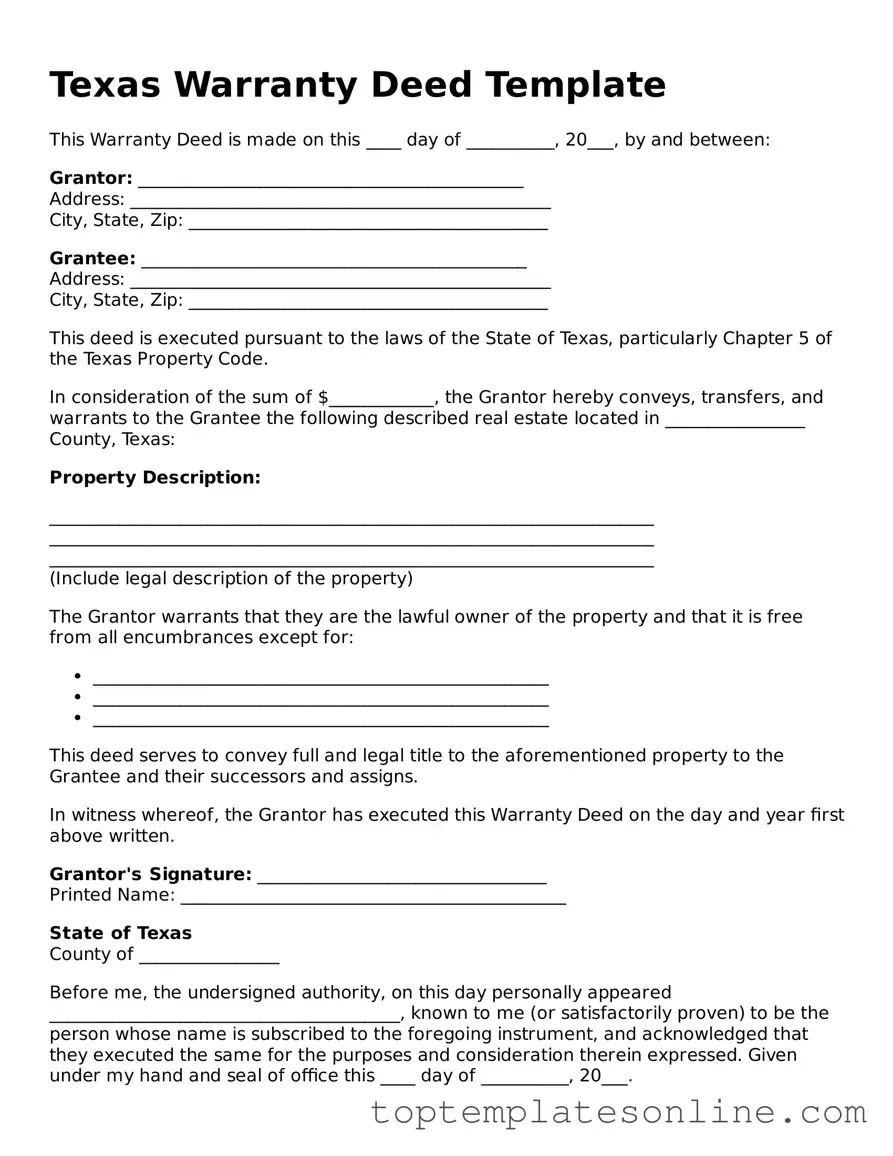

Blank Deed Template for Texas State

The Texas Deed form plays a crucial role in the transfer of real estate ownership within the state, serving as the official document that outlines the legal transfer of property from one party to another. This form captures essential details, including the names of the grantor (the person selling or transferring the property) and the grantee (the person receiving the property), as well as a clear description of the property being conveyed. Additionally, the Texas Deed may specify any conditions or restrictions related to the property, ensuring that both parties are aware of their rights and obligations. Importantly, the form must be signed by the grantor and often requires notarization to validate the transaction legally. Furthermore, the deed is typically recorded in the county where the property is located, providing public notice of the ownership change. Understanding the components and requirements of the Texas Deed form is essential for anyone involved in real estate transactions, as it not only facilitates the transfer of property but also protects the interests of both the buyer and the seller.

