Attorney-Approved Real Estate Purchase Agreement Form

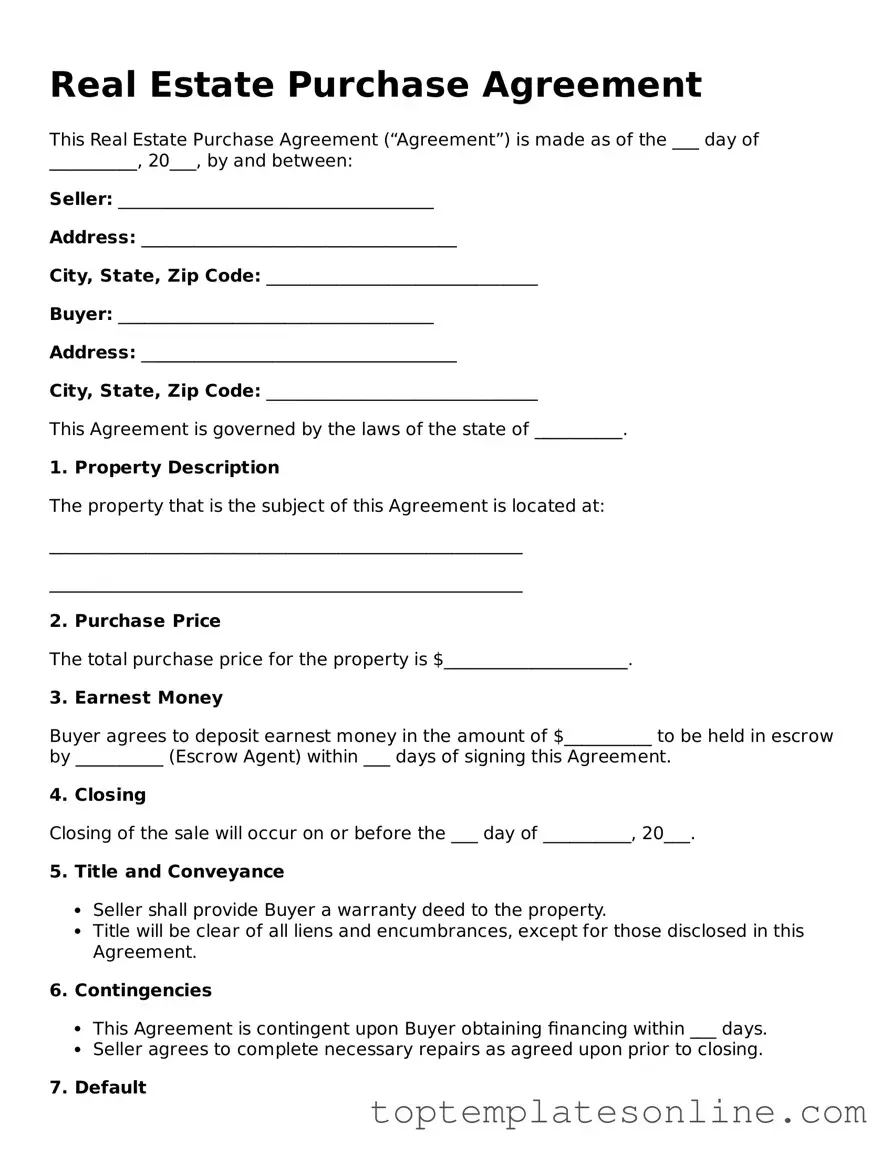

When embarking on the journey of buying or selling a home, the Real Estate Purchase Agreement form serves as a crucial document that outlines the terms and conditions of the transaction. This form typically includes essential details such as the purchase price, the legal description of the property, and the closing date, which together establish the framework for the deal. Additionally, it addresses contingencies that may affect the sale, such as financing, inspections, and the sale of the buyer's current home. Parties involved in the transaction must also consider the earnest money deposit, which demonstrates the buyer's commitment to the purchase. Moreover, the agreement often specifies any personal property included in the sale, such as appliances or fixtures, ensuring clarity for both the buyer and seller. By carefully reviewing and understanding each component of this form, individuals can navigate the complexities of real estate transactions with greater confidence and security.

