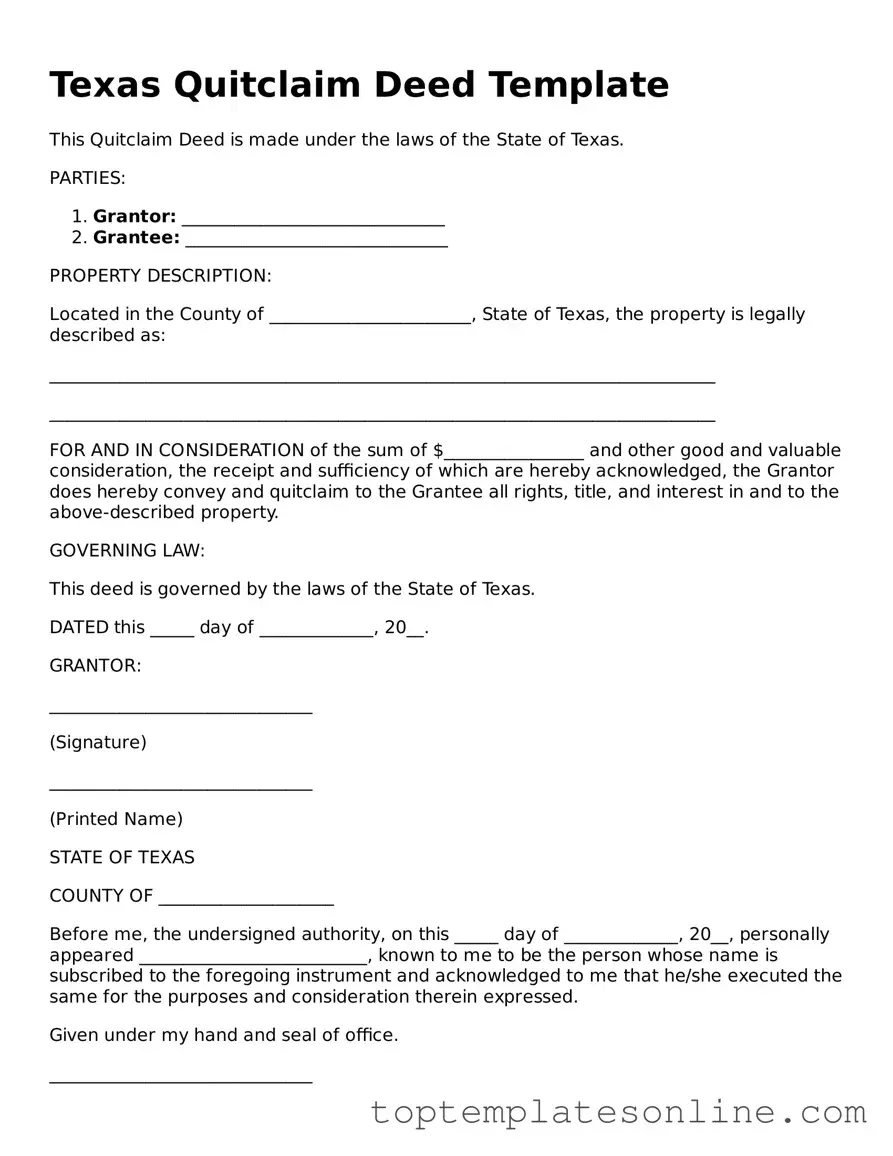

Blank Quitclaim Deed Template for Texas State

The Texas Quitclaim Deed form serves as a crucial legal instrument for transferring property rights between parties. Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property, nor does it provide any warranties against future claims. This makes it a straightforward option for transferring ownership, particularly in situations involving family members or when the parties know each other well. The form typically includes essential details such as the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Importantly, the quitclaim deed must be signed by the grantor in the presence of a notary public to ensure its validity. While this form is often used in divorce settlements, estate transfers, or to clear up title issues, it is essential for both parties to understand the implications of using a quitclaim deed, as it does not protect the grantee from any existing liens or claims against the property. Thus, while the Texas Quitclaim Deed form can facilitate a simple transfer of ownership, it is vital to approach its use with caution and awareness of potential risks.

