Blank Lady Bird Deed Template for Texas State

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This form provides a way to avoid the often lengthy and costly probate process, as it allows for a smooth transition of property upon the owner's death. One of the key features of the Lady Bird Deed is that the original owner maintains the right to live on and use the property, as well as the ability to sell or modify it without the consent of the beneficiaries. This flexibility can be crucial for individuals who want to ensure their loved ones inherit their property but still want to retain control over it during their lifetime. Additionally, the Lady Bird Deed can provide tax benefits and help protect the property from creditors. Understanding how this deed works and its implications can empower property owners in Texas to make informed decisions about their estate planning needs.

Some Other State-specific Lady Bird Deed Templates

How to Get a Lady Bird Deed in Michigan - It provides greater peace of mind knowing the property will go to chosen individuals automatically.

Filling out the Texas TREC Residential Contract form can be a complex process, but having the right resources can make it much easier. Potential buyers and sellers should ensure they have a clear understanding of the form and its requirements to protect their interests in the transaction. For those who need assistance or a more straightforward way to complete the form, useful information can be found at https://texasformspdf.com/, which offers valuable tools and insights into the nuances of the document.

What Is a Lady Bird Deed in Nc - This type of deed can be particularly beneficial for single homeowners.

Common mistakes

-

Failing to include all necessary parties. It is essential to list all current owners of the property, as well as any intended beneficiaries. Omitting a party can lead to disputes or invalidation of the deed.

-

Not accurately describing the property. The legal description of the property must be precise. Using vague or incorrect descriptions can create confusion and potential legal issues.

-

Incorrectly identifying the beneficiaries. Beneficiaries should be clearly named. Errors in spelling or misidentifying individuals can complicate the transfer of property.

-

Neglecting to sign and date the form. The deed must be signed by the grantor(s) and properly dated. Failure to do so can render the deed ineffective.

-

Not having the deed notarized. A Lady Bird Deed typically requires notarization to be legally valid. Without this step, the document may not hold up in court.

-

Overlooking local recording requirements. Each county in Texas may have specific requirements for recording the deed. Not adhering to these can delay or prevent the transfer of property.

