Attorney-Approved Release of Promissory Note Form

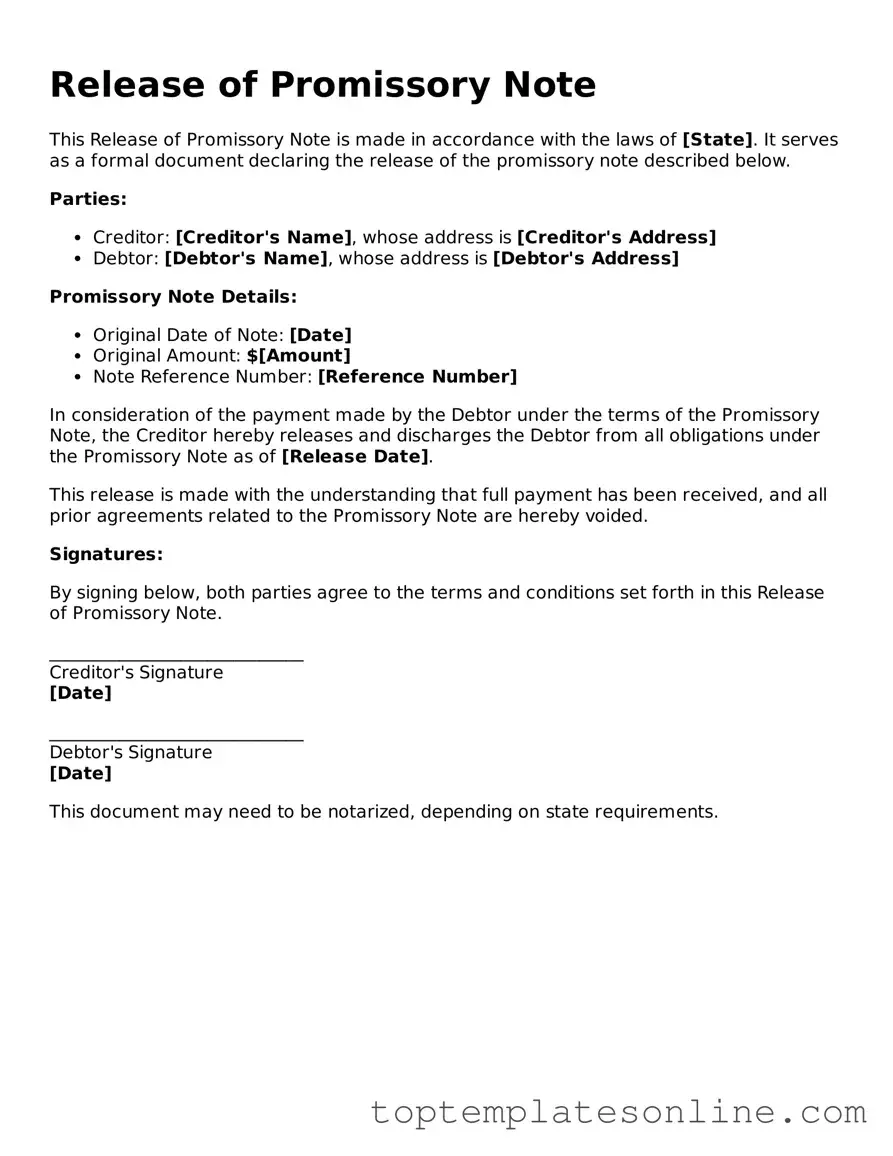

The Release of Promissory Note form serves as a crucial document in the realm of financial transactions, particularly when a borrower has fulfilled their obligations under a promissory note. This form not only signifies the lender's acknowledgment of the debt's satisfaction but also provides a clear record that the borrower has met all terms and conditions outlined in the original agreement. By executing this form, both parties can ensure that the borrower's credit history is accurately reflected, eliminating any lingering obligations that could affect future financial dealings. Additionally, the form typically includes essential details such as the names of the parties involved, the original loan amount, and the date of repayment, which collectively contribute to a comprehensive understanding of the transaction's closure. In essence, the Release of Promissory Note form is an important tool for fostering trust and clarity in financial relationships, safeguarding the interests of both borrowers and lenders alike.

Find More Types of Release of Promissory Note Templates

Car Loan Note - Creates a mutual understanding of financial commitments in a car loan.

When engaging in financial agreements, utilizing a New York Promissory Note is essential for ensuring mutual understanding between parties. It outlines the repayment terms, thereby eliminating any potential misunderstandings. For templates and further assistance, you can refer to nytemplates.com, which offers comprehensive resources to help you draft a legally sound agreement.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to delays. Ensure that all fields are filled out accurately, including names, addresses, and dates.

-

Incorrect Signatures: Signatures must match the names listed on the form. A mismatch can cause confusion and may invalidate the release.

-

Missing Dates: Dates are crucial for tracking the timeline of the transaction. Omitting the date can create ambiguity regarding when the release takes effect.

-

Not Providing Copies: It is important to keep copies of the completed form for personal records. Failing to do so may lead to issues in the future.

-

Overlooking Notarization Requirements: Some jurisdictions may require notarization for the release to be valid. Check local regulations to ensure compliance.

Guide to Writing Release of Promissory Note

After completing the Release of Promissory Note form, you will need to submit it to the appropriate parties involved in the transaction. This may include the lender, borrower, or any other relevant entities. Ensure that everyone who needs a copy receives one for their records.

- Begin by obtaining the Release of Promissory Note form. You can find it online or request a copy from your lender.

- Fill in the date at the top of the form. This should be the date you are completing the release.

- Enter the names and addresses of both the lender and the borrower. Make sure to spell everything correctly.

- Provide details about the promissory note being released. This includes the original amount, date of the note, and any other relevant information.

- Indicate if there are any conditions for the release. If there are none, you can simply write "none."

- Sign the form where indicated. If you are the lender, ensure you sign as the authorized party.

- Include the date of your signature.

- Make copies of the completed form for your records and for the borrower.

Documents used along the form

The Release of Promissory Note form is an important document that signifies the satisfaction of a debt. However, it often works in conjunction with other forms and documents to ensure a smooth process. Below is a list of related documents that may be needed.

- Promissory Note: This is the original agreement where the borrower promises to repay the lender a specified amount under agreed terms.

- Template for Promissory Note: Utilizing a template can simplify the process of drafting your promissory note. You can find one suitable for Alabama by visiting this page.

- Loan Agreement: A comprehensive document outlining the terms and conditions of the loan, including interest rates, repayment schedules, and default consequences.

- Security Agreement: This document details any collateral that secures the loan, providing the lender with rights to the asset if the borrower defaults.

- Payment History Statement: A record of all payments made on the loan, which can help clarify any outstanding amounts before the release is finalized.

- Debt Settlement Agreement: If the loan was settled for less than the full amount owed, this document outlines the terms of that settlement.

- Certificate of Satisfaction: A formal statement that confirms the debt has been fully paid and the lender no longer has any claim against the borrower.

- Notice of Default: A document that informs the borrower of their failure to meet the terms of the loan, often preceding any legal actions.

- Affidavit of Debt: A sworn statement by the lender confirming the amount owed by the borrower, often used in legal proceedings.

- Release of Lien: If the loan was secured by a lien on property, this document removes the lien once the debt is paid.

- Loan Payoff Statement: A document provided by the lender detailing the exact amount needed to pay off the loan in full.

Understanding these documents can help ensure that all aspects of the loan are properly addressed and that the release process goes smoothly. It’s important to have the right paperwork in order to protect both parties involved.