Attorney-Approved Self-Proving Affidavit Form

The Self-Proving Affidavit is an essential legal document that plays a pivotal role in the estate planning process, particularly in the context of wills. This form serves to simplify the probate process by allowing a will to be accepted as valid without the need for witness testimony. When executed correctly, it provides a layer of assurance that the testator— the person who created the will— was of sound mind and acted voluntarily. Typically, this affidavit is signed by the testator and witnesses in the presence of a notary public, ensuring that all parties affirm the authenticity of the will. By including this affidavit, individuals can help streamline the court's review process, potentially reducing delays and legal challenges during probate. Furthermore, it can ease the burden on loved ones during an already difficult time, offering clarity and confidence in the execution of the deceased's wishes. Understanding the nuances of the Self-Proving Affidavit is crucial for anyone looking to establish a legally sound and enforceable will.

Find More Types of Self-Proving Affidavit Templates

Free Printable Affidavit of Identity - This document often plays a critical role in various legal or financial scenarios.

For those looking to understand the implications of a Hold Harmless Agreement in detail, it's crucial to explore how this document safeguards parties involved in various activities. You can find more information at our in-depth guide on Hold Harmless Agreement procedures.

Death Affidavit - A means of providing clarity on the status of a person's life for legal reasons.

Declaration of Residency - The process of creating an Affidavit of Residency is straightforward, promoting accessibility.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required information. Each section of the Self-Proving Affidavit must be filled out completely. Leaving out details can lead to delays or complications in the probate process.

-

Incorrect Signatures: Signatures must be collected from the appropriate parties. Often, individuals forget to have witnesses sign or do not include the notary's signature. This can render the affidavit invalid.

-

Not Following State Guidelines: Each state has specific requirements for Self-Proving Affidavits. Ignoring these guidelines can result in a document that does not hold up in court. It is crucial to understand local laws before submitting the form.

-

Filing Errors: Mistakes can occur during the filing process, such as submitting the affidavit to the wrong office or failing to file it within the required timeframe. These errors can complicate the estate administration process.

