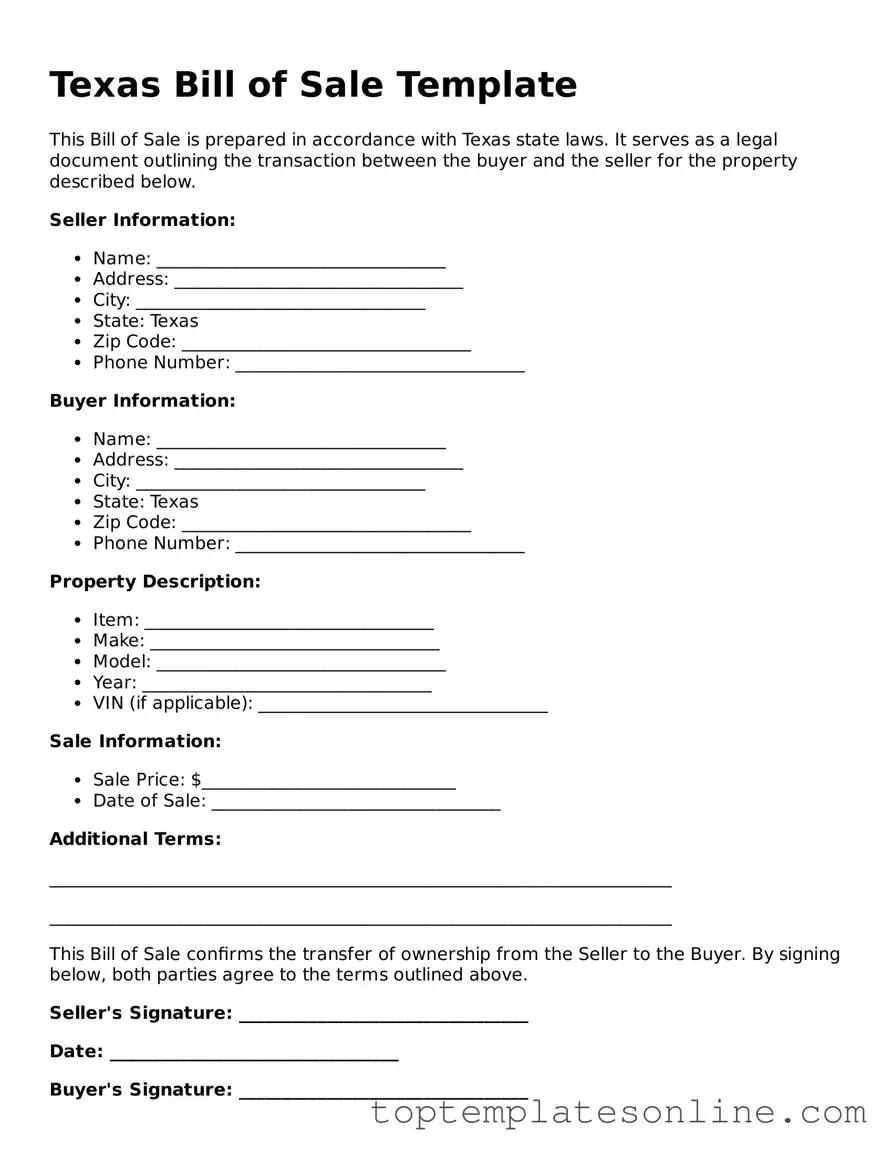

Blank Bill of Sale Template for Texas State

The Texas Bill of Sale form serves as a vital document for individuals engaging in the sale or transfer of personal property within the state. This form not only establishes a clear record of the transaction but also provides essential details that protect both the buyer and the seller. Typically, it includes information such as the names and addresses of both parties, a description of the property being sold, and the sale price. Additionally, the form may outline any warranties or guarantees associated with the item, ensuring that both parties understand their rights and responsibilities. By properly utilizing the Texas Bill of Sale, individuals can avoid potential disputes and create a transparent and legally sound transaction, making it an indispensable tool in the realm of personal property sales. Understanding its components and significance can empower individuals to navigate the complexities of property transfer with confidence.

Some Other State-specific Bill of Sale Templates

Vehicle Bill of Sale Form - It is often recommended to have a witness or notary present during the signing for added validity.

