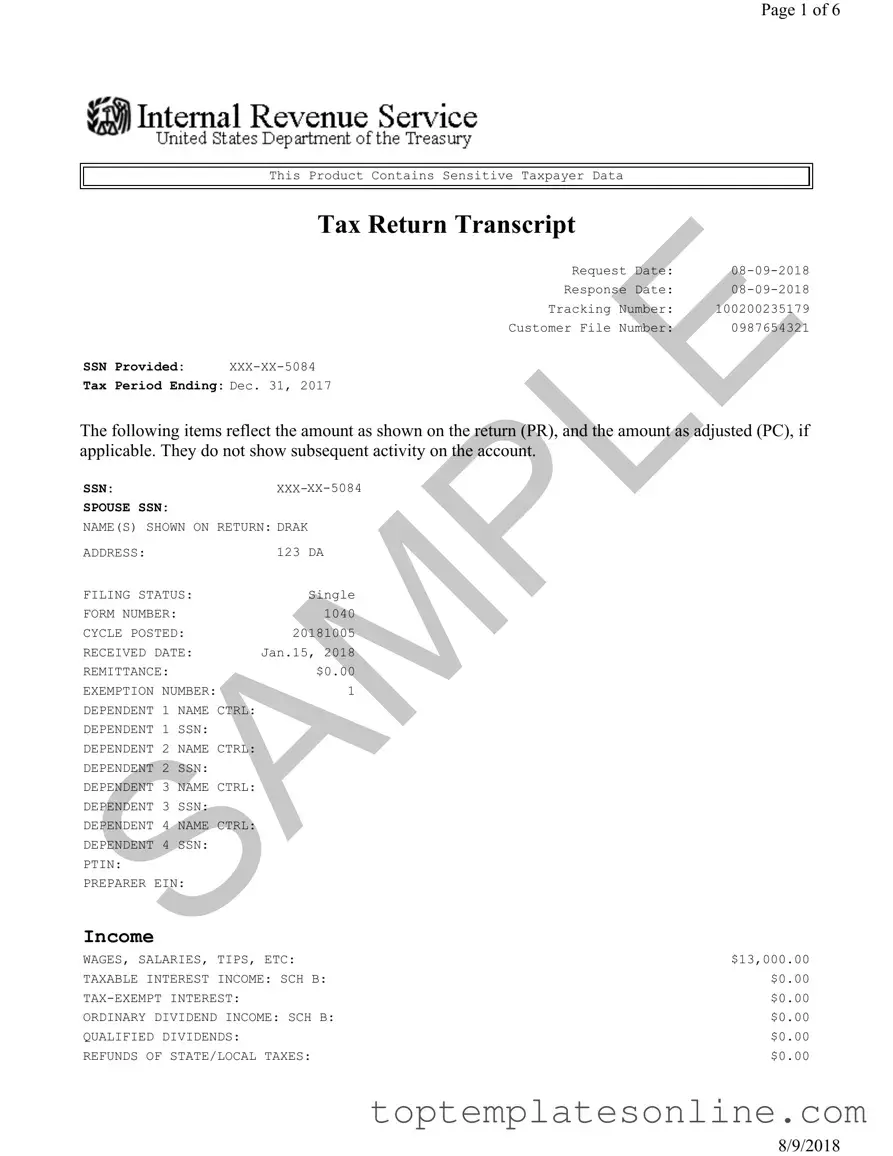

Fillable Sample Tax Return Transcript Form

The Sample Tax Return Transcript form serves as a vital document for individuals seeking to understand their tax situation for a specific year. This form encapsulates essential details such as the taxpayer's Social Security Number (SSN), filing status, and total income, providing a snapshot of financial activities reported on the tax return. For instance, it highlights wages, business income, and other sources of revenue, along with adjustments that affect the taxpayer's adjusted gross income. Additionally, the form outlines tax liabilities, including tentative tax amounts and any applicable credits, which can significantly influence the overall tax responsibility. It also includes information on payments made, whether through withholding or estimated tax payments, and specifies any balance owed or refund due. By summarizing these critical elements, the Sample Tax Return Transcript form not only aids taxpayers in reviewing their financial standing but also serves as a reference for lenders and other entities requiring verification of income and tax compliance.

