Attorney-Approved Purchase Agreement Addendum Form

When entering into a real estate transaction, clarity and thoroughness are key to ensuring a smooth process. The Purchase Agreement Addendum form plays a vital role in this regard. It serves as an essential document that modifies or adds specific terms to the original purchase agreement. Whether it addresses contingencies, repairs, or financing details, this addendum helps to clarify the responsibilities and expectations of both buyers and sellers. By outlining additional provisions, it can protect the interests of all parties involved. Moreover, it can streamline negotiations by providing a clear framework for any changes that need to be made after the initial agreement is signed. Understanding how to properly utilize this form can make a significant difference in the overall experience of buying or selling a property.

Find More Types of Purchase Agreement Addendum Templates

Terminate Real Estate Agent Contract Letter - The form serves as a mutual agreement to cancel the real estate deal.

Utilizing the Florida Residential Lease Agreement form is essential for landlords and tenants alike, as it provides a comprehensive framework for the rental arrangement, ensuring that both parties are aware of their rights and obligations. For a detailed template, you can visit floridaforms.net/blank-residential-lease-agreement-form/, which serves as a valuable resource to simplify the lease drafting process.

Proprietor Financing Agreement - This agreement can offer tax advantages for sellers through installment sales, depending on their situation.

Common mistakes

-

Neglecting to Read the Entire Document: Many individuals overlook the importance of thoroughly reading the entire Purchase Agreement Addendum. This can lead to misunderstandings about the terms and conditions outlined within the document.

-

Failing to Include Necessary Details: Some people forget to provide essential information such as property addresses, dates, and the names of all parties involved. Omitting these details can create confusion and complicate the transaction process.

-

Not Specifying Contingencies: It is crucial to clearly outline any contingencies, such as financing or inspection requirements. Failing to do so can result in disputes later on.

-

Using Ambiguous Language: When filling out the form, vague or unclear language can lead to different interpretations. It is important to use precise terms to avoid potential conflicts.

-

Ignoring Deadlines: Deadlines for contingencies and other actions must be adhered to. Ignoring these timelines can jeopardize the agreement and lead to lost opportunities.

-

Not Seeking Professional Guidance: Some individuals attempt to complete the addendum without consulting a real estate professional or attorney. This can result in costly mistakes that could have been easily avoided.

-

Failing to Sign and Date the Document: Lastly, neglecting to sign and date the addendum is a common oversight. Without these signatures, the document may not be legally binding, rendering it ineffective.

