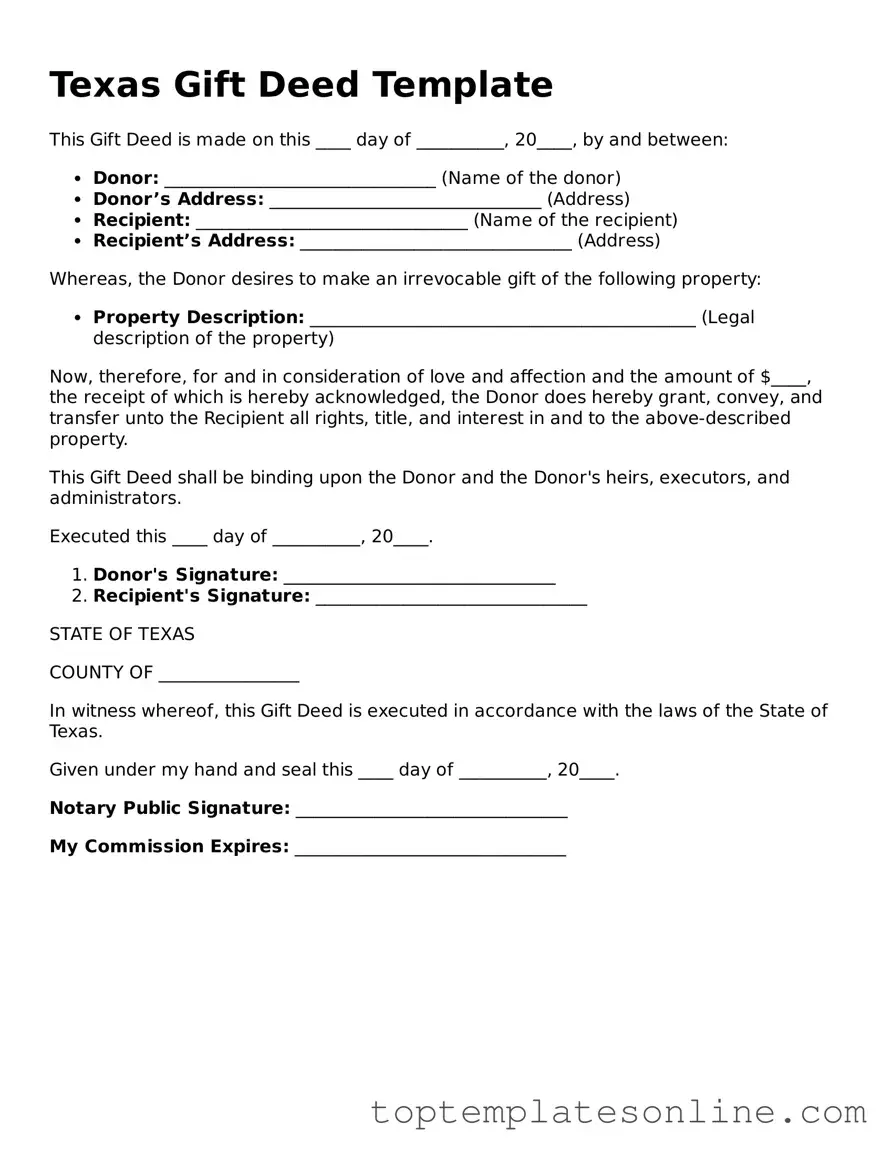

Blank Gift Deed Template for Texas State

In Texas, a Gift Deed serves as a vital legal instrument for transferring property ownership without the exchange of money. This form is particularly useful when an individual wishes to give real estate to a family member or friend, ensuring that the transfer is clear and legally binding. The Gift Deed outlines essential details, such as the names of both the donor and the recipient, a description of the property being gifted, and any conditions that may apply to the transfer. Importantly, the document must be signed by the donor and typically requires notarization to enhance its validity. Understanding the nuances of this form is crucial, as it helps prevent future disputes over ownership and ensures that the donor's intentions are honored. Whether you are considering gifting a home, land, or other real property, knowing how to properly execute a Gift Deed can facilitate a smooth transfer and provide peace of mind for both parties involved.

