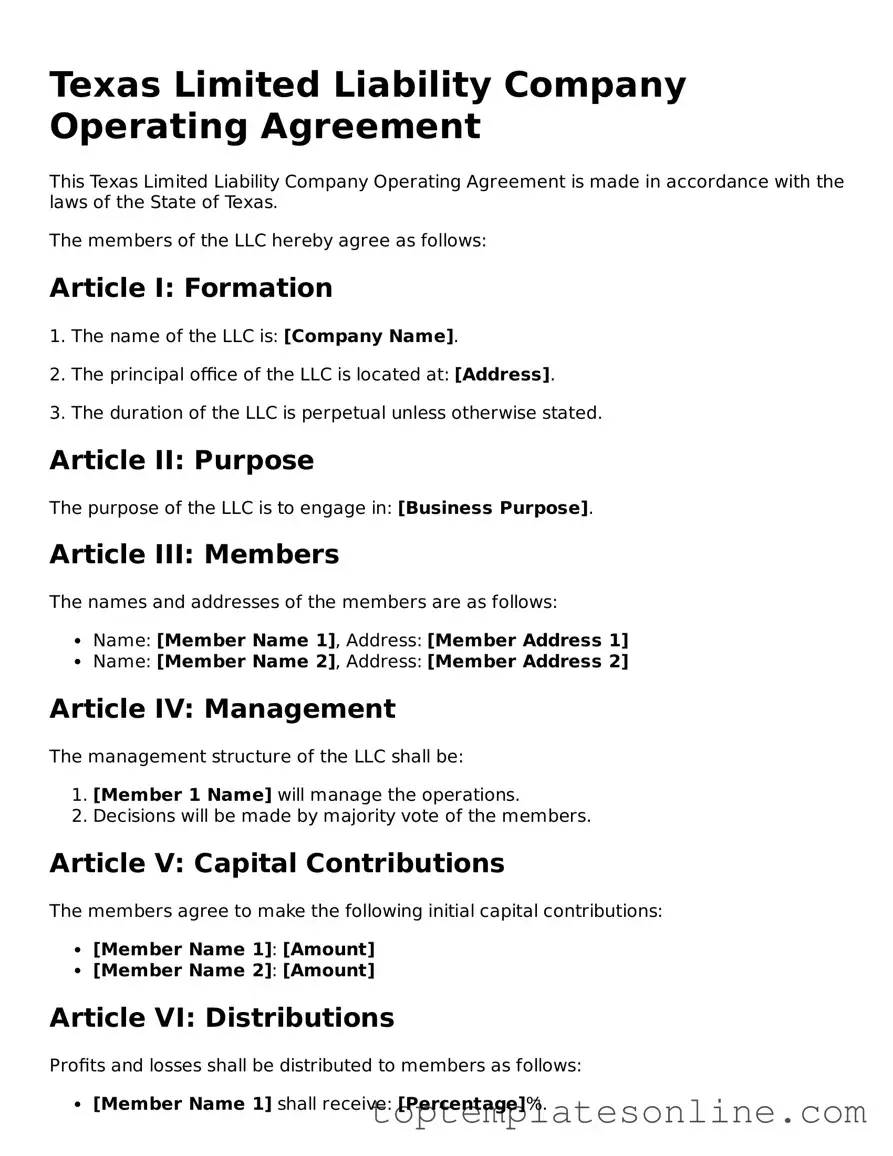

Blank Operating Agreement Template for Texas State

The Texas Operating Agreement form serves as a crucial document for limited liability companies (LLCs) in Texas, outlining the internal operations and management structure of the business. This agreement is essential for defining the roles and responsibilities of members, detailing how profits and losses will be distributed, and establishing procedures for decision-making. It also addresses the process for adding new members or handling the departure of existing ones, ensuring that all parties are clear on the protocols to follow. Additionally, the form can include provisions for dispute resolution, which can help prevent conflicts from escalating into legal battles. By setting these guidelines, the Texas Operating Agreement not only helps in maintaining order within the company but also provides legal protection for its members. Properly executed, this document can enhance the credibility of the LLC and provide a clear roadmap for its operations, making it an indispensable tool for any business owner in the state.

Some Other State-specific Operating Agreement Templates

Operating Agreement for Llc Georgia - The document is key to protecting member interests in an LLC.

Ohio Llc Operating Agreement Template - The agreement may outline the distribution of voting power among members.