Some Other State-specific Deed Templates

New York Warranty Deed Form - Frequently accompanied by other documents like title searches or property surveys.

Nj House Deed - Essential for changing titles of real estate.

To facilitate the ownership transfer process, utilizing a reliable template can be immensely helpful; for instance, the NY Templates provides a comprehensive tool for crafting a thorough ATV Bill of Sale, ensuring that all necessary details are included to protect both the buyer and seller.

Ohio Warranty Deed Form - In estate situations, a deed may be needed to transfer property to heirs.

Common mistakes

-

Incorrect Names: Failing to use the full legal names of all parties involved can lead to complications. Ensure that names match the identification documents.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. Ensure the notary's information is complete and accurate.

-

Incorrect Property Description: A vague or incorrect property description can create legal issues. Use a detailed legal description from a prior deed.

-

Failure to Include Consideration: The deed must state the consideration, or value exchanged for the property. Leaving this out can lead to disputes.

-

Not Using the Correct Form: Different types of deeds exist, such as warranty deeds and quitclaim deeds. Make sure to use the appropriate form for your transaction.

-

Ignoring Local Laws: Each county may have specific requirements. Familiarize yourself with local regulations to avoid issues.

-

Inaccurate Tax Information: Ensure that all tax information related to the property is accurate. Errors can lead to tax complications.

-

Not Recording the Deed: After completing the deed, it must be recorded with the county clerk. Failing to do so can leave the property title in question.

-

Rushing the Process: Taking your time is crucial. Rushing can lead to mistakes that may require costly corrections later.

Guide to Writing Texas Deed

Once you have the Texas Deed form ready, you will need to fill it out accurately to ensure a smooth transfer of property. Each section must be completed with the correct information. After filling out the form, you will need to have it signed and notarized before filing it with the county clerk.

- Start by entering the grantor's name in the designated space. This is the person transferring the property.

- Next, fill in the grantee's name, which is the person receiving the property.

- Provide a description of the property. This should include the address and any relevant details that identify the property.

- Indicate the consideration amount, which is the value exchanged for the property. This could be a dollar amount or another form of compensation.

- Include the date of the transaction. This is the date when the deed is being executed.

- Sign the document in the space provided for the grantor. If there are multiple grantors, each must sign.

- Have the deed notarized. This step is crucial for the document to be legally binding.

- Finally, submit the completed deed to the county clerk's office in the county where the property is located.

Documents used along the form

When transferring property in Texas, the Deed form is a crucial document, but it is often accompanied by other forms and documents to ensure a smooth transaction. Here’s a list of commonly used documents that complement the Texas Deed form:

- Title Commitment: This document outlines the terms under which a title insurance company will insure the title to the property. It identifies any liens, easements, or other encumbrances that may affect ownership.

- Property Survey: A property survey provides a detailed map of the property boundaries, showing the location of structures and any encroachments. This document helps prevent disputes over property lines.

- Closing Disclosure: This form outlines the final terms of the mortgage loan, including all closing costs. It is provided to the buyer at least three days before closing to ensure transparency in the transaction.

- Affidavit of Heirship: In cases where property is inherited, this document establishes the rightful heirs of the deceased owner. It helps to clarify ownership and can simplify the transfer process.

- Bill of Sale: If personal property is included in the sale, a Bill of Sale transfers ownership of these items from the seller to the buyer. This document lists the items being sold and their condition.

- Loan Documents: If the buyer is financing the purchase, various loan documents will be involved. These include the promissory note and mortgage agreement, which outline the terms of the loan.

- Non-Disclosure Agreement: This document is essential for protecting sensitive information during the transaction process, ensuring that all parties maintain confidentiality regarding proprietary details. Learn more at https://newyorkform.com/free-non-disclosure-agreement-template.

- Transfer Tax Form: This form is required for reporting the transfer of real estate to the county tax office. It ensures that any applicable taxes are properly assessed and collected.

Each of these documents plays a significant role in the property transfer process in Texas. They help clarify ownership, ensure compliance with legal requirements, and protect the interests of all parties involved. Being familiar with these forms can facilitate a smoother transaction and provide peace of mind.