Attorney-Approved Quitclaim Deed Form

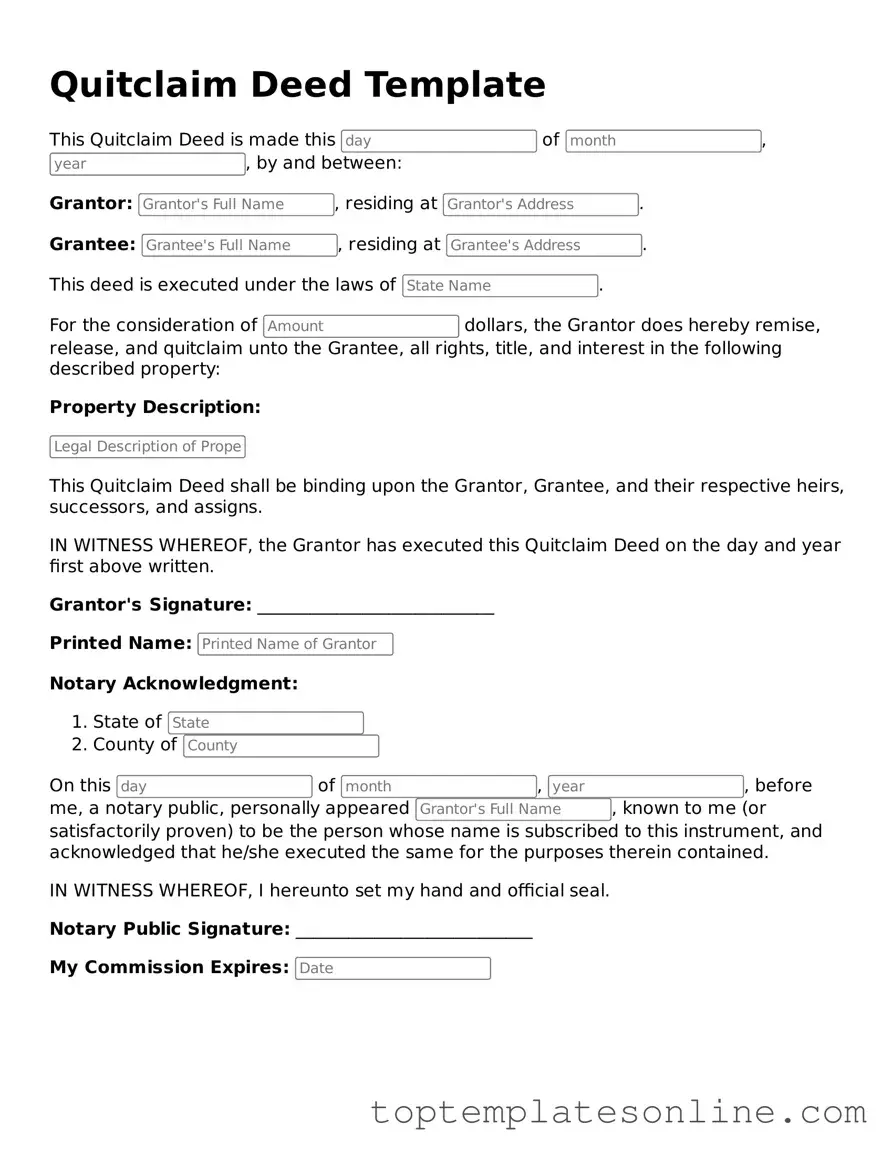

The Quitclaim Deed form serves as a vital tool in the realm of property transfers, enabling individuals to relinquish any interest they may have in a property without making guarantees about the title's validity. This type of deed is particularly useful in situations where the parties involved have a level of trust, such as family members or close friends, as it does not require a title search or warranties. The form typically includes essential information such as the names of the grantor (the person giving up their interest) and the grantee (the person receiving the interest), along with a legal description of the property in question. Additionally, it often requires the signature of the grantor and may need to be notarized to ensure its legality. Understanding the Quitclaim Deed is crucial for anyone involved in real estate transactions, as it can simplify the transfer process while also carrying certain risks, especially regarding the clarity of ownership rights. When executed properly, this form can effectively facilitate the transfer of property rights, making it an important document for both individuals and legal professionals alike.

