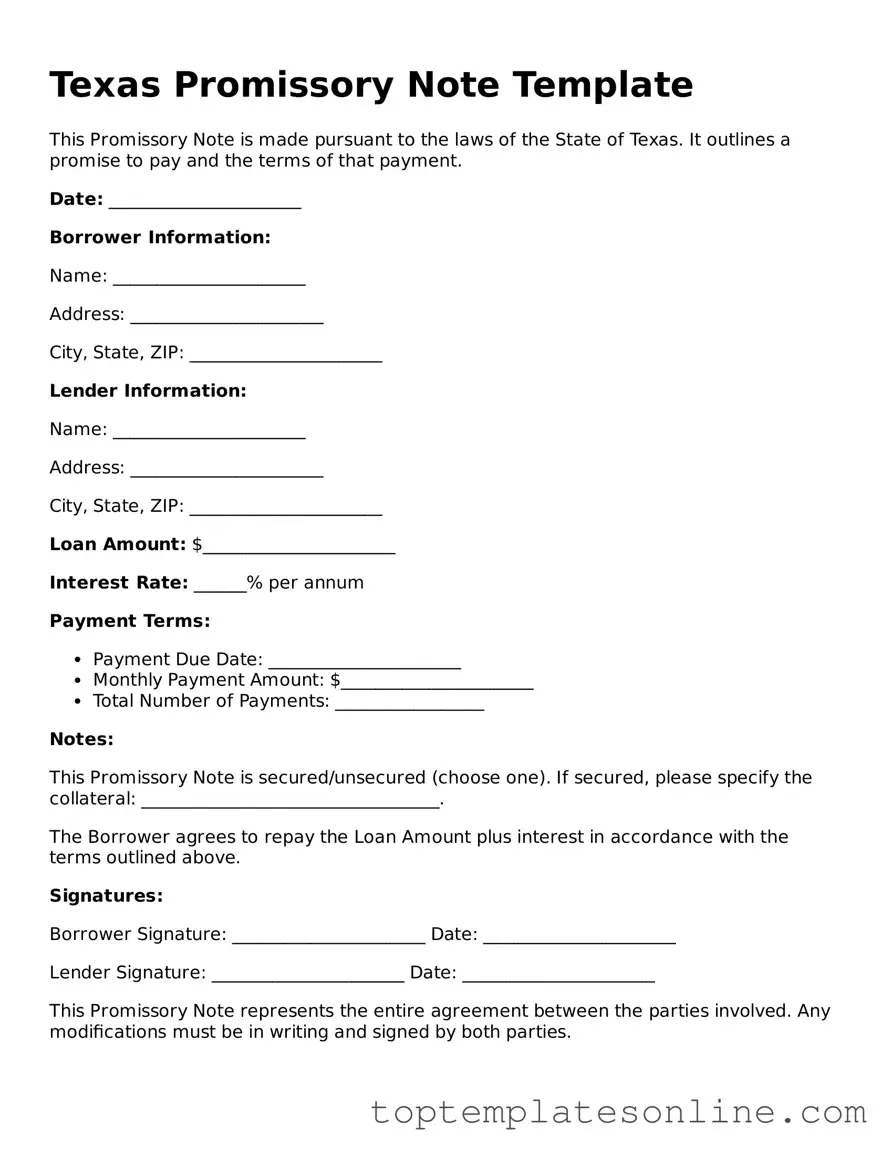

Blank Promissory Note Template for Texas State

The Texas Promissory Note form serves as a crucial financial instrument in lending and borrowing transactions across the state. This legally binding document outlines the terms under which one party, the borrower, agrees to repay a specific amount of money to another party, the lender, often with interest. Key elements of the form include the principal amount, interest rate, repayment schedule, and any applicable late fees or penalties for missed payments. Additionally, the note may specify whether the loan is secured or unsecured, which can significantly impact the lender's rights in the event of default. By clearly detailing these terms, the Texas Promissory Note helps to protect the interests of both parties involved, providing a clear framework for the loan agreement and ensuring that all parties understand their obligations. Understanding the nuances of this form is essential for anyone engaging in financial transactions in Texas, whether for personal loans, business financing, or real estate transactions.

