Attorney-Approved Single-Member Operating Agreement Form

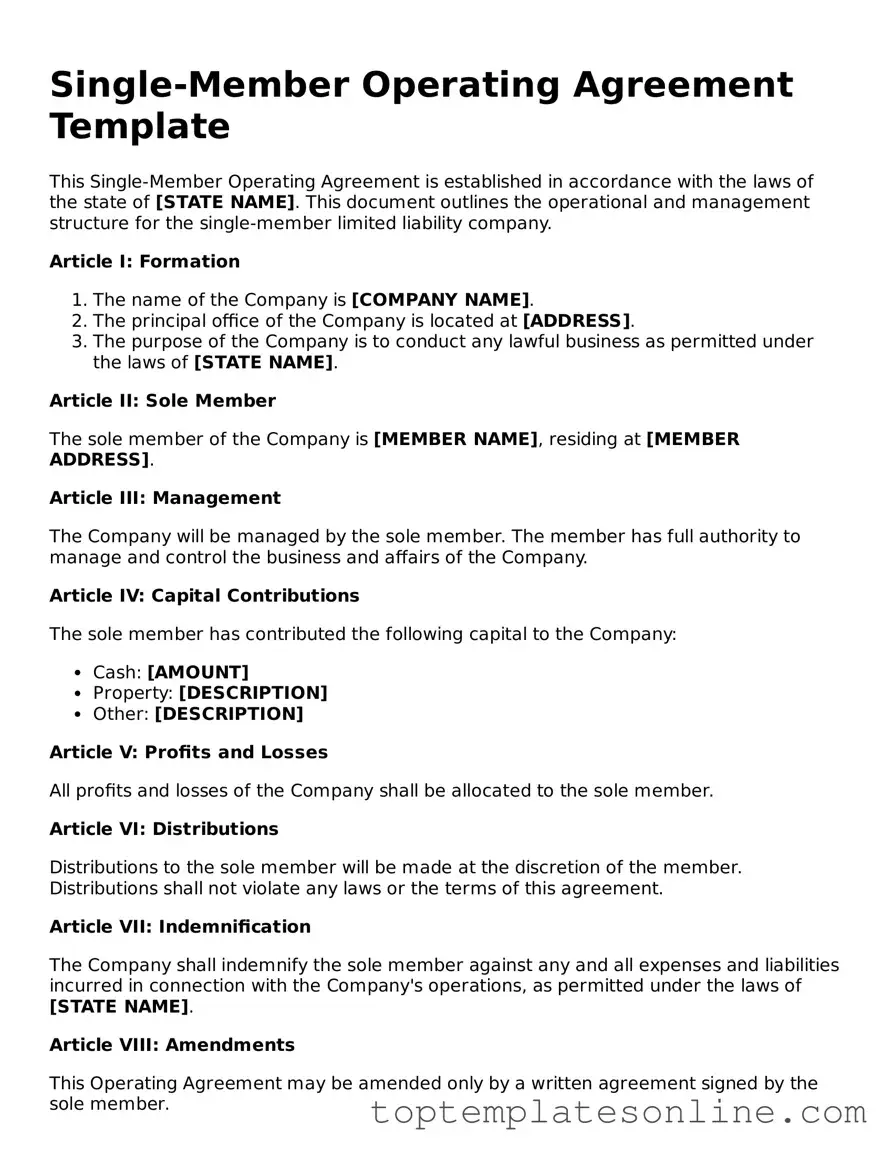

When establishing a single-member limited liability company (LLC), the Single-Member Operating Agreement form plays a crucial role in defining the structure and operation of the business. This document outlines the ownership details, management responsibilities, and operational procedures, ensuring clarity and legal protection for the owner. It typically includes essential elements such as the name of the LLC, the purpose of the business, and the duration of its existence. Additionally, it addresses financial matters, including how profits and losses will be allocated, as well as the process for making decisions. Importantly, the agreement serves to reinforce the limited liability status of the LLC, helping to separate personal and business assets. By laying out these key aspects, the Single-Member Operating Agreement not only facilitates smoother business operations but also safeguards the owner's interests against potential disputes or liabilities.

Common mistakes

-

Neglecting to Include Basic Information: Many people forget to fill in essential details such as the name of the LLC, the address, and the owner's name. This information is crucial for identifying your business.

-

Omitting Purpose of the LLC: It's important to clearly state the purpose of your LLC. Some individuals leave this section blank or provide vague descriptions, which can lead to confusion later on.

-

Not Specifying Ownership Structure: Even in a single-member LLC, it's vital to outline the ownership structure. Failing to do so can create ambiguity about who owns the business.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding operating agreements. Some people overlook these requirements, which can lead to issues with compliance.

-

Forgetting to Include Management Details: Clearly defining how the business will be managed is essential. Some individuals skip this section, which can create operational challenges.

-

Not Addressing Amendments: Life changes and so do business needs. Failing to include a section on how amendments can be made to the agreement can complicate future adjustments.

-

Overlooking Signatures: A common mistake is forgetting to sign the document. An unsigned agreement may not hold up in a legal context.

-

Neglecting to Keep Records: After filling out the agreement, some individuals fail to keep a copy for their records. This can lead to issues if the agreement needs to be referenced later.

Guide to Writing Single-Member Operating Agreement

Once you have the Single-Member Operating Agreement form ready, you’ll want to fill it out accurately. This document will help outline the ownership and operational structure of your business. Follow these steps to complete the form effectively.

- Start with your business name: Write the full legal name of your business at the top of the form.

- Provide your personal information: Fill in your name and address. This identifies you as the sole member.

- Specify the business address: Enter the primary location where your business operates.

- Detail the purpose of the business: Briefly describe what your business does or will do.

- State the management structure: Indicate that you will manage the business as the sole member.

- Outline the financial arrangements: Specify how profits and losses will be handled.

- Include any additional provisions: Add any specific rules or guidelines you want to establish for your business.

- Sign and date the document: Make sure to sign and date the form to validate it.

After completing the form, keep it in a safe place. This document may be needed for future reference or legal purposes, so ensure it's easily accessible.

Documents used along the form

A Single-Member Operating Agreement is a crucial document for individuals who own and operate a single-member limited liability company (LLC). It outlines the management structure, operational procedures, and financial arrangements of the LLC. However, several other forms and documents often accompany this agreement to ensure comprehensive governance and compliance. Below is a list of important documents that may be used alongside a Single-Member Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes essential information such as the business name, address, and the name of the registered agent.

- Employer Identification Number (EIN) Application: An EIN is a unique number assigned by the IRS for tax purposes. This application is necessary for opening a business bank account and hiring employees.

- Initial Resolutions: These are formal decisions made by the member to establish the LLC’s operations. They may include resolutions to open bank accounts or appoint officers.

- Membership Certificate: This document serves as proof of ownership in the LLC. It outlines the member's share in the company and may be required for certain transactions.

- Bylaws or Internal Rules: While not always necessary for single-member LLCs, these guidelines can help govern the internal operations and decision-making processes of the business.

- Annual Reports: Many states require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the business and its operations.

- Operating Agreement Form: For a solid foundation in managing your LLC, refer to our comprehensive Operating Agreement form guide to ensure all member responsibilities are clearly outlined.

- Tax Forms: Depending on the business structure, various tax forms may need to be filed annually. This includes forms for income tax, self-employment tax, and potentially sales tax.

In summary, while the Single-Member Operating Agreement is a foundational document for a single-member LLC, it is essential to consider these additional forms and documents. Together, they help establish a solid framework for the business, ensuring compliance with legal requirements and facilitating smooth operations.