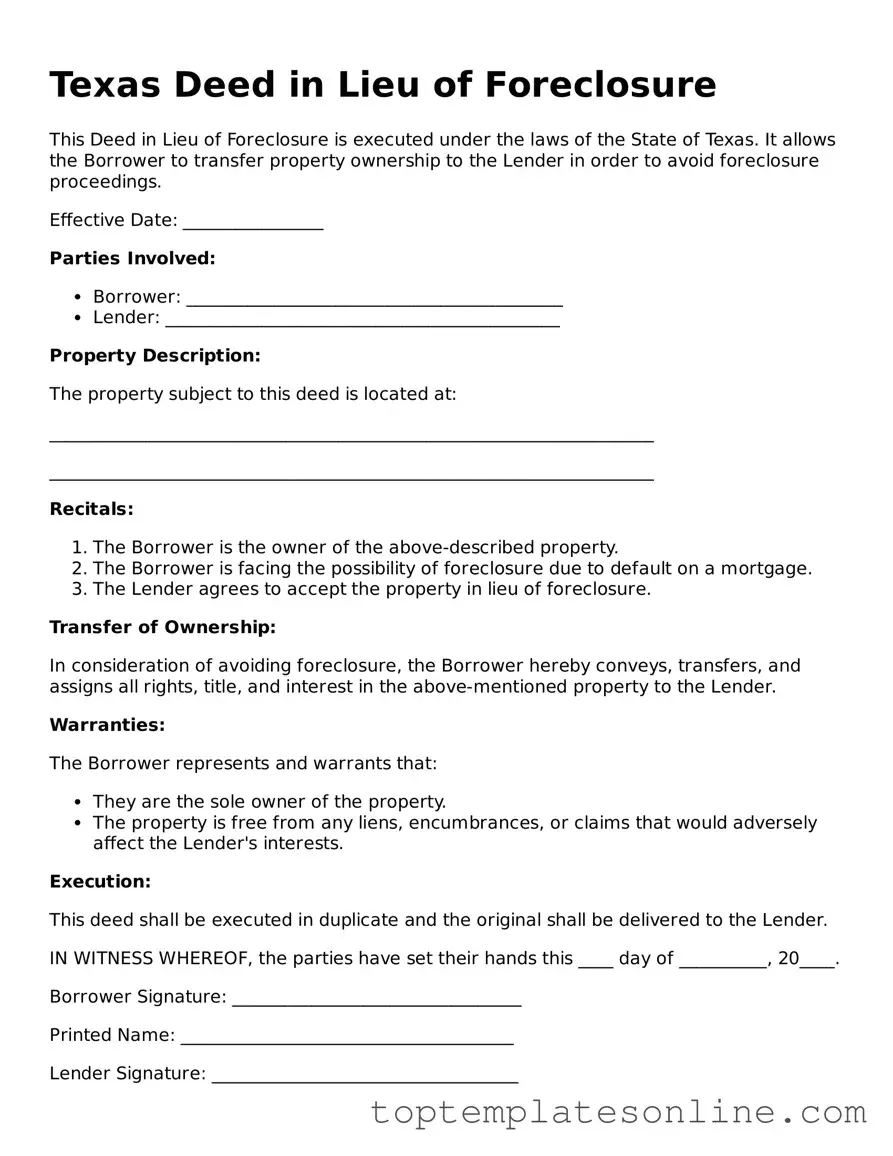

Blank Deed in Lieu of Foreclosure Template for Texas State

In Texas, homeowners facing financial difficulties may find themselves exploring various options to avoid the distressing process of foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal instrument that allows a homeowner to voluntarily transfer their property back to the lender. This process can be beneficial for both parties involved, as it enables the homeowner to escape the burdensome consequences of foreclosure while providing the lender with a more streamlined method of reclaiming their asset. The Deed in Lieu of Foreclosure form outlines the terms and conditions under which the property is transferred, including any potential debts that may still be owed. Additionally, it addresses issues such as the homeowner's right to vacate the property and the lender's responsibilities after the transfer. By understanding the nuances of this form, homeowners can make informed decisions during a challenging financial period, ultimately leading to a more amicable resolution with their lender.

