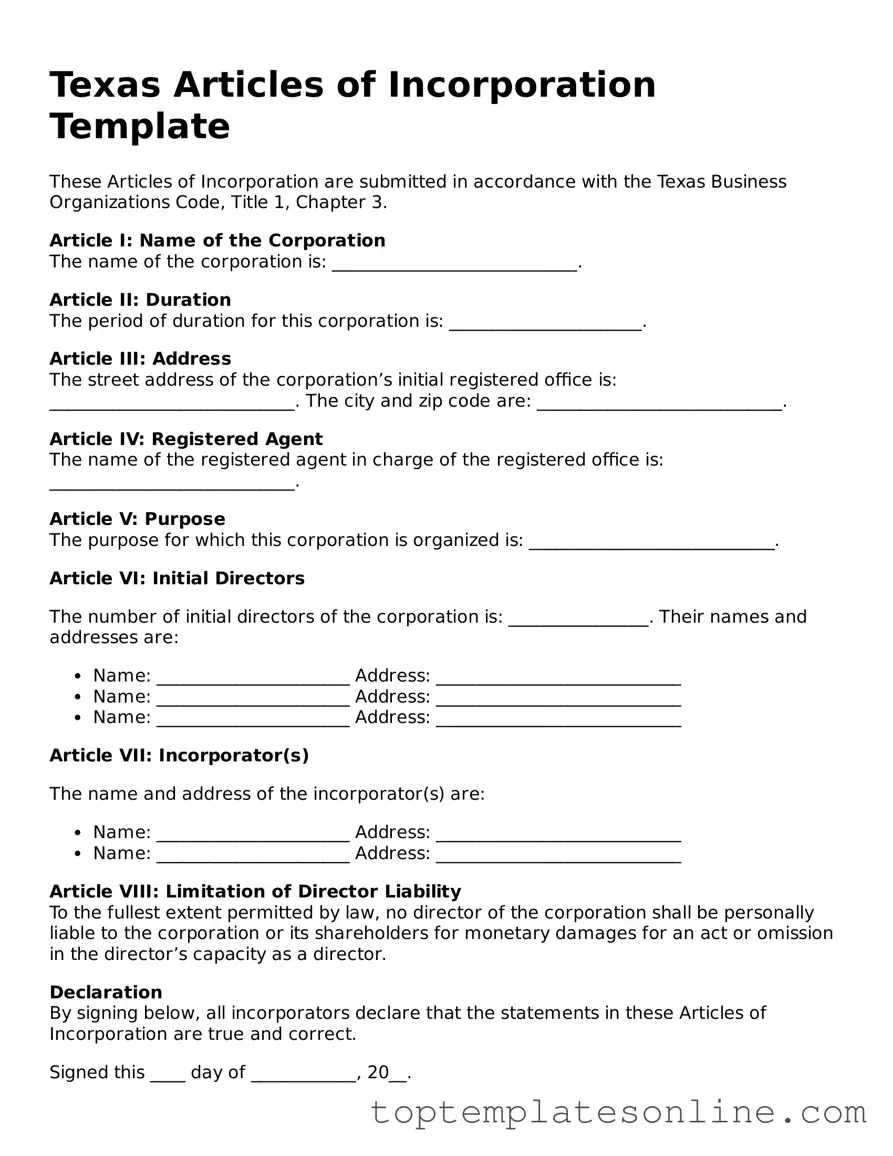

Blank Articles of Incorporation Template for Texas State

When starting a business in Texas, one of the first steps is to file the Articles of Incorporation. This essential document serves as the foundation for your corporation, outlining its purpose and structure. The form requires key information, such as the corporation's name, which must be unique and comply with state naming regulations. Additionally, it includes details about the registered agent, who will serve as the point of contact for legal matters. The Articles also specify the corporation's duration, whether it’s intended to exist perpetually or for a limited time. Furthermore, the form addresses the number and type of shares the corporation is authorized to issue, which is critical for establishing ownership and investment opportunities. By completing this form accurately, you set the stage for your business to operate legally and effectively in Texas.

