Blank Last Will and Testament Template for Texas State

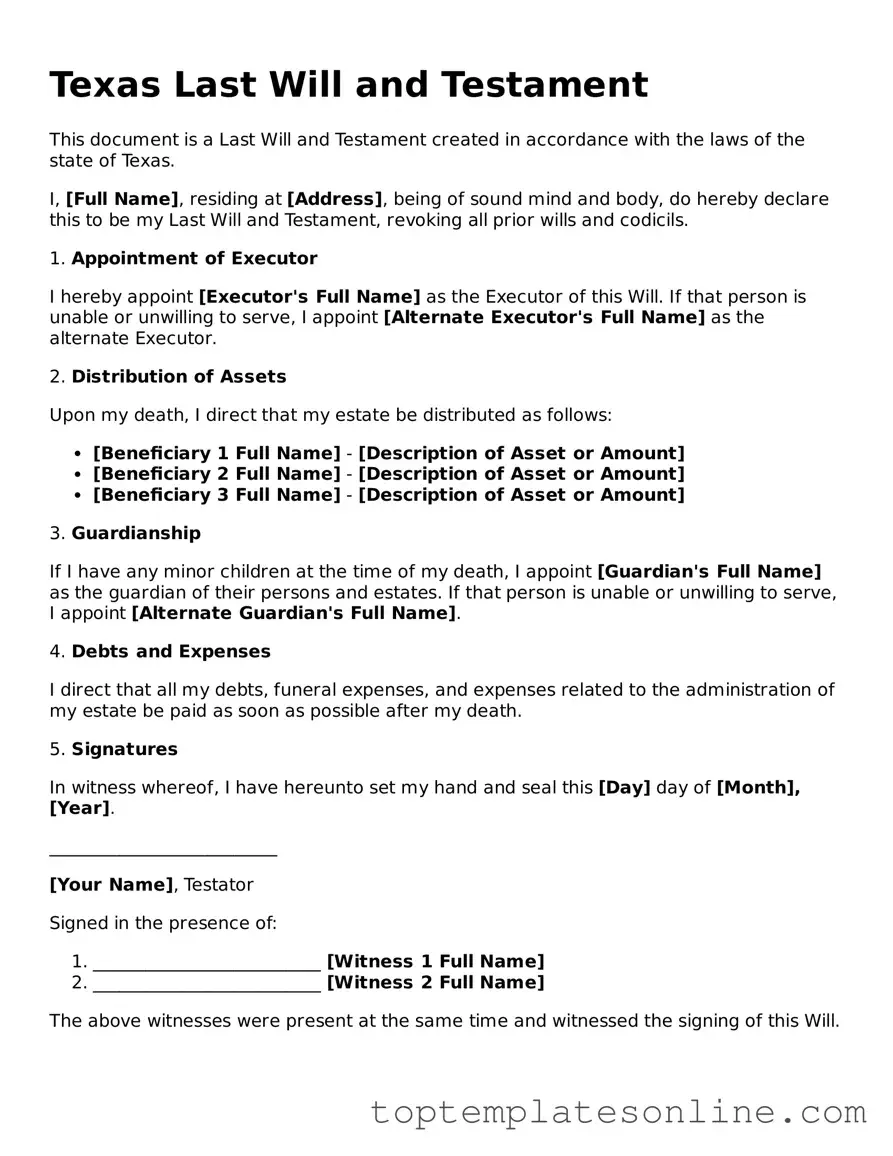

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Texas, this legal document serves as a formal declaration of how you want your assets distributed, who will manage your estate, and who will care for any minor children. The Texas Last Will and Testament form typically includes sections for naming an executor, specifying beneficiaries, and detailing any specific bequests. It also allows for the appointment of guardians for dependents, ensuring their well-being in accordance with your preferences. Additionally, the form must adhere to certain legal requirements, such as being signed in the presence of witnesses, to be considered valid. Understanding these key components can help individuals navigate the process of creating a will that accurately reflects their intentions and provides peace of mind for their loved ones.

Some Other State-specific Last Will and Testament Templates

Free Ohio Last Will and Testament Form Pdf - Can include charitable donations or bequests to organizations.

In the realm of employment documentation, the California Employment Verification form serves as an essential tool for affirming an individual's employment status, which can be pivotal in situations such as loan applications and rental agreements. To facilitate these processes and avoid any ambiguities, it is often recommended to use a reliable resource for guidance, such as the Work Comfirmation Letter, ensuring that both employees and employers are adequately informed about the necessary steps to complete and utilize this form effectively.