State-specific Information for Real Estate Purchase Agreement Documents

Real Estate Purchase Agreement Categories

Common Templates

Photo Booth Rental Contract Template - Defines the limits of usage for the photo booth during the event.

One of the key components in establishing a smooth rental experience is the use of a well-drafted agreement, such as the Rental Lease Agreement, which delineates the obligations and expectations of both landlords and tenants, thus minimizing misunderstandings and conflicts during the lease term.

Death Affidavit - A document meant to assert the need for a funeral or memorial service.

Lien Waiver - The Chicago Title Waiver Format form plays a vital role in protecting both contractors and property owners during transactions.

Common mistakes

-

Incomplete Information: One common mistake is not filling out all required sections of the form. Every detail matters, from the buyer's and seller's names to the property address. Leaving any part blank can lead to confusion or disputes later on.

-

Incorrect Dates: Entering the wrong dates can create significant issues. For example, the closing date must be accurate and agreed upon by both parties. If the dates don’t align, it can cause delays or even jeopardize the sale.

-

Misunderstanding Contingencies: Many people do not fully grasp the contingencies included in the agreement. These are conditions that must be met for the sale to proceed. Failing to understand or properly outline these can lead to problems if the buyer or seller wants to back out.

-

Not Seeking Professional Help: Some individuals attempt to fill out the agreement without consulting a real estate agent or attorney. This can result in overlooking important legal implications or necessary clauses that protect both parties.

Guide to Writing Real Estate Purchase Agreement

Completing a Real Estate Purchase Agreement form is an essential step in the process of buying or selling property. Following these instructions will help ensure that all necessary information is accurately captured, leading to a smoother transaction.

- Begin with the date: Write the date when the agreement is being filled out at the top of the form.

- Identify the parties: Clearly state the full names of the buyer(s) and seller(s). Include any applicable titles, such as Mr., Mrs., or Ms.

- Provide property details: Enter the complete address of the property being purchased, including the city, state, and ZIP code.

- Specify the purchase price: Clearly indicate the total amount the buyer agrees to pay for the property.

- Outline payment terms: Detail how the buyer intends to pay for the property, including any down payment and financing arrangements.

- Include contingencies: List any conditions that must be met for the sale to proceed, such as financing approval or home inspections.

- Set closing details: Indicate the proposed closing date and any specific requirements for the closing process.

- Signatures: Ensure that all parties sign and date the agreement to make it legally binding.

Once the form is filled out, it is advisable to review it for accuracy and completeness. Both parties should retain a copy for their records. This agreement will guide the subsequent steps in the real estate transaction process.

Documents used along the form

When engaging in a real estate transaction, several important documents accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose and helps ensure a smooth process for both buyers and sellers. Here’s a brief overview of six commonly used forms and documents.

- Property Disclosure Statement: This document provides potential buyers with important information about the property's condition. Sellers must disclose any known defects or issues that could affect the value or safety of the property.

- Last Will and Testament: This essential legal document details how a person's assets will be distributed after their death, providing a clear directive for estate management. For templates and guidance, check NY Templates.

- Title Report: A title report outlines the legal ownership of the property. It reveals any liens, encumbrances, or claims against the property, ensuring that the buyer receives clear title upon purchase.

- Financing Addendum: This document details the terms of the buyer’s financing. It specifies the type of loan, interest rates, and any contingencies related to securing financing for the purchase.

- Home Inspection Report: After an inspection, this report highlights the property's condition. It often identifies repairs needed, helping buyers make informed decisions about their purchase.

- Closing Statement: This document is prepared for the closing meeting. It summarizes all financial transactions involved in the sale, including fees, commissions, and the final sale price.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be legally effective.

Understanding these documents is crucial for anyone involved in a real estate transaction. They not only protect the interests of both parties but also facilitate a clearer and more transparent process. Being informed can lead to better decisions and a smoother experience overall.