Georgia Bill of Sale - Having a completed Bill of Sale can simplify the process of proving ownership when reselling an item later.

Motor Vehicle Bill of Sale - The form can be modified to suit specific legal requirements in different states.

For those requiring a reliable means of documentation for the transfer of ownership, our specialized guide on the essential elements of a bill of sale template can be invaluable. To learn more about how to secure your transactions, visit this bill of sale resource.

Title Transfer New Jersey - A Bill of Sale can make transferring ownership of items more formal.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and signatures, can render the document invalid.

-

Incorrect Date: Entering the wrong date can lead to confusion about when the sale occurred, which may affect warranties or legal claims.

-

Omitting Vehicle Identification Number (VIN): Not including the VIN for vehicles can create issues with registration and ownership transfer.

-

Wrong Purchase Price: Listing an inaccurate purchase price may lead to disputes or complications with tax assessments.

-

Not Notarizing the Document: While notarization is not always required, failing to do so can make it harder to prove the authenticity of the sale.

-

Using a Generic Template: Relying on a generic template without customizing it for Texas laws can result in missing critical elements specific to the state.

-

Not Keeping Copies: Forgetting to make copies for both the buyer and seller can lead to disputes later on regarding the terms of the sale.

-

Ignoring Local Regulations: Overlooking local laws and regulations that may apply can lead to complications during the transfer process.

-

Failing to Disclose Issues: Not mentioning any known defects or issues with the item being sold can result in legal repercussions down the line.

Guide to Writing Texas Bill of Sale

Once you have your Texas Bill of Sale form ready, it’s time to fill it out accurately. This form is essential for documenting the sale of personal property, and completing it properly ensures a smooth transaction. Follow these steps to make sure you fill out the form correctly.

- Obtain the Form: Start by downloading or printing the Texas Bill of Sale form from a reliable source.

- Identify the Parties: Enter the full names and addresses of both the seller and the buyer. Make sure to double-check the spelling.

- Describe the Item: Provide a detailed description of the item being sold. Include information such as make, model, year, and any identifying numbers (like a VIN for vehicles).

- State the Sale Price: Clearly indicate the amount of money being exchanged for the item. Be specific about the currency.

- Include Date of Sale: Write the date when the transaction takes place. This is important for record-keeping.

- Signatures: Both the seller and the buyer must sign the form. This signifies that both parties agree to the terms outlined in the document.

- Witness or Notary (if needed): Depending on the item being sold, you may need a witness or notary to sign the form. Check the requirements based on the type of item.

After completing the form, keep a copy for your records. The buyer should also retain a copy as proof of ownership. This documentation can be crucial for future reference, especially if any disputes arise or for registration purposes.

Documents used along the form

The Texas Bill of Sale form is an important document for transferring ownership of personal property, such as vehicles, boats, or other items. However, it is often accompanied by additional forms and documents that help clarify the transaction and protect both the buyer and seller. Here are four commonly used documents that complement the Texas Bill of Sale:

- Title Transfer Document: This document is essential for transferring ownership of vehicles. It includes details about the vehicle, such as its identification number and current owner. Completing this form ensures that the new owner is officially recognized in state records.

- Affidavit of Ownership: In cases where a title is lost or unavailable, an Affidavit of Ownership can serve as a substitute. This sworn statement provides proof of ownership and details the circumstances surrounding the loss of the title.

- General Bill of Sale Form: To facilitate the transfer of personal property, utilize our easy-to-use general bill of sale form resources for accurate documentation.

- Vehicle Registration Application: After purchasing a vehicle, the new owner must register it with the state. This application includes personal information, vehicle details, and proof of ownership, such as the Bill of Sale or Title Transfer Document.

- Odometer Disclosure Statement: Required for most vehicle sales, this document records the vehicle's mileage at the time of sale. Both the seller and buyer must sign it to confirm the accuracy of the information, ensuring transparency in the transaction.

Using these documents in conjunction with the Texas Bill of Sale can streamline the process of transferring ownership and provide legal protection for both parties involved. It is always advisable to keep copies of all documents for your records, ensuring clarity and accountability in any transaction.