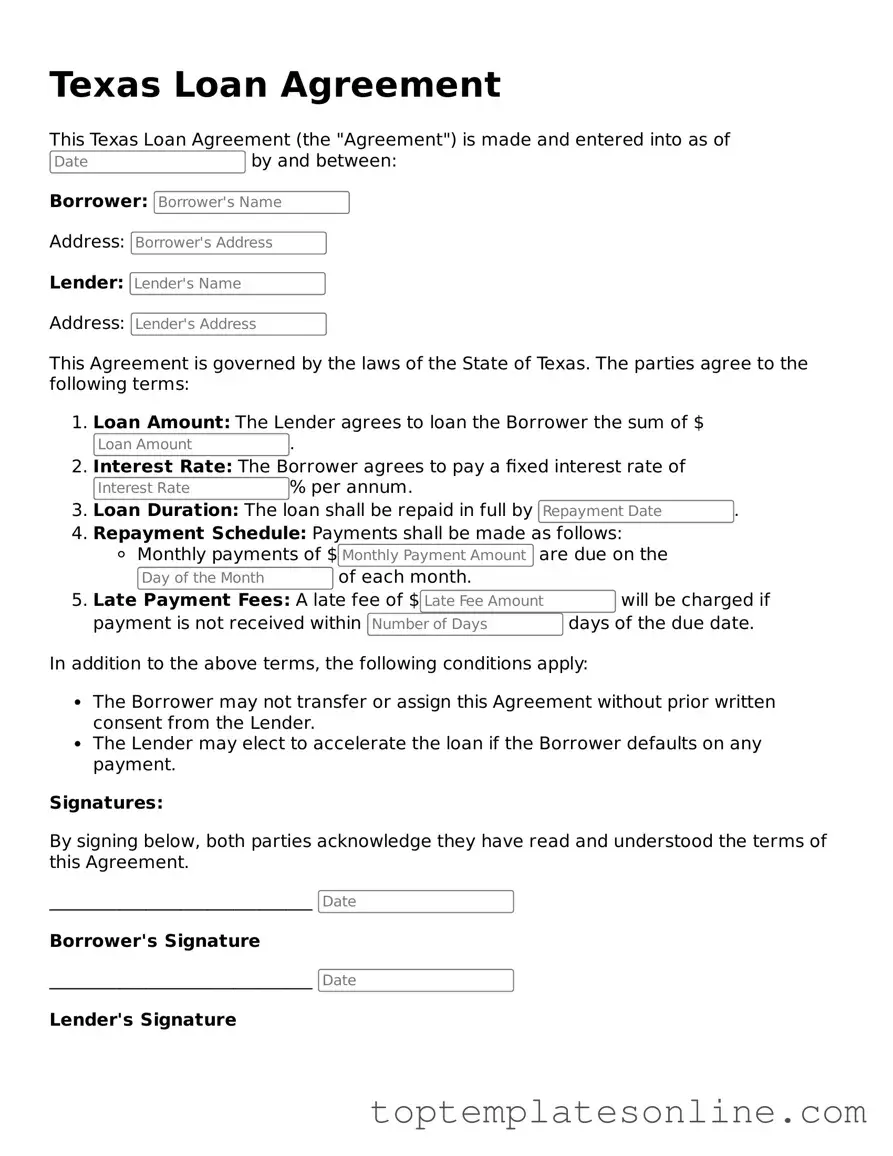

Blank Loan Agreement Template for Texas State

The Texas Loan Agreement form is an essential document for individuals and businesses engaged in lending and borrowing activities within the state. This form outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It serves to protect both the lender and the borrower by clearly detailing the obligations and rights of each party involved. Additionally, the agreement may include provisions related to default, collateral, and dispute resolution, ensuring that all potential scenarios are addressed. Understanding the components of this form is crucial for anyone looking to enter into a loan agreement in Texas, as it helps to establish a clear framework for the financial transaction and promotes transparency throughout the lending process.