State-specific Information for Quitclaim Deed Documents

Find More Types of Quitclaim Deed Templates

Free Printable Gift Deed Form - Having a Gift Deed can give the donor peace of mind knowing their wishes are legally documented.

In addition to its protective role, a New York Non-disclosure Agreement form can often be easily accessed and customized to fit specific needs, with templates available online, such as the one found at newyorkform.com/free-non-disclosure-agreement-template, ensuring that you have the right documentation to secure your confidential information.

Common mistakes

-

Not using the correct form: Each state has its own specific quitclaim deed form. Using the wrong one can lead to complications.

-

Incomplete information: Failing to fill out all required fields can render the deed invalid. Ensure that all necessary details are included.

-

Incorrect names: Names must match exactly as they appear on legal documents. Even a small typo can create issues later.

-

Missing signatures: All parties involved must sign the deed. Omitting a signature can invalidate the document.

-

Not having the deed notarized: Many states require notarization for the deed to be legally binding. Skipping this step can lead to problems.

-

Incorrect property description: A clear and accurate description of the property is essential. Vague or incorrect descriptions can cause disputes.

-

Failing to record the deed: After filling out the quitclaim deed, it must be filed with the appropriate county office. Neglecting this step can leave the transfer unrecognized.

-

Not understanding the implications: A quitclaim deed transfers ownership without guarantees. It's crucial to understand what this means for both parties.

-

Ignoring local laws: Each locality may have its own rules regarding quitclaim deeds. Familiarizing yourself with local requirements is important.

-

Assuming it’s a simple process: While quitclaim deeds can be straightforward, overlooking details can lead to significant issues. Taking the time to carefully complete the form is essential.

Guide to Writing Quitclaim Deed

Once you have the Quitclaim Deed form ready, it’s important to fill it out accurately. This ensures that the transfer of property rights is clear and legally binding. After completing the form, it typically needs to be signed, notarized, and then filed with the appropriate county office.

- Begin by entering the date at the top of the form.

- Provide the name of the person transferring the property (the grantor) in the designated space.

- Next, write the name of the person receiving the property (the grantee).

- Include the full legal description of the property. This can often be found on the property’s title or deed.

- Indicate the address of the property being transferred.

- Specify any consideration, or payment, made for the transfer, if applicable.

- Have the grantor sign the form in the appropriate section.

- Find a notary public to witness the signing and notarize the document.

- Finally, submit the completed and notarized Quitclaim Deed to the county recorder’s office where the property is located.

Documents used along the form

A Quitclaim Deed is a useful document for transferring ownership of property. However, it is often accompanied by other forms and documents that help clarify the transaction and protect the interests of all parties involved. Below is a list of documents commonly used alongside a Quitclaim Deed.

- Title Search Report: This document provides a history of the property’s title, including any liens or encumbrances. It ensures that the seller has the right to transfer ownership.

- Property Tax Statement: This statement outlines any outstanding property taxes. Buyers should review it to understand their financial obligations after the transfer.

- Affidavit of Identity: This form verifies the identity of the parties involved in the transaction. It helps prevent fraud and ensures that the correct individuals are signing the Quitclaim Deed.

- Purchase Agreement: This contract details the terms of the sale, including the price and any contingencies. It serves as a binding agreement between the buyer and seller.

- Articles of Incorporation: This document is essential for establishing a corporation in New York, detailing the corporation's name, purpose, and structure. For further guidance, you can refer to templates provided by NY Templates.

- Notice of Transfer: This document notifies relevant authorities, such as the local tax assessor, about the change in property ownership. It is often required for tax purposes.

- Power of Attorney: If one party cannot be present to sign the Quitclaim Deed, this document allows another person to act on their behalf. It must be executed properly to be valid.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents outline rules, regulations, and any fees associated with the community. Buyers should review these carefully.

- Closing Statement: This document summarizes all financial transactions related to the sale, including fees, commissions, and the final sale price. It provides a clear picture of the financial aspects of the deal.

Using these documents alongside a Quitclaim Deed can help ensure a smooth property transfer process. Each form plays a vital role in protecting the rights and responsibilities of everyone involved in the transaction.