In order to better understand the implications of a Hold Harmless Agreement, it is beneficial to consult resources such as those offered by NY Templates, which provide templates and information that can aid in the proper execution of this legal form, ensuring that all parties are aware of their rights and responsibilities while engaging in potentially risky activities.

Nys Llc - This document serves as a reference for member obligations and rights.

New Jersey Operating Agreement - The document can specifically address limitations on members' authority.

Common mistakes

-

Neglecting to Include All Members: It's crucial to list every member involved in the LLC. Omitting a member can lead to disputes later on.

-

Failing to Define Roles and Responsibilities: Clearly outlining each member's role helps avoid confusion. Without defined responsibilities, tasks may overlap or be neglected.

-

Inadequate Capital Contributions: Members must specify their initial contributions. Failing to document these amounts can create misunderstandings regarding ownership percentages.

-

Ignoring Voting Rights: The agreement should detail how voting will be conducted. Not addressing this can lead to conflicts when decisions need to be made.

-

Overlooking Profit and Loss Distribution: It's important to outline how profits and losses will be shared among members. Without this clarity, disputes may arise during financial distributions.

-

Not Including a Dissolution Clause: A plan for dissolving the LLC should be included. This prepares members for potential future scenarios and minimizes complications.

-

Forgetting to Update the Agreement: As circumstances change, the operating agreement should be revised. Failing to keep it current can lead to outdated practices and potential legal issues.

-

Neglecting to Seek Legal Advice: Many individuals fill out the form without consulting a legal professional. This can lead to errors that may have been easily avoided with proper guidance.

Guide to Writing Texas Operating Agreement

Completing the Texas Operating Agreement form is an essential step in establishing the framework for your business. Once you have filled out the form, you will be able to outline the roles, responsibilities, and operational procedures for your LLC. This clarity will help ensure smooth operations and prevent misunderstandings among members.

- Begin by downloading the Texas Operating Agreement form from a reliable source.

- Enter the name of your LLC at the top of the form. Ensure it matches the name registered with the state.

- Provide the principal office address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Include their roles and ownership percentages.

- Outline the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Detail the procedures for adding new members or removing existing ones. This section should be clear to avoid future disputes.

- Include information about how profits and losses will be distributed among members. Be specific about the distribution percentages.

- Specify the duration of the LLC. Indicate whether it is perpetual or for a fixed term.

- Provide any additional provisions that may be necessary for your specific business needs. This could include decision-making processes or dispute resolution methods.

- Finally, have all members sign and date the agreement. Ensure that each signature is dated to reflect when the agreement was finalized.

Documents used along the form

When forming a limited liability company (LLC) in Texas, the Operating Agreement is a crucial document. However, several other forms and documents are often used in conjunction with it to ensure a smooth and legally compliant operation. Below is a list of key documents that you may encounter.

- Certificate of Formation: This document is filed with the Texas Secretary of State to officially create your LLC. It includes basic information such as the company name, registered agent, and purpose of the business.

- Employer Identification Number (EIN): Obtained from the IRS, this number is essential for tax purposes. It allows your LLC to hire employees, open a bank account, and file tax returns.

- Membership Interest Certificates: These certificates represent ownership in the LLC. They can be issued to members to document their share of the business and any rights associated with it.

- Bylaws: While not always required for LLCs, bylaws outline the internal rules and procedures for managing the company. They can help clarify roles and responsibilities among members.

- Operating Procedures: This document details how day-to-day operations will be handled. It can include policies on decision-making, meetings, and member duties.

- Member Buy-Sell Agreement: This agreement establishes the terms under which a member can sell their interest in the LLC. It helps prevent disputes and ensures a smooth transition of ownership.

- Annual Franchise Tax Report: Texas requires LLCs to file an annual report to maintain good standing. This report includes financial information and confirms the business's ongoing operations.

- Motor Vehicle Power of Attorney: This form is essential for authorizing someone to manage motor vehicle transactions on your behalf, such as title transfers and registrations. For more information, you can find the Motor Vehicle Power of Attorney form.

- Resolution of the Members: This document records important decisions made by the members of the LLC. It serves as an official record of actions taken and can be useful for legal purposes.

- Tax Election Forms: Depending on your business structure, you may need to file specific tax election forms with the IRS. This can affect how your LLC is taxed at the federal level.

These documents work together to provide a comprehensive framework for your LLC's operation and compliance. Understanding each one can help ensure that your business runs smoothly and meets all legal requirements.