a Car form serves as an important document in the process of financing a vehicle. This form outlines the agreement between the borrower and the lender, detailing the amount borrowed, the interest rate, and the repayment schedule. It typically includes information about the vehicle being purchased, such as its make, model, and identification number. In addition, the form specifies the consequences of defaulting on the loan, which may include repossession of the car. Both parties sign the document, signifying their commitment to the terms laid out within. Understanding this form is crucial for anyone looking to finance a car, as it protects the rights of both the borrower and the lender. By clearly stating the obligations and expectations, the Promissory Note helps to prevent misunderstandings and disputes down the line.

Find More Types of Promissory Note for a Car Templates

Satisfaction and Release Form - Use this release to provide clear documentation of debt resolution.

A promissory note in Alabama is a crucial document that ensures clarity in financial transactions. It serves as a written promise to repay a specified amount of money to a designated party at an agreed-upon time, detailing the terms such as interest rates and repayment schedules. To get started on your own promissory note, click to open the necessary form and begin your financial agreement.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to confusion or disputes later. Ensure you fill out every section, including your name, address, and loan amount.

-

Incorrect Loan Amount: Double-check the loan amount you are requesting. An error here can affect your repayment terms and interest calculations.

-

Missing Signatures: Both parties must sign the note for it to be valid. Forgetting to sign can render the document unenforceable.

-

Not Specifying Payment Terms: Clearly outline how and when payments will be made. Vague terms can lead to misunderstandings down the line.

-

Ignoring State Laws: Each state may have different regulations regarding promissory notes. Not adhering to these laws can invalidate your note.

-

Failing to Keep a Copy: Always retain a copy of the signed promissory note for your records. This can be crucial if any disputes arise in the future.

Guide to Writing Promissory Note for a Car

Filling out the Promissory Note for a Car form is an important step in securing a loan for your vehicle. Once completed, this document will outline the terms of your agreement with the lender. It is crucial to ensure that all information is accurate and clearly stated to avoid any misunderstandings in the future.

- Gather necessary information: Before you start filling out the form, collect all relevant details such as the buyer's name, address, and contact information, as well as the lender's information.

- Enter the date: Write the date on which you are completing the form at the top of the document.

- Fill in the borrower’s information: Clearly write the name and address of the person borrowing the money for the car.

- Provide lender’s information: Enter the name and address of the lender who is providing the loan.

- Specify loan amount: Clearly state the total amount of money being borrowed for the purchase of the car.

- Detail the interest rate: Indicate the interest rate that will apply to the loan. Ensure that this is agreed upon by both parties.

- Outline repayment terms: Describe how and when payments will be made, including the payment schedule and any grace periods.

- Include collateral information: Specify the car being purchased as collateral for the loan, including its make, model, year, and Vehicle Identification Number (VIN).

- Sign and date: Both the borrower and the lender must sign and date the form to validate the agreement.

After completing the form, both parties should keep a copy for their records. This ensures that everyone has access to the terms agreed upon and can refer back to them if needed.

Documents used along the form

When you enter into a financing agreement for a car, several important documents often accompany the Promissory Note. Each of these forms serves a specific purpose in the transaction, ensuring that both parties understand their rights and obligations. Here’s a brief overview of four common documents you may encounter.

- Vehicle Purchase Agreement: This document outlines the terms of the sale, including the purchase price, vehicle details, and any warranties or guarantees. It serves as a formal agreement between the buyer and seller, detailing the specifics of the transaction.

- Title Transfer Document: This form is essential for transferring ownership of the vehicle from the seller to the buyer. It includes information about the vehicle, such as the VIN (Vehicle Identification Number), and must be filed with the appropriate state agency to officially record the change in ownership.

- Bill of Sale: A Bill of Sale acts as a receipt for the transaction. It provides proof that the buyer has purchased the vehicle and includes information about the buyer, seller, and the vehicle itself. This document can be useful for future reference or in case of disputes.

- Promissory Note: This is a critical document that sets forth the agreement between the borrower and lender regarding the loan amount, interest rate, and repayment terms. For templates and further assistance, you can refer to nytemplates.com.

- Loan Agreement: If financing is involved, a Loan Agreement details the terms of the loan, including the interest rate, payment schedule, and any fees associated with the loan. This document helps clarify the financial obligations of the borrower and the lender.

Understanding these documents is crucial for anyone involved in buying or financing a vehicle. Each plays a vital role in protecting your interests and ensuring a smooth transaction. Always take the time to review each document carefully before signing.