Common PDF Templates

Florida Family Law Financial Affidavit Short Form - The form can be found on the Florida state court website.

This essential Employment Verification document can greatly simplify the process of confirming an individual's job history. It is designed to provide the necessary details for various applications, ensuring that all relevant information is accurately represented. Proper use of this form not only facilitates background checks but also supports efficient loan processing.

Printable Medication Mar Sheet - Supports accurate tracking of patient medication history across days.

Common mistakes

-

Incorrect Social Security Numbers: Failing to enter the correct Social Security Number (SSN) can lead to significant delays. Always double-check the SSN for accuracy.

-

Missing Signatures: Not signing the form is a common oversight. Ensure that all required signatures are present before submission.

-

Incorrect Tax Year: Filling out the form for the wrong tax year can cause confusion. Make sure to specify the correct tax period.

-

Omitting Income Sources: Forgetting to include all sources of income can lead to inaccuracies. List every income source as required.

-

Errors in Filing Status: Choosing the wrong filing status can affect tax calculations. Review your options carefully before making a selection.

-

Not Keeping Copies: Failing to keep a copy of the submitted form for personal records can create issues later. Always retain a copy for your files.

Guide to Writing Sample Tax Return Transcript

Filling out the Sample Tax Return Transcript form requires attention to detail. Each section must be completed accurately to ensure that the information reflects your tax situation correctly. After filling out the form, you may need to submit it to the appropriate tax authority or keep it for your records, depending on your needs.

- Begin by entering the Request Date at the top of the form. This is the date you are filling out the form.

- Fill in the Response Date, which is typically the same as the request date.

- Write down the Tracking Number. This number helps in tracking the status of your request.

- Input your Customer File Number, which is specific to your tax records.

- Provide your Social Security Number (SSN). Make sure to format it correctly.

- Indicate the Tax Period Ending date. This should reflect the end of the tax year you are reporting.

- Fill in your Name(s) Shown on Return as it appears on your tax documents.

- Enter your Address accurately, ensuring that it matches your tax records.

- Select your Filing Status from the options provided (e.g., Single, Married Filing Jointly).

- Complete the Form Number section, indicating the specific form you are referencing (e.g., 1040).

- Note the Cycle Posted date, which indicates when your tax return was processed.

- Record the Received Date, which is when your tax return was submitted.

- Fill in the Remittance amount, if applicable, showing any payments made.

- List your Exemption Number and any dependents you are claiming, including their names and SSNs.

- Detail your Income sources, including wages, interest, dividends, and any business income.

- Complete the Adjustments to Income section, listing any applicable deductions.

- Fill in the Tax and Credits section, providing details on your tax liability and any credits you may qualify for.

- Record any Payments made towards your tax obligation.

- Finally, indicate the Refund or Amount Owed based on the calculations made throughout the form.

Documents used along the form

The Sample Tax Return Transcript form is commonly used to provide a summary of an individual's tax return information. Alongside this form, several other documents may be necessary for various purposes such as verification, application for loans, or tax-related inquiries. Below is a list of five documents frequently associated with the Sample Tax Return Transcript form.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers to report their income, claim deductions and credits, and calculate their tax liability.

- Form W-2: Employers issue this form to report wages paid to employees and the taxes withheld. It is essential for individuals to complete their income tax returns accurately.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It is commonly issued for freelance work, interest income, and dividends.

- Schedule C: This document is used by sole proprietors to report income or loss from a business they operated or a profession they practiced. It details gross receipts and expenses.

- Arizona Motor Vehicle Bill of Sale: A critical document for the transfer of vehicle ownership in Arizona, it serves as proof for the transaction and includes necessary details like the VIN and purchase price. For further reference, check Legal PDF Documents.

- Form 4506-T: This form allows individuals to request a transcript of their tax return from the IRS. It is often used when applying for loans or verifying income.

These documents serve various functions, from reporting income to verifying tax information. Having them readily available can facilitate smoother interactions with financial institutions and tax authorities.