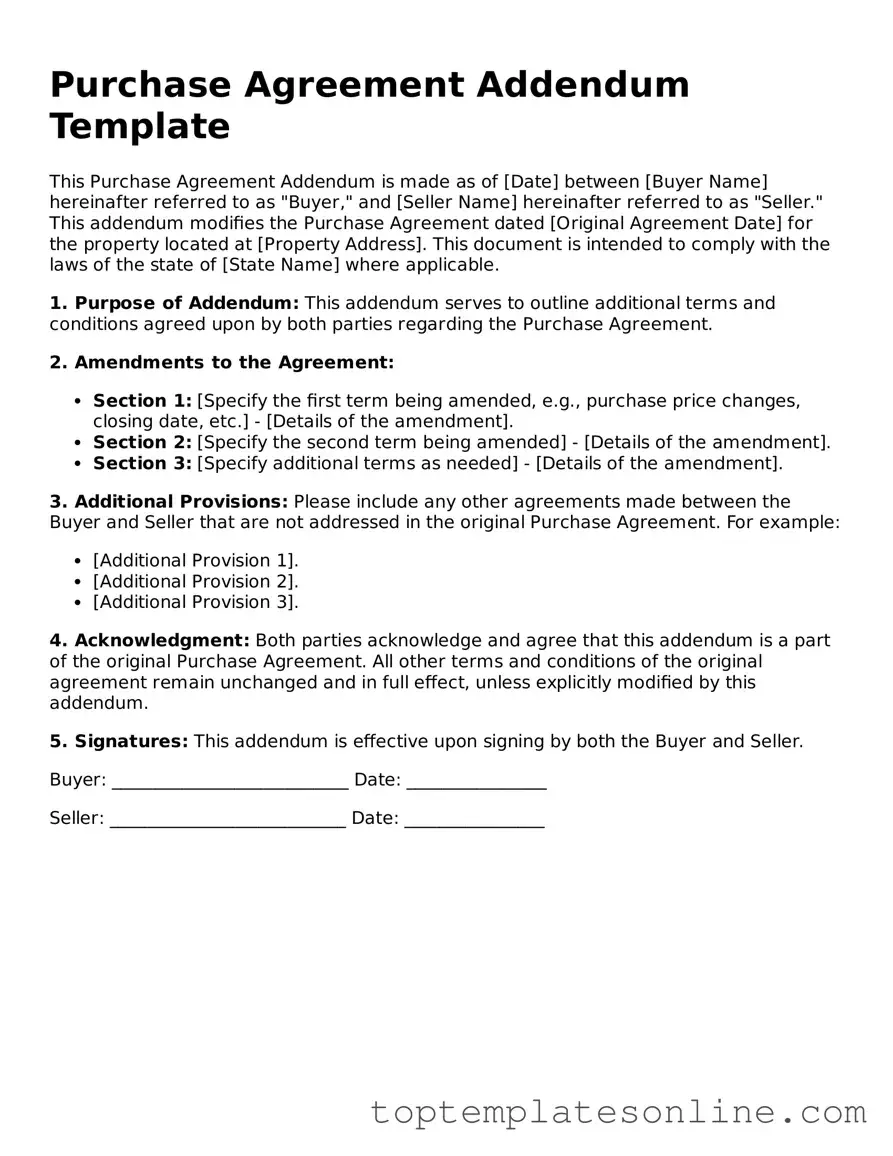

Guide to Writing Purchase Agreement Addendum

After obtaining the Purchase Agreement Addendum form, you will need to provide specific information to ensure it aligns with your agreement. This process involves detailing the terms that are being amended or added to your original purchase agreement. Careful attention to each section is important to avoid misunderstandings later.

- Begin by entering the date at the top of the form. This date should reflect when the addendum is being created.

- Next, identify the parties involved in the purchase agreement. Include the full names of the buyer(s) and seller(s) as they appear in the original agreement.

- Clearly state the address of the property in question. This should match the address listed in the original purchase agreement.

- In the section for amendments, describe the specific changes or additions to the original agreement. Be as detailed as possible to avoid ambiguity.

- If there are any new terms or conditions, list them clearly. Each term should be numbered or bulleted for easy reference.

- Make sure to include a section for signatures. Both parties should sign and date the addendum to indicate their agreement to the changes.

- Finally, provide a copy of the signed addendum to all parties involved and keep a copy for your records.

Documents used along the form

When engaging in real estate transactions, various forms and documents complement the Purchase Agreement Addendum to ensure clarity and legal compliance. Each document serves a specific purpose and contributes to a smoother transaction process. Below is a list of some commonly used forms that you may encounter.

- Purchase Agreement: This foundational document outlines the terms and conditions of the sale between the buyer and seller. It includes critical details such as the purchase price, financing terms, and contingencies.

- Disclosure Statements: Sellers are often required to provide disclosure statements that inform buyers of any known issues with the property, such as structural problems or environmental hazards. These disclosures protect both parties by ensuring transparency.

- Inspection Reports: After a property is inspected, an inspection report details the findings. This document can influence negotiations and may lead to additional requests for repairs or concessions.

- Real Estate Purchase Agreement: Consider utilizing the texasformspdf.com/ to access a fillable form that simplifies the process of drafting your agreement while ensuring all essential details are covered.

- Financing Addendum: If the buyer plans to finance the purchase, this addendum outlines the specific terms of the financing arrangement, including loan amounts, interest rates, and timelines for approval.

- Title Commitment: This document provides assurance that the title to the property is clear and that there are no liens or encumbrances. It is essential for protecting the buyer's ownership rights.

- Closing Statement: At the closing of the transaction, a closing statement summarizes all financial aspects of the sale, including the purchase price, closing costs, and any adjustments. This document ensures that both parties understand their financial obligations.

Understanding these documents and their roles in the transaction can significantly enhance your experience in real estate dealings. Each form contributes to a well-structured process, helping to mitigate risks and clarify responsibilities for all parties involved.