Attorney-Approved Purchase Letter of Intent Form

A Purchase Letter of Intent (LOI) serves as a crucial document in the early stages of a transaction between a buyer and a seller. This form outlines the intentions of the parties involved, providing a framework for negotiations. It typically includes key details such as the purchase price, payment terms, and any contingencies that must be met before the final agreement is executed. Additionally, it may address timelines for due diligence and closing, ensuring both parties have a clear understanding of their obligations. While the LOI is not legally binding in most cases, it signals a serious commitment to proceed with the transaction and can help facilitate smoother negotiations. By clearly articulating the main points of the deal, the Purchase Letter of Intent lays the groundwork for a formal purchase agreement, making it an essential step in the buying process.

Find More Types of Purchase Letter of Intent Templates

Letter of Intent Resume - Aids in establishing an effective hiring workflow.

In the world of finance, having a solid understanding of the Investment Letter of Intent is essential for both investors and businesses. This document, which outlines the preliminary agreement regarding proposed investment terms, plays a vital role in ensuring clarity. It lays out important elements such as investment amounts, timelines, and necessary conditions that both parties must agree upon before finalizing any deals. To learn more about this significant form, you can visit topformsonline.com/investment-letter-of-intent, which provides further insights into its importance and functionality.

Letter of Intent to Lease Commercial Property Pdf - It can serve as a reference point for future conversations during lease drafting.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that every section is filled out completely.

-

Incorrect Property Description: Misidentifying the property can cause confusion. Double-check the address and any legal descriptions.

-

Unclear Terms: Vague language regarding price or conditions can create misunderstandings. Be specific about your offers and expectations.

-

Omitting Contingencies: Not including necessary contingencies can result in complications later. Clearly outline any conditions that must be met.

-

Missing Signatures: Forgetting to sign the document can invalidate it. Make sure all required parties sign before submission.

-

Ignoring Deadlines: Submitting the form after the deadline can jeopardize the deal. Keep track of all relevant dates.

-

Not Seeking Legal Advice: Skipping professional guidance can lead to mistakes. Consulting with an attorney can help clarify complex issues.