Some Other State-specific Quitclaim Deed Templates

What Does a Deed Look Like in Nj - Generally inexpensive compared to other real estate transactions.

To ensure that the transaction is legally binding and compliant with state regulations, it is advisable to utilize a reliable template for the Arizona Motor Vehicle Bill of Sale. One excellent resource for this is Legal PDF Documents, which provides a comprehensive template that can be filled out with the necessary details to properly document the sale.

Quick Claim Deeds Michigan - A Quitclaim Deed is often considered a basic form of property transfer document.

Warranty Deed - Taking care of local jurisdiction requirements is necessary for a valid Quitclaim Deed.

Common mistakes

-

Incorrect Grantee Information: Many people fail to provide accurate details about the grantee, such as the full legal name and address. This can lead to confusion in property ownership.

-

Omitting a Legal Description: A common mistake is not including a precise legal description of the property. Without this, the deed may not be valid, as the property cannot be clearly identified.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be legally binding. Some individuals overlook this crucial step, which can result in the deed being challenged later.

-

Failing to Check for Liens: Before transferring property, it’s essential to ensure there are no outstanding liens. Many people neglect this, which can lead to unexpected financial burdens.

-

Improper Witness Signatures: Some states require witnesses to sign the deed. In Texas, while it’s not mandatory, having witnesses can help avoid disputes. Failing to do so can be a missed opportunity for added security.

-

Not Recording the Deed: After completing the quitclaim deed, it’s vital to record it with the county clerk’s office. Many individuals forget this step, which can cause issues with proving ownership in the future.

Guide to Writing Texas Quitclaim Deed

Once you have gathered all necessary information, you can begin filling out the Texas Quitclaim Deed form. This document will need to be completed accurately to ensure the transfer of property rights is valid. Follow the steps below to complete the form correctly.

- Obtain the Form: Download the Texas Quitclaim Deed form from a reliable source or visit your local county clerk’s office to obtain a physical copy.

- Identify the Grantor: In the first section of the form, write the full name of the person or entity transferring the property (the grantor).

- Identify the Grantee: Next, enter the full name of the person or entity receiving the property (the grantee).

- Provide Property Description: Include a detailed description of the property being transferred. This should include the address, lot number, and any other identifying details.

- Consideration Amount: State the consideration amount, which is the value exchanged for the property. This can be a nominal amount, such as $10, if no significant payment is involved.

- Sign the Document: The grantor must sign the form in the designated area. If there are multiple grantors, each must sign.

- Notarization: Have the signature(s) notarized. A notary public will verify the identity of the grantor(s) and witness the signing.

- File the Deed: Submit the completed and notarized Quitclaim Deed to the county clerk’s office in the county where the property is located. There may be a filing fee.

After completing these steps, the Quitclaim Deed will be officially recorded, and the property transfer will be documented. Keep a copy of the filed deed for your records.

Documents used along the form

When dealing with property transfers in Texas, the Quitclaim Deed is a common document used to convey ownership. However, several other forms and documents often accompany it to ensure a smooth and legally sound transaction. Below is a list of these essential documents, each serving a specific purpose in the process.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, it offers protection to the buyer against any future claims on the property.

- Property Transfer Tax Form: This form is typically required by the state to report the transfer of property ownership. It ensures that any applicable taxes are assessed and paid during the transaction.

- Affidavit of Heirship: In cases where property is inherited, this document establishes the heirs' rights to the property. It helps clarify ownership and can be crucial when transferring property that has not gone through probate.

- Title Insurance Policy: This policy protects the buyer from any future claims or disputes regarding ownership. It ensures that the title is clear and can provide peace of mind in the event of any unforeseen issues.

- Employment Verification Form: For confirming employment history, ensure to utilize the essential Employment Verification form resources for accurate document preparation.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including price, closing date, and any contingencies. It serves as a binding agreement between the buyer and seller before the Quitclaim Deed is executed.

- Closing Statement: Also known as a HUD-1 form, this document details all financial transactions involved in the sale, including fees, commissions, and the final amount due at closing. It ensures transparency in the financial aspects of the property transfer.

Understanding these documents can greatly assist in navigating the complexities of property transactions in Texas. Each form plays a vital role in ensuring that the transfer of ownership is clear, legal, and protects the interests of all parties involved.