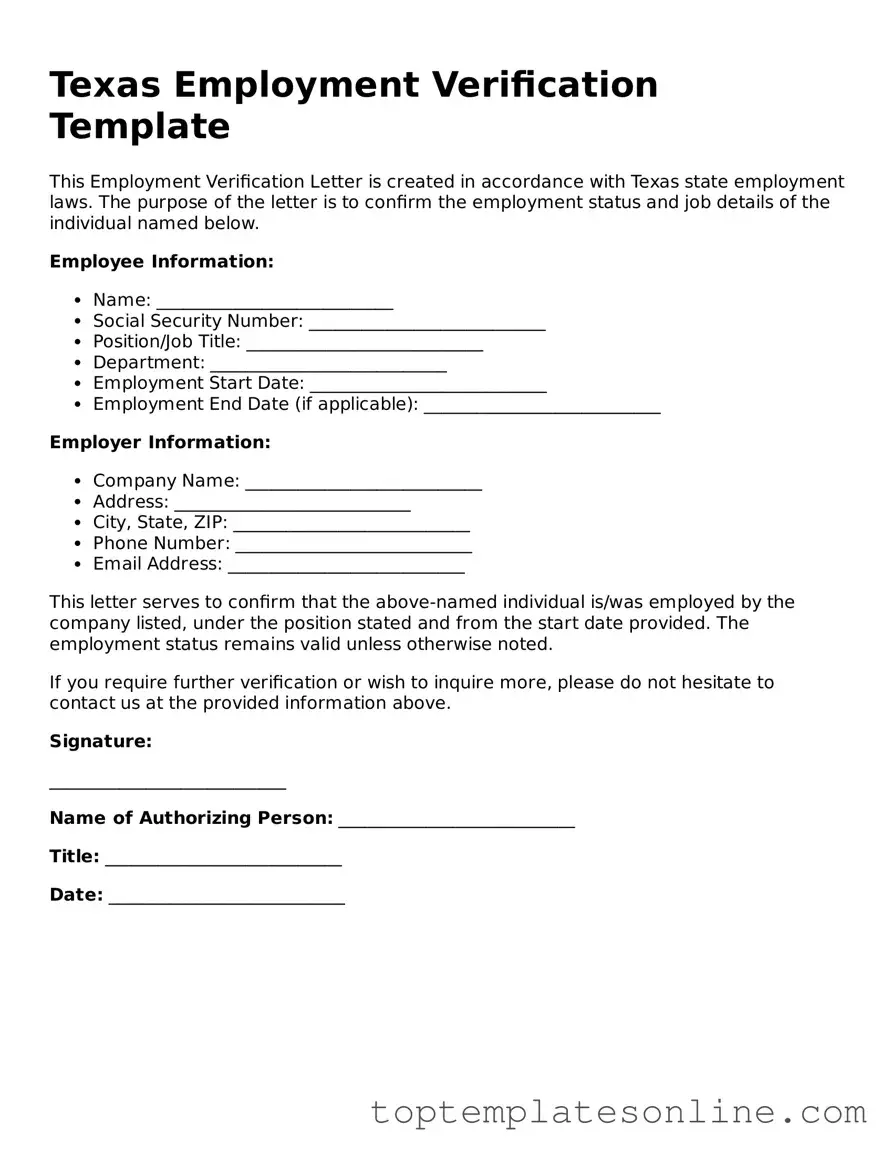

Blank Employment Verification Template for Texas State

In Texas, employers often require an Employment Verification form to confirm a job candidate's work history and qualifications. This form serves multiple purposes, including ensuring that applicants meet the necessary criteria for the position and maintaining compliance with state regulations. It typically includes key information such as the applicant's previous job titles, dates of employment, and reasons for leaving prior positions. Additionally, the form may request details about the applicant's performance, attendance, and any disciplinary actions taken during their employment. By using this form, employers can make informed hiring decisions while also protecting themselves from potential legal issues related to misrepresentation or fraud. Understanding the importance of this document can help both employers and employees navigate the hiring process more effectively.

Some Other State-specific Employment Verification Templates

Letter for Employment - This verification can bolster a job seeker’s application for new positions.

In addition to understanding the eviction process, landlords can access important resources and templates for necessary documentation, such as the Florida Forms, to ensure they follow the correct legal procedures when issuing a Notice to Quit form.

Wage Verification Form Georgia - It helps potential employers understand a candidate’s work background.

Common mistakes

-

Incomplete Information: Failing to provide all required fields can lead to delays. Ensure every section is filled out accurately.

-

Incorrect Dates: Entering wrong employment dates can cause confusion. Double-check the start and end dates for accuracy.

-

Wrong Employer Information: Listing incorrect employer details can invalidate the verification. Verify the employer's name and contact information.

-

Signature Issues: Not signing the form or using an illegible signature can lead to rejection. Ensure the signature is clear and matches the printed name.

-

Failure to Specify Job Title: Omitting the job title can create uncertainty about the role. Clearly state the job title held during employment.

-

Neglecting to Include Contact Information: Not providing a phone number or email for follow-up can hinder the verification process. Include accurate contact details.

-

Inconsistent Information: Providing information that contradicts other documents can raise red flags. Ensure consistency across all submitted materials.

-

Ignoring Instructions: Not following the specific instructions on the form can result in errors. Read all guidelines carefully before filling out the form.

-

Submitting Without Review: Sending the form without a final review can lead to overlooked mistakes. Always double-check for errors before submission.

Guide to Writing Texas Employment Verification

Completing the Texas Employment Verification form is a straightforward process. After filling out the form, it will need to be submitted to the appropriate authority or employer as required. Make sure to double-check all information for accuracy before submission.

- Begin by entering the employee's full name in the designated field.

- Provide the employee's Social Security Number (SSN) accurately.

- Fill in the employee's job title and the department they work in.

- Indicate the start date of employment.

- List the employee's current salary or hourly wage.

- Include the employer's name and contact information.

- Sign and date the form to verify that the information is correct.

Documents used along the form

When completing the Texas Employment Verification form, several other documents may be necessary to support the verification process. These documents provide additional information about an employee's work history, eligibility, and other relevant details. Below is a list of commonly used forms and documents that often accompany the Employment Verification form.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld. It serves as proof of income and employment for the previous year.

- Durable Power of Attorney Form: To ensure your legal wishes are respected, refer to the essential Durable Power of Attorney documentation that empowers your designated representative in critical situations.

- Pay Stubs: Recent pay stubs offer a snapshot of an employee's earnings and can help confirm current employment status and income levels.

- Employment Offer Letter: This document outlines the terms of employment, including position, salary, and start date, providing context for the employee's role.

- Tax Returns: Personal tax returns can verify income over a longer period and provide insight into an employee's financial history.

- Social Security Card: This card verifies an employee's Social Security number, which is essential for tax reporting and eligibility verification.

- Driver’s License: A valid driver's license can serve as a form of identification and verify the employee's identity and residency.

- Background Check Authorization: This document allows employers to conduct background checks, which can confirm employment history and other relevant information.

- Reference Letters: Letters from previous employers or colleagues can provide insights into an employee's work ethic and performance.

- Job Descriptions: Detailed job descriptions can clarify the responsibilities and expectations of the employee's role, aiding in the verification process.

Utilizing these documents alongside the Texas Employment Verification form can streamline the verification process and ensure that all necessary information is accurately represented. Proper documentation is essential for maintaining compliance and establishing trust between employers and employees.