Guide to Writing Purchase Letter of Intent

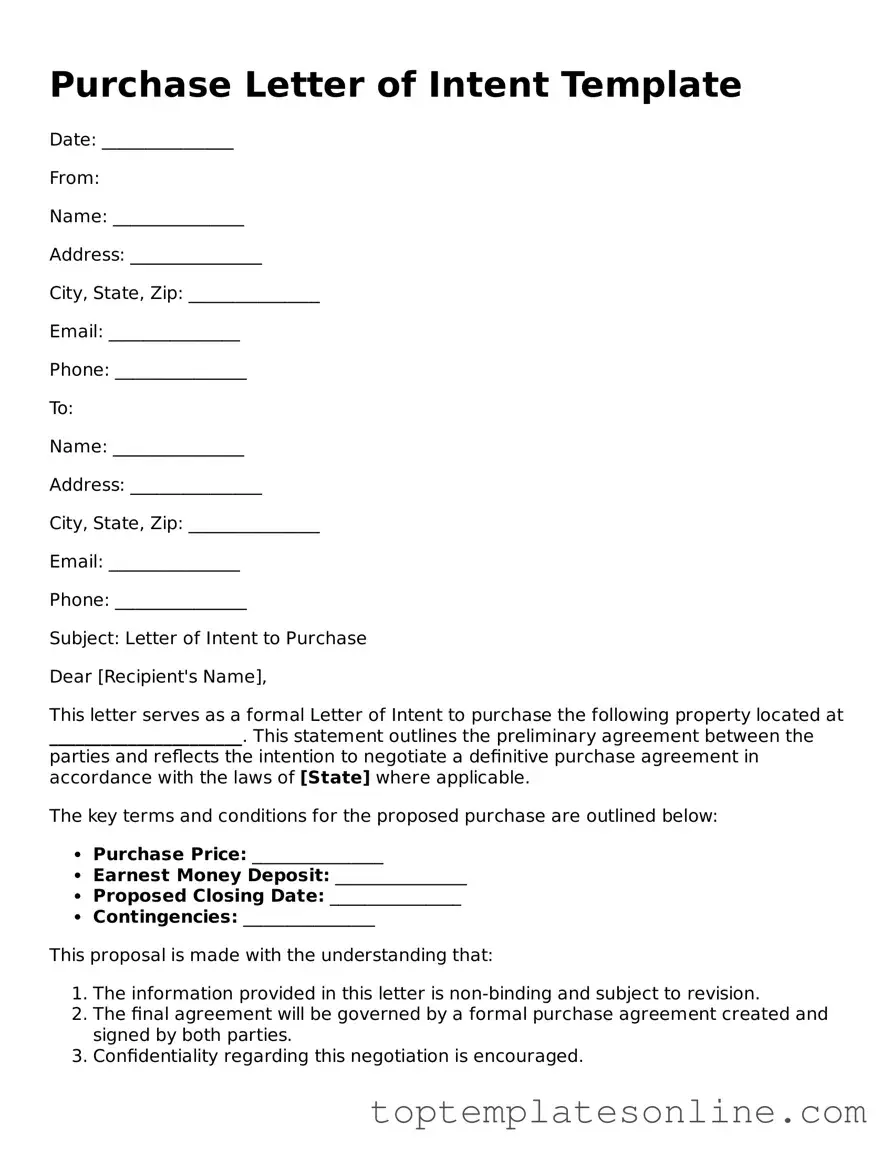

Once you have the Purchase Letter of Intent form in front of you, it's time to begin filling it out. This form serves as a preliminary step in the purchasing process, signaling your intention to buy. Completing it accurately is essential for moving forward smoothly.

- Start with your information: At the top of the form, enter your full name, address, phone number, and email address. Make sure all details are correct.

- Seller's details: Next, provide the name and contact information of the seller. This could be an individual or a company.

- Property description: Clearly describe the property you intend to purchase. Include the address, type of property, and any specific details that are relevant.

- Purchase price: Indicate the proposed purchase price. Be clear and precise about the amount.

- Deposit amount: State the amount of the deposit you are willing to make. This is usually a percentage of the purchase price.

- Contingencies: List any conditions that must be met before the sale can proceed, such as inspections or financing approvals.

- Closing date: Specify your preferred closing date, which is when the sale will be finalized.

- Signature: Finally, sign and date the form at the bottom. This signifies your agreement to the terms outlined in the letter.

After completing the form, review all the information for accuracy. Once everything is confirmed, you can submit it to the seller or their representative. This step will help facilitate further discussions and negotiations regarding the purchase.

Documents used along the form

When considering a purchase agreement, the Purchase Letter of Intent (LOI) serves as an important initial step. However, it is often accompanied by several other forms and documents that help clarify the terms of the transaction and protect the interests of both parties. Below is a list of commonly used documents that you may encounter in conjunction with a Purchase Letter of Intent.

- Purchase Agreement: This is the formal contract that outlines the specific terms and conditions of the sale, including the purchase price, payment terms, and any contingencies that must be met before the sale is finalized.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document ensures that sensitive information shared during negotiations remains confidential, protecting both parties from potential information leaks.

- Homeschool Letter of Intent: This form is critical for parents wishing to formally declare their intention to homeschool their children, and it ensures compliance with state regulations. For more information, visit the Homeschool Letter of Intent.

- Due Diligence Checklist: This is a comprehensive list of items that the buyer should investigate before finalizing the purchase. It may include financial records, legal documents, and operational details to ensure that the buyer is fully informed.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document outlines the terms of the loan or financing arrangement, including interest rates and repayment schedules.

- Escrow Agreement: This document establishes a neutral third party to hold funds or documents until all conditions of the sale are met, providing security for both the buyer and the seller.

- Letter of Credit: A letter of credit is a financial document issued by a bank that guarantees payment to the seller upon fulfillment of specific conditions, often used in international transactions.

- Title Report: This report provides information about the ownership of the property and any liens or encumbrances that may affect the sale, ensuring that the buyer is aware of any potential issues.

- Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property, ensuring transparency and protecting the buyer from unexpected surprises after the purchase.

- Closing Statement: Also known as a settlement statement, this document summarizes all the financial details of the transaction, including fees, taxes, and the final amounts to be paid by both parties at closing.

Understanding these documents can significantly enhance your confidence in the purchasing process. Each plays a vital role in ensuring that the transaction proceeds smoothly and that both parties are protected. Always consider consulting with a legal professional to guide you through the complexities of these forms and documents.