Blank Durable Power of Attorney Template for Texas State

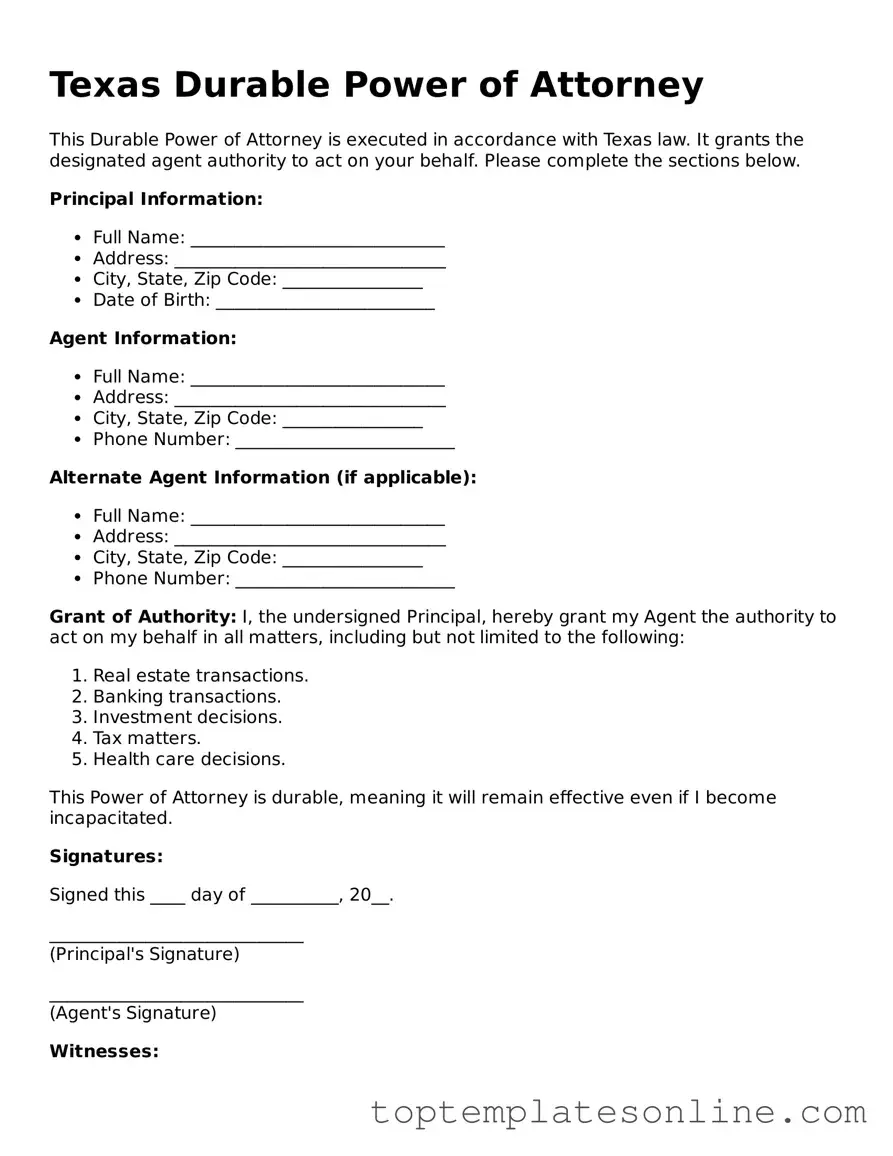

The Texas Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to make financial and legal decisions on their behalf, especially in situations where they may become incapacitated. This form remains effective even if the person who created it loses the ability to make decisions, providing peace of mind for both the principal and the agent. By clearly outlining the powers granted, the form can cover a range of financial matters, from managing bank accounts to handling real estate transactions. It is important for individuals to understand the responsibilities and limitations of the appointed agent, as well as the specific powers they wish to grant. Additionally, the Texas Durable Power of Attorney can be tailored to fit individual needs, allowing for flexibility in how authority is assigned. Properly executing this document involves specific requirements, including signatures and witnesses, ensuring that it complies with Texas law. Understanding these key aspects can help individuals make informed decisions about their future and ensure that their wishes are honored when they cannot advocate for themselves.