Some Other State-specific Gift Deed Templates

Gift Deed Georgia - Witness signatures may be required in some jurisdictions to validate the Gift Deed.

To ensure a successful rental experience, both landlords and tenants should take the time to understand the New York Lease Agreement form. This legally binding document not only protects the rights of each party but also stipulates the responsibilities associated with the lease. For those looking for a straightforward option, you can find a useful template at https://newyorkform.com/free-lease-agreement-template/, which can aid in drafting a clear and comprehensive agreement that minimizes misunderstandings.

Common mistakes

-

Incomplete Information: One common mistake is not providing all required details. This includes the full names and addresses of both the giver and the recipient. Omitting any of this information can lead to confusion or disputes later.

-

Incorrect Property Description: It is crucial to accurately describe the property being gifted. Failing to include the correct legal description or using vague terms can create issues with ownership transfer. Always ensure that the property description matches what is recorded in public records.

-

Not Notarizing the Document: A Gift Deed in Texas must be notarized to be legally binding. Some individuals forget this step, which can render the document invalid. It's important to ensure that a notary public witnesses the signing of the deed.

-

Failing to Record the Deed: After completing the Gift Deed, it should be filed with the county clerk's office where the property is located. Neglecting to record the deed can lead to complications in proving ownership in the future.

Guide to Writing Texas Gift Deed

Once you have the Texas Gift Deed form in hand, you can begin the process of filling it out. This form is essential for transferring property ownership without any exchange of money. After completing the form, you will need to have it signed in front of a notary public and then filed with the appropriate county office.

- Start by entering the date at the top of the form.

- Identify the grantor (the person giving the gift). Fill in their full name and address.

- Next, provide the grantee's (the person receiving the gift) full name and address.

- Clearly describe the property being transferred. Include the legal description, which can usually be found on the current deed or tax records.

- Indicate any exceptions or reservations regarding the property, if applicable.

- Sign the form in the presence of a notary public. The notary will also need to sign and stamp the document.

- Make copies of the completed and notarized form for your records.

- Finally, file the original deed with the county clerk's office in the county where the property is located.

Documents used along the form

When transferring property as a gift in Texas, several forms and documents may accompany the Gift Deed to ensure a smooth transaction. Each document serves a specific purpose in the process, helping to clarify the intentions of the parties involved and to comply with legal requirements.

- Warranty Deed: This document guarantees that the grantor has clear title to the property and has the right to transfer it. It provides assurance to the grantee that there are no undisclosed claims against the property.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in the property without any guarantees. It is often used when the parties know each other well, such as family members.

- Affidavit of Heirship: This affidavit is used to establish the heirs of a deceased property owner. It can help clarify ownership issues when property is passed down as a gift after someone has passed away.

- Power of Attorney Form: A Florida Power of Attorney form is essential for enabling someone to make decisions on your behalf. It's crucial to understand its implications, especially for financial and healthcare matters. For more information, you can refer to Florida Forms.

- Property Tax Exemption Application: If the gifted property is intended to be a primary residence, this application may be necessary to claim homestead exemptions for property taxes.

- Title Insurance Policy: Obtaining title insurance protects the grantee against potential defects in the title that may arise after the transfer of property ownership.

- Gift Tax Return (Form 709): This form is required by the IRS if the value of the gift exceeds a certain amount. It helps report the gift and any applicable taxes owed.

- Notice of Gift: A notice may be drafted to inform relevant parties, such as lenders or other interested parties, about the gift transfer, especially if the property has existing mortgages.

- Statement of Value: This document outlines the fair market value of the property being gifted. It can be useful for tax purposes and to establish the value of the gift for both parties.

- Power of Attorney: If the grantor cannot be present to sign the Gift Deed, a power of attorney can authorize another person to act on their behalf in the transaction.

These documents play vital roles in ensuring that the transfer of property as a gift is legally sound and recognized by all parties involved. Understanding each document's purpose can help streamline the process and prevent potential disputes in the future.