Guide to Writing Self-Proving Affidavit

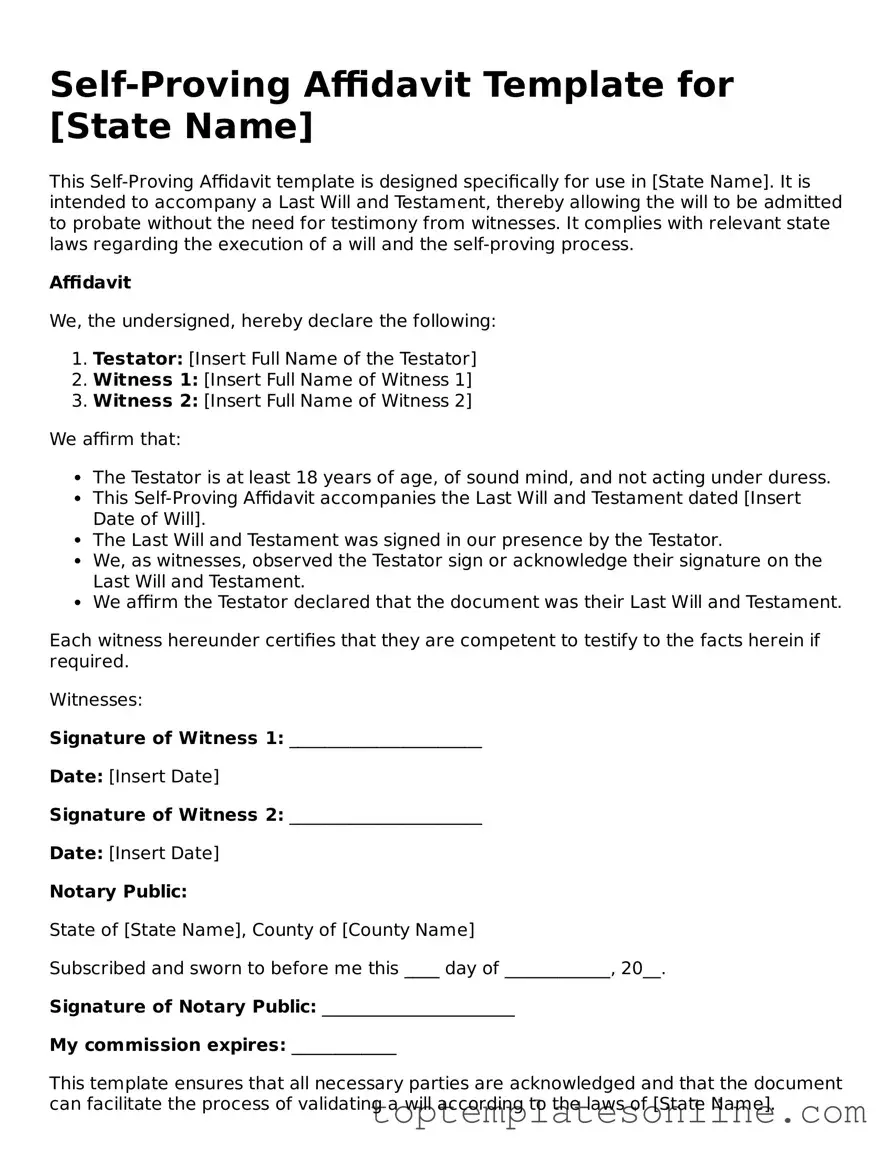

After you have gathered the necessary information and documents, you are ready to fill out the Self-Proving Affidavit form. This form is an important step in ensuring that your will is recognized and respected in the event of your passing. Follow the steps below to complete the form accurately.

- Begin by writing your name at the top of the form, ensuring it is clear and legible.

- Next, provide the date on which the affidavit is being executed.

- Indicate your relationship to the deceased, if applicable, or state your role in the execution of the will.

- Fill in the name of the deceased person whose will you are affirming.

- Clearly state the location (city and state) where the affidavit is being signed.

- In the designated section, provide a statement affirming that the will was signed in your presence by the testator.

- Sign your name in the appropriate space, confirming your statement.

- Have a witness sign the affidavit, if required, ensuring they also print their name and provide their address.

- Finally, if necessary, have the affidavit notarized to add an extra layer of authenticity.

Once you have completed the form, review it carefully to ensure all information is accurate. This will help prevent any issues when the affidavit is submitted. Keep a copy for your records and provide the original to the appropriate parties as needed.

Documents used along the form

The Self-Proving Affidavit is an important document in the estate planning process, often used to streamline the probate of a will. Alongside this affidavit, several other forms and documents may be necessary to ensure that the wishes of the deceased are honored and that the legal process runs smoothly. Below is a list of common documents that are frequently associated with the Self-Proving Affidavit.

- Last Will and Testament: This is the primary document that outlines the wishes of the deceased regarding the distribution of their assets and the care of any dependents.

- Executor's Affidavit: This document affirms the appointment of the executor, who is responsible for managing the estate and ensuring that the will is executed according to the deceased's wishes.

- Death Certificate: A legal document that officially confirms the death of an individual. This is often required to initiate the probate process.

- Notice to Creditors: A formal notification to creditors that the estate is being probated. This allows creditors to make claims against the estate for any outstanding debts.

- Quitclaim Deed: A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property’s title. This straightforward instrument allows the grantor to relinquish any claim to the property, making it a popular choice for transactions between family members or in situations where the seller cannot provide a clear title. For more information, visit Florida Forms.

- Inventory of Assets: A detailed list of all assets owned by the deceased at the time of death, which assists in the valuation of the estate.

- Petition for Probate: A legal request submitted to the court to initiate the probate process, asking for the will to be validated and the executor to be appointed.

- Waiver of Notice: A document signed by interested parties, indicating they do not require formal notice of the probate proceedings, which can expedite the process.

- Affidavit of Heirship: This document is used to establish the identity of the heirs when there is no will, helping to determine how the estate should be distributed.

- Bond for Executor: In some cases, the court may require the executor to post a bond, which acts as insurance to protect the estate from potential mismanagement.

Each of these documents plays a crucial role in the probate process and helps ensure that the estate is settled according to the deceased's wishes. Properly preparing and submitting these forms can facilitate a smoother transition during what is often a challenging time for families.