How to Make a Will in Nj - Takes effect upon your death, ensuring your wishes are legally recognized.

Common mistakes

-

Failing to sign the will. A will must be signed by the person creating it, known as the testator. Without a signature, the will is not valid.

-

Not having witnesses. In Texas, a will must be witnessed by at least two people who are present at the same time. If this step is skipped, the will may not be enforceable.

-

Using outdated forms. Laws change, and using an old version of the will form can lead to complications. Always ensure you have the most current form.

-

Failing to specify beneficiaries clearly. It’s important to name beneficiaries clearly to avoid confusion. Ambiguities can lead to disputes among heirs.

-

Not including a residuary clause. This clause addresses what happens to any assets not specifically mentioned in the will. Omitting it can leave some assets unaccounted for.

-

Neglecting to update the will. Life changes, such as marriage, divorce, or the birth of a child, may require updates to the will. Failing to make these updates can lead to unintended consequences.

-

Not considering alternate beneficiaries. If a primary beneficiary passes away before the testator, it’s wise to name an alternate beneficiary to ensure assets are distributed as intended.

-

Overlooking the importance of storage. A will should be stored in a safe place where it can be easily accessed after the testator's death. Hiding it or placing it in an inaccessible location can cause problems.

-

Relying solely on the will for estate planning. A will does not cover everything. Consider other documents, such as trusts or powers of attorney, for comprehensive planning.

Guide to Writing Texas Last Will and Testament

After gathering your thoughts and deciding how you want your assets distributed, it's time to fill out the Texas Last Will and Testament form. This document will allow you to clearly express your wishes regarding your estate and ensure that your loved ones are taken care of according to your desires.

- Obtain the form: You can find the Texas Last Will and Testament form online or at a legal stationery store. Make sure you have the most current version.

- Title the document: At the top of the form, write "Last Will and Testament" to clearly identify the purpose of the document.

- Identify yourself: Fill in your full legal name, address, and date of birth. This information establishes your identity as the testator.

- Declare your intentions: Include a statement that indicates this document is your last will, revoking any previous wills or codicils.

- Appoint an executor: Choose someone you trust to carry out your wishes. Write their name and contact information in the designated section.

- List your beneficiaries: Clearly identify each person or organization that will receive your assets. Include their full names and relationship to you.

- Detail your assets: Specify how you want your property, money, and possessions distributed among your beneficiaries. Be as clear and specific as possible.

- Include guardianship provisions: If you have minor children, designate a guardian to care for them. Write down their name and any specific instructions you have.

- Sign the document: Sign and date the will in the presence of at least two witnesses. Ensure they are not beneficiaries to avoid any conflicts of interest.

- Have witnesses sign: Your witnesses should sign and date the document, confirming they witnessed you signing the will.

- Store the will safely: Keep the completed document in a secure place, such as a safe or a safety deposit box. Inform your executor and loved ones where it is located.

Documents used along the form

When creating a Texas Last Will and Testament, several other documents may be necessary to ensure that your wishes are fully realized and that your estate is managed according to your desires. Each of these documents serves a unique purpose in the estate planning process.

- Durable Power of Attorney: This document allows you to designate someone to make financial decisions on your behalf if you become incapacitated. It remains effective even if you lose the ability to make decisions for yourself.

- Last Will and Testament: This essential legal document dictates how an individual's assets and affairs should be handled after their death. For resources on creating a last will, you can visit NY Templates for helpful templates and guidance.

- Medical Power of Attorney: Similar to the durable power of attorney, this document grants someone the authority to make healthcare decisions for you if you are unable to communicate your wishes.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you are terminally ill or permanently unconscious. It serves as a guide for your healthcare providers and loved ones.

- Trust Document: Establishing a trust can help manage your assets during your lifetime and after your death. A trust can provide for your beneficiaries while potentially avoiding probate.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, require you to specify beneficiaries. These designations override your will and can simplify the transfer of assets.

- Letter of Intent: While not a legally binding document, a letter of intent can provide guidance to your executor or loved ones regarding your wishes for your estate, funeral arrangements, or other personal matters.

- Pet Trust: If you have pets, a pet trust ensures that they will be cared for after your passing. This document outlines how your pets should be cared for and who will be responsible for them.

- Affidavit of Heirship: This document may be used to establish the heirs of a deceased person when there is no will. It can simplify the process of transferring property without going through probate.

Understanding these documents can significantly enhance your estate planning strategy. Each serves a specific function, helping to protect your interests and ensure that your wishes are honored. It is advisable to consult with a qualified professional to tailor these documents to your individual needs and circumstances.