Some Other State-specific Deed in Lieu of Foreclosure Templates

Georgia Foreclosure - This agreement can be beneficial for both the borrower and the lender, as it provides a quicker resolution to a distressed property situation.

The New York Lease Agreement form is a legally binding document that outlines the terms and conditions under which a tenant can rent property from a landlord in New York State. Its purpose is to protect the rights and responsibilities of both parties throughout the rental period. For those looking for a practical template, you can find one at newyorkform.com/free-lease-agreement-template/. Having a clear and comprehensive lease agreement is essential for avoiding misunderstandings and ensuring a smooth tenant-landlord relationship.

Foreclosure Vs Deed in Lieu - This option allows for a more amicable resolution between the homeowner and the lender.

Common mistakes

-

Not fully understanding the implications: Many people do not grasp that signing a deed in lieu of foreclosure means they are voluntarily giving up their property. This can have long-term effects on their credit score and financial future.

-

Failing to consult a legal professional: Some individuals attempt to fill out the form without seeking advice from a lawyer or real estate expert. This can lead to errors that may complicate the process.

-

Incorrectly filling out property details: Providing inaccurate information about the property, such as the legal description or address, can invalidate the deed and create further complications.

-

Not including all necessary parties: If there are co-owners or other interested parties, failing to include their signatures can render the deed incomplete and unenforceable.

-

Ignoring potential tax consequences: Many overlook the tax implications that can arise from a deed in lieu of foreclosure. This can lead to unexpected financial burdens later on.

-

Not reviewing lender requirements: Each lender may have specific requirements regarding the deed in lieu process. Ignoring these can result in rejection of the form.

-

Assuming the process is quick and simple: Some individuals believe that once the form is submitted, the process will be straightforward. In reality, it can take time and may involve negotiations with the lender.

Guide to Writing Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, the next step is to ensure that it is properly executed and recorded. This process helps in transferring the property back to the lender and can help avoid further foreclosure proceedings.

- Obtain the form: Download the Texas Deed in Lieu of Foreclosure form from a reliable source or get a copy from your lender.

- Fill in your information: Provide your name as the grantor. Include your address and any other required personal details.

- Identify the grantee: Enter the name of the lender or financial institution that will receive the property.

- Describe the property: Clearly describe the property being transferred. Include the address and any legal description if available.

- Sign the form: As the grantor, sign the document in the designated area. Ensure your signature matches the name provided earlier.

- Have the form notarized: Take the signed form to a notary public. They will verify your identity and witness your signature.

- Submit the form: Send the completed and notarized form to the lender. Keep a copy for your records.

- File with the county: Depending on local requirements, you may need to file the deed with the county clerk's office where the property is located.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Texas, several other forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose in the transaction and helps protect the interests of both the borrower and the lender. Below is a list of commonly used forms that accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms, such as interest rates or payment schedules, which may be negotiated before the deed is executed.

- Notice of Default: This formal notice informs the borrower that they have defaulted on their loan, typically sent before initiating foreclosure proceedings.

- Release of Lien: This document releases the lender’s claim against the property once the deed is executed, ensuring that the borrower is no longer responsible for the mortgage debt.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no undisclosed liens or claims against it.

- Property Condition Disclosure: This form requires the seller to disclose any known issues or defects with the property, helping the lender assess potential risks.

- Settlement Statement: This document outlines the financial details of the transaction, including any costs or fees associated with the deed transfer.

- Certificate of Insurance: Required for Master Plumbers in Texas, this document confirms a Responsible Master Plumber's liability coverage. Ensure compliance by using the form available at texasformspdf.com/.

- Quitclaim Deed: This type of deed transfers any interest the borrower has in the property to the lender, often used in conjunction with the Deed in Lieu of Foreclosure.

- Borrower’s Financial Statement: This statement provides the lender with an overview of the borrower’s financial situation, which can be important for assessing eligibility for the deed.

- Power of Attorney: This document may be necessary if the borrower cannot be present to sign the deed, allowing another person to act on their behalf.

Understanding these documents can help individuals navigate the complexities of a Deed in Lieu of Foreclosure. Each form plays a vital role in ensuring that the transaction is conducted fairly and legally, protecting the rights of all parties involved.