Some Other State-specific Loan Agreement Templates

Promissory Note New York - The document may cater to specific loan types, like personal loans or mortgages.

In order to ensure compliance with local regulations and protect your interests, it's important to familiarize yourself with the specifics of the Florida Residential Lease Agreement. For comprehensive guidance and access to the necessary forms, you can visit Florida Forms, which provides a valuable resource for both landlords and tenants navigating the rental process in the state of Florida.

Georgia Promissory Note - Clear terms in the document can prevent future disputes.

Common mistakes

-

Incomplete Information: Failing to provide all required personal details can lead to delays or rejections. Ensure that names, addresses, and contact information are fully completed.

-

Incorrect Loan Amount: Entering an incorrect loan amount can cause confusion. Double-check the requested amount against your needs and the lender’s requirements.

-

Missing Signatures: Omitting signatures on the agreement can invalidate the document. All parties involved must sign where indicated.

-

Not Reading Terms: Overlooking the terms and conditions can lead to misunderstandings. Take the time to read and understand all provisions before signing.

-

Incorrect Dates: Entering wrong or inconsistent dates can create legal complications. Ensure that all dates, including the loan start and repayment dates, are accurate.

-

Ignoring Fees: Failing to account for fees associated with the loan can result in unexpected costs. Review all fees and charges listed in the agreement.

-

Providing False Information: Intentionally or unintentionally providing inaccurate information can lead to serious consequences. Always provide truthful and accurate details.

-

Neglecting to Include Co-Signers: If a co-signer is required, failing to include their information can delay the loan process. Make sure to list all necessary parties.

-

Forgetting to Keep Copies: Not retaining a copy of the signed agreement can create issues later. Always keep a copy for your records.

-

Not Seeking Clarification: Avoiding questions about unclear terms can lead to future disputes. If anything is unclear, ask for clarification before signing.

Guide to Writing Texas Loan Agreement

Filling out the Texas Loan Agreement form is a straightforward process that requires attention to detail. This form is essential for documenting the terms of a loan between parties. Once completed, it serves as a binding agreement that outlines the responsibilities of both the lender and the borrower.

- Begin by entering the date at the top of the form. This date marks when the agreement is made.

- Provide the full name and address of the lender in the designated section. Make sure all information is accurate.

- Next, fill in the borrower's full name and address. Again, accuracy is key.

- Specify the loan amount in the appropriate field. This should be the total amount being borrowed.

- Indicate the interest rate for the loan. This can be either a fixed or variable rate, so be clear about which one applies.

- Detail the repayment schedule. Include how often payments will be made (weekly, monthly, etc.) and the duration of the loan.

- Include any late fees or penalties for missed payments. This ensures both parties understand the consequences of late payments.

- Provide a section for any additional terms or conditions that may apply to the loan. This can include things like collateral or specific obligations.

- Both the lender and borrower should sign and date the form at the bottom. This finalizes the agreement.

After completing these steps, review the form carefully to ensure all information is correct. Once verified, both parties should keep a copy for their records. This helps avoid any misunderstandings in the future.

Documents used along the form

When entering into a loan agreement in Texas, several additional forms and documents may be required to ensure clarity and legal compliance. Each of these documents serves a specific purpose in the lending process. Here are five commonly used documents alongside the Texas Loan Agreement form:

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, detailing the repayment schedule, interest rate, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets being used as security and the rights of the lender in case of default.

- Disclosure Statement: This form provides borrowers with essential information about the loan terms, including fees, interest rates, and any other costs associated with the loan.

- Loan Application: This document collects personal and financial information from the borrower to assess their eligibility for the loan.

- Hold Harmless Agreement: For events and activities, the essential Hold Harmless Agreement form protects parties from liability and ensures understanding of risk acceptance.

- Guaranty Agreement: If a third party is backing the loan, this agreement outlines their commitment to repay the loan if the primary borrower defaults.

These documents work together to create a comprehensive understanding of the loan arrangement. It is crucial to review each document carefully to ensure all parties are protected and informed throughout the process.