Some Other State-specific Promissory Note Templates

Nc Promissory Note - Used in various contexts from personal loans to formal business agreements.

For those navigating the complexities of vehicle transactions, understanding the significance of a proper document is crucial. Our guide covers the essential aspects of completing a Motor Vehicle Bill of Sale form to ensure a seamless transfer of ownership between parties.

Michigan Promissory Note Example - A promissory note is a financial document that promises to pay a specific amount of money to a designated person or entity.

Common mistakes

-

Not including all necessary details: Many people forget to fill in essential information such as the names of the borrower and lender, the loan amount, and the interest rate. These details are crucial for the document to be valid.

-

Using incorrect dates: Some individuals make the mistake of entering the wrong date for the loan agreement or payment due dates. This can lead to confusion and potential disputes later on.

-

Failing to sign the document: A common oversight is not signing the promissory note. Without a signature, the note may not be enforceable, and the lender could face difficulties in collecting the debt.

-

Not understanding the terms: It's important to fully understand the terms of the loan before signing. Some people rush through the process without reading the fine print, which can result in unexpected obligations.

Guide to Writing Texas Promissory Note

Once you have the Texas Promissory Note form ready, you will need to fill it out carefully. Each section of the form requires specific information that must be accurate to ensure the document is valid. Follow these steps to complete the form correctly.

- Start with the date at the top of the form. Write the date when the note is being created.

- In the first blank, enter the name of the borrower. This is the person or entity that will be receiving the loan.

- Next, fill in the address of the borrower. This should be the current residential or business address.

- In the next section, write the name of the lender. This is the individual or organization providing the loan.

- Fill in the lender’s address in the space provided. Ensure this is accurate and up to date.

- Specify the amount of money being borrowed. Write this clearly in both numerical and written form to avoid confusion.

- Indicate the interest rate, if applicable. This should be expressed as a percentage.

- Next, outline the repayment terms. Specify how and when the borrower will repay the loan.

- If there are any late fees or penalties for missed payments, include those details in the appropriate section.

- Sign the document where indicated. The borrower should sign first, followed by the lender.

- Finally, date the signatures. This confirms when each party agreed to the terms of the note.

After completing the form, keep a copy for your records. It’s important for both parties to have a signed copy for reference. If you have any questions about the terms or need further assistance, consider consulting a legal professional.

Documents used along the form

When dealing with a Texas Promissory Note, several other forms and documents are often necessary to ensure clarity and legal compliance. Each document serves a specific purpose in the transaction process. Below is a list of commonly used documents that accompany a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the borrower and lender.

- Articles of Incorporation: This essential document establishes a corporation in New York, detailing important aspects such as the name, purpose, and structure of the company. For more insights, visit NY Templates.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security. It details the lender's rights in case of default.

- Disclosure Statement: This statement provides important information about the loan, such as the total cost of credit, including interest and fees. It helps borrowers understand their financial obligations.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the loan, adding an extra layer of security for the lender.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular installments, showing how much of each payment goes toward principal and interest.

- Default Notice: This document is issued if the borrower fails to make payments as agreed. It serves as a formal warning and outlines the lender's options moving forward.

- Release of Lien: Once the loan is repaid, this document is used to officially release any claims the lender had against the borrower's collateral.

- Assignment of Note: If the lender decides to transfer the loan to another party, this document facilitates that transfer, ensuring the new lender has the right to collect payments.

- Power of Attorney: In certain situations, a borrower may grant someone else the authority to act on their behalf in relation to the loan. This document outlines the scope of that authority.

Each of these documents plays a crucial role in the lending process. It is essential to have them prepared and reviewed to protect the interests of both parties involved. Ensure all documents are accurate and complete to avoid any complications down the line.