Some Other State-specific Articles of Incorporation Templates

Certificate of Incorporation New York - Incorporators may tailor the Articles to suit the specific needs of their business.

Document Retrieval Center - Defines the business structure and responsibilities.

When navigating the complexities of legal documents, it's essential to understand the significance of a Power of Attorney form. In New York, this legal instrument empowers one individual to designate another to handle vital matters, including financial and medical decisions, ensuring a person's interests are represented even in their absence. For those interested in creating such a document, resources like newyorkform.com/free-power-of-attorney-template provide valuable templates to streamline the process.

Lara Llc - It is important for corporations to ensure accuracy in their Articles of Incorporation.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the name of the corporation or the purpose of incorporation, can lead to delays or rejection.

-

Incorrect Name: Using a name that is already taken or does not comply with Texas naming requirements can result in the application being denied.

-

Improper Designation: Not indicating the correct type of corporation (for example, nonprofit vs. for-profit) can create significant legal issues later.

-

Missing Registered Agent Information: Omitting the name and address of the registered agent can lead to problems with receiving legal documents.

-

Failure to Include Initial Directors: Not listing the initial directors, as required, can cause complications in governance and compliance.

-

Incorrect Filing Fee: Submitting an incorrect fee can delay processing. Ensure that the payment matches the current fee schedule.

-

Signature Issues: Not having the correct individuals sign the form or missing signatures altogether can invalidate the application.

-

Not Following Submission Guidelines: Ignoring the specific submission guidelines, such as format and method of filing, can result in rejection.

-

Neglecting to Review the Form: Failing to double-check for errors or omissions before submission can lead to unnecessary delays.

Guide to Writing Texas Articles of Incorporation

After completing the Texas Articles of Incorporation form, you will need to submit it to the Texas Secretary of State along with the required filing fee. Once processed, your corporation will be officially recognized in Texas, allowing you to begin your business operations legally.

- Visit the Texas Secretary of State's website to access the Articles of Incorporation form.

- Provide the name of your corporation. Ensure it meets Texas naming requirements.

- List the duration of your corporation. Most corporations are set up to exist perpetually.

- Specify the purpose of your corporation. Be clear and concise about what your business will do.

- Enter the registered agent's name and address. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the number of shares your corporation is authorized to issue. If applicable, include the par value of shares.

- Fill in the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Provide any additional provisions if necessary. This can include rules or regulations specific to your corporation.

- Review the form for accuracy. Ensure all information is correct and complete before submission.

- Submit the form along with the filing fee to the Texas Secretary of State. You can do this online, by mail, or in person.

Documents used along the form

When forming a corporation in Texas, the Articles of Incorporation is just the beginning. Several other important documents will help establish and maintain your corporation. Here’s a brief overview of seven essential forms and documents that often accompany the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It covers everything from how meetings are conducted to the roles and responsibilities of directors and officers.

- Initial Board of Directors Resolution: This resolution is typically adopted by the incorporators and designates the initial board of directors. It sets the stage for governance and decision-making.

- Durable Power of Attorney: A crucial document that allows the principal to nominate an agent to manage financial and legal matters, even in cases of incapacitation. For more information, you can refer to NY Templates.

- Registered Agent Consent Form: This form shows that the registered agent has agreed to serve in this capacity. A registered agent is essential for receiving legal documents on behalf of the corporation.

- Certificate of Formation: While similar to the Articles of Incorporation, this document may be required for specific types of corporations, such as professional corporations. It outlines the purpose and structure of the business.

- Employer Identification Number (EIN) Application: This form, often called Form SS-4, is submitted to the IRS to obtain an EIN. This number is necessary for tax purposes and hiring employees.

- Business License Applications: Depending on your industry and location, you may need to apply for various business licenses and permits to operate legally.

- Annual Franchise Tax Report: Texas requires corporations to file an annual report detailing their business activities and financial status. This report is crucial for maintaining good standing with the state.

Having these documents prepared and filed correctly can save you time and trouble down the line. Each plays a vital role in ensuring your corporation runs smoothly and complies with state regulations. Take the time to understand each one, as they are key to your business's success.