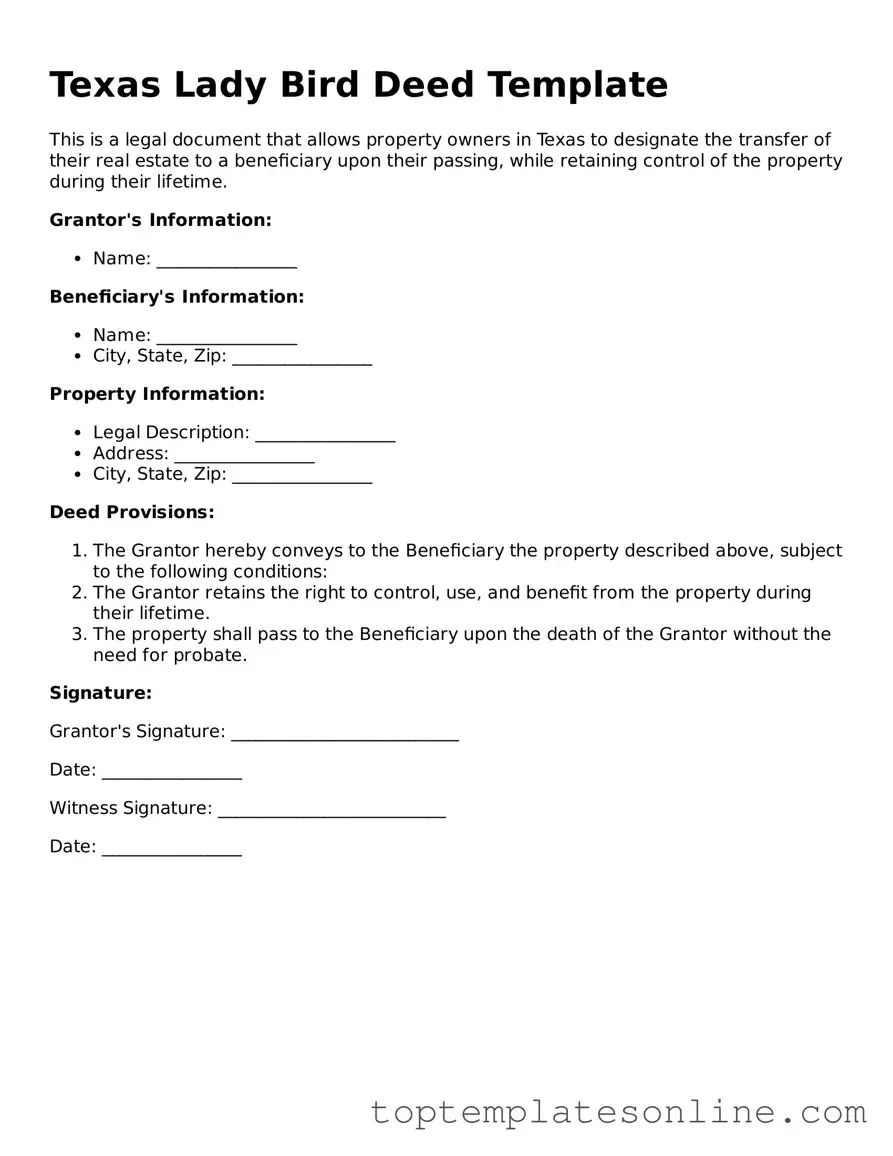

Guide to Writing Texas Lady Bird Deed

Filling out the Texas Lady Bird Deed form requires careful attention to detail. This form allows property owners to transfer their property to a beneficiary while retaining certain rights. Follow these steps to ensure you complete the form correctly.

- Obtain the Form: Start by downloading the Texas Lady Bird Deed form from a reliable source or obtain a physical copy from a legal office.

- Property Description: In the designated section, provide a clear and accurate description of the property. Include the address and any relevant legal descriptions.

- Grantor Information: Fill in the name(s) of the current property owner(s) (grantor(s)). This should match the names on the property title.

- Beneficiary Information: Enter the name(s) of the individual(s) or entity that will receive the property upon the grantor's passing. Ensure correct spelling and full names.

- Retained Rights: Indicate any rights the grantor wishes to retain, such as the right to live in the property or sell it during their lifetime. Be specific about these rights.

- Signatures: The grantor(s) must sign the form in the presence of a notary public. Ensure that the signatures are clear and match the names provided earlier.

- Notarization: Have the notary public complete their section, which verifies the identities of the signers and the date of signing.

- Record the Deed: After notarization, take the completed form to the county clerk’s office where the property is located to officially record the deed.

Once you have completed these steps, the Lady Bird Deed will be legally effective, and the property will be transferred according to your specifications. It's advisable to keep a copy for your records and consult with a legal professional if you have any questions about the process.

Documents used along the form

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. When utilizing this deed, several other documents may also be necessary to ensure a smooth transition of property and to address any related legal matters. Below are some commonly used forms and documents that often accompany the Lady Bird Deed.

- Durable Power of Attorney: This document grants a trusted individual the authority to make financial and legal decisions on behalf of the property owner, especially if they become incapacitated. It ensures that someone can manage the property and other affairs without needing a court-appointed guardian.

- Will: A will outlines how a person wishes their assets to be distributed upon their death. While the Lady Bird Deed handles the transfer of property, a will can address other assets and provide instructions for personal items, guardianship for minor children, and funeral arrangements.

- Transfer on Death Deed (TODD): Similar to the Lady Bird Deed, a TODD allows property owners to designate beneficiaries who will receive the property upon their death. However, it does not allow the same level of control during the owner's lifetime, making the Lady Bird Deed a more flexible option.

- Trailer Bill of Sale: This form serves as proof of transaction for the sale and transfer of ownership of a trailer in Florida, ensuring clarity between buyer and seller. For more information, visit Florida Forms.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person when there is no will. It can help clarify the distribution of property and is often used in conjunction with the Lady Bird Deed to confirm the rightful heirs of the property after the owner's passing.

Each of these documents plays a vital role in estate planning and property transfer. By understanding their purposes and how they work together with the Texas Lady Bird Deed, individuals can create a comprehensive plan that protects their interests and ensures a smooth transition for their loved ones.