Some Other State-specific Durable Power of Attorney Templates

New York State Power of Attorney Form - It is essential for anyone seeking to plan for potential health issues or disabilities.

For those looking to understand property transactions better, our study on the Arizona bill of sale form offers comprehensive insights into its legal significance and practical applications. You can find more information by visiting this resource on Bill of Sale documentation.

North Carolina Power of Attorney Requirements - Your agent can be a family member, friend, or professional, depending on your unique circumstances and needs.

Common mistakes

-

Not Naming an Agent: Failing to designate a specific agent can lead to confusion. Without a clear choice, it may be difficult for others to know who has the authority to act on your behalf.

-

Leaving Sections Blank: Omitting information in key sections can invalidate the document. It is essential to complete all required fields to ensure the form is legally binding.

-

Not Specifying Powers Clearly: Vague language regarding the powers granted can create ambiguity. Clearly outline the specific powers you wish to confer to avoid misunderstandings later.

-

Failing to Sign and Date: Not signing or dating the form renders it ineffective. Ensure that the document is properly executed by including your signature and the date of signing.

-

Not Having Witnesses or Notarization: Depending on the situation, some forms require witnesses or notarization. Check local requirements to ensure compliance and validity.

-

Neglecting to Update the Document: Life changes such as marriage, divorce, or the death of an agent necessitate updates. Regularly review and revise the document to reflect your current wishes.

Guide to Writing Texas Durable Power of Attorney

Filling out the Texas Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes if you become unable to do so yourself. This document allows you to designate someone you trust to act on your behalf. Below are the steps to properly complete this form.

- Obtain the Form: Start by downloading the Texas Durable Power of Attorney form from a reliable source or obtain a physical copy from a legal office.

- Read the Instructions: Carefully review any instructions that accompany the form to understand what information is required.

- Identify Yourself: Fill in your full legal name, address, and date of birth in the designated section. This identifies you as the principal.

- Select an Agent: Choose a trusted individual to act as your agent. Write their full name, address, and phone number in the appropriate fields.

- Specify Powers: Clearly indicate the powers you wish to grant your agent. You may choose general powers or specify particular areas, such as financial matters or real estate transactions.

- Include Successor Agents: If desired, you can name one or more successor agents who will take over if your primary agent is unable to serve.

- Sign and Date: Sign and date the form in the presence of a notary public. This step is crucial as it validates the document.

- Distribute Copies: After notarization, make copies of the signed form. Provide a copy to your agent, your attorney, and keep one for your records.

Documents used along the form

When considering a Texas Durable Power of Attorney, it is often beneficial to understand other related forms and documents that can complement this legal tool. Each of these documents serves a specific purpose and can help in various situations involving decision-making and asset management.

- Medical Power of Attorney: This document allows an individual to appoint someone to make medical decisions on their behalf if they become unable to do so. It is crucial for ensuring that healthcare preferences are respected.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate their preferences. This document often addresses end-of-life care and life-sustaining treatments.

- HIPAA Release Form: This form grants permission for designated individuals to access medical records and information. It is essential for ensuring that those you trust can make informed decisions about your healthcare.

- Will: A will is a legal document that specifies how a person's assets and responsibilities should be handled after their death. It can help prevent disputes among heirs and ensure that wishes are honored.

- Trust Agreement: A trust agreement establishes a trust, which can manage assets for the benefit of specific individuals. This document can provide more control over how and when assets are distributed.

- Declaration of Guardian: This document allows an individual to name a guardian for themselves in case they become incapacitated. It ensures that someone trusted is appointed to make personal and financial decisions.

- Financial Power of Attorney: Similar to a durable power of attorney, this document specifically focuses on financial matters. It allows someone to manage financial affairs on behalf of another person.

- Residential Lease Agreement Form: For those renting properties in New York, the essential Residential Lease Agreement guidelines can help clarify the terms between landlords and tenants.

- Asset Inventory List: An asset inventory list is a detailed record of all significant assets owned by an individual. This document can be helpful for both the person granting power and their agents to understand what is involved.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, such as life insurance or retirement accounts, upon the individual’s passing. They ensure that assets are transferred according to the individual’s wishes.

Understanding these documents can help individuals make informed decisions about their legal and financial planning. Each form plays a role in ensuring that preferences are honored and that trusted individuals are empowered to act when necessary.