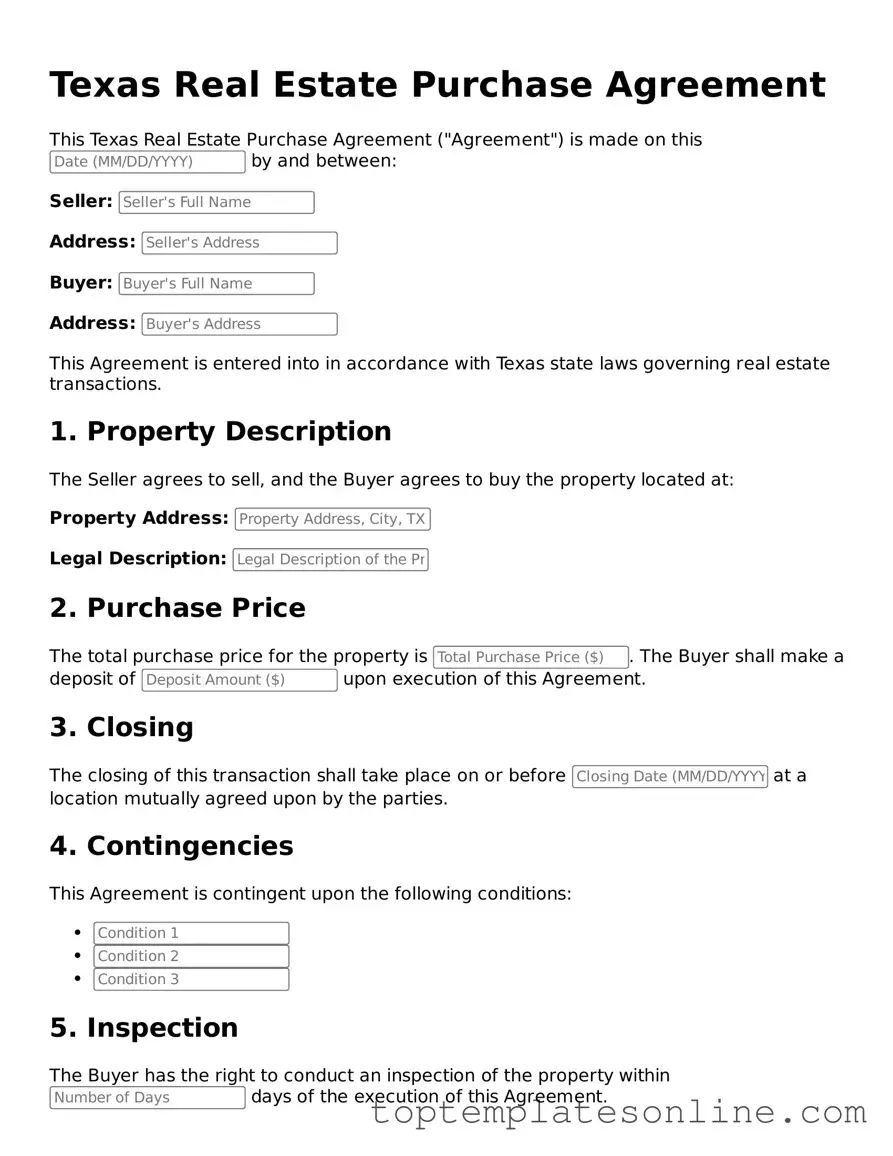

Blank Real Estate Purchase Agreement Template for Texas State

In Texas, the Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property. This legally binding contract outlines the terms and conditions agreed upon by both the buyer and the seller, ensuring that all parties are on the same page. Key components of the form include the purchase price, financing details, and the closing date, which collectively establish the framework for the transaction. Additionally, the agreement addresses contingencies, such as inspections and financing approval, allowing buyers and sellers to navigate potential hurdles with clarity. The inclusion of earnest money provisions also plays a vital role, as it demonstrates the buyer's commitment while protecting the seller's interests. Furthermore, the form outlines the responsibilities of both parties regarding property disclosures and any potential repairs. Understanding these elements is essential for anyone involved in a real estate transaction in Texas, as they help to facilitate a smooth transfer of ownership and minimize misunderstandings.

Some Other State-specific Real Estate Purchase Agreement Templates

North Carolina Association of Realtors - Buyers should check for any special assessments that affect the property.

This informative guide on creating an effective Employee Handbook is vital for any organization seeking to establish clear workplace guidelines. By utilizing this template, employers can ensure that employees are well-informed of their rights and responsibilities. For further assistance, check out our essential Employee Handbook creation guide.

Purchasing Agreements - It might clarify the conditions under which the buyer may back out.

Common mistakes

-

Not Including Accurate Property Details: Buyers and sellers often forget to include complete property descriptions. This includes the legal description, address, and any relevant details about the property. Missing information can lead to disputes later.

-

Neglecting to Specify the Purchase Price: It's crucial to clearly state the purchase price in the agreement. Leaving this blank or writing it incorrectly can create confusion and complicate the transaction.

-

Overlooking Contingencies: Many people fail to include necessary contingencies, such as financing or inspection contingencies. These clauses protect the buyer's interests and should not be ignored.

-

Incorrectly Filling Out Dates: Dates for the contract signing, closing, and any contingencies must be accurate. Errors in dates can delay the process or lead to legal issues.

-

Not Initialing Changes: If any changes are made to the agreement, all parties must initial these changes. Failing to do so can result in misunderstandings and disputes down the line.

Guide to Writing Texas Real Estate Purchase Agreement

Completing the Texas Real Estate Purchase Agreement form is an important step in the home buying process. This document outlines the terms of the sale and ensures that both the buyer and seller are on the same page. Follow these steps carefully to fill out the form accurately.

- Begin by entering the date at the top of the form.

- Provide the names of the buyer(s) and seller(s) in the designated sections.

- Fill in the property address, including city, state, and ZIP code.

- Specify the purchase price of the property in the appropriate field.

- Indicate the amount of earnest money to be deposited and the due date for this payment.

- Outline the financing terms, including whether the purchase is cash, conventional loan, or another type of financing.

- Detail any contingencies, such as financing or inspection requirements, that must be met for the sale to proceed.

- Include any personal property that will be included in the sale, such as appliances or fixtures.

- Review the closing date and any specific terms regarding the transfer of possession.

- Both buyer and seller should sign and date the agreement at the bottom of the form.

Documents used along the form

When engaging in a real estate transaction in Texas, several forms and documents work in conjunction with the Texas Real Estate Purchase Agreement. These documents help clarify the terms of the sale and protect the interests of both the buyer and seller. Below are some key forms commonly used alongside the Purchase Agreement.

- Seller's Disclosure Notice: This document requires the seller to disclose any known issues with the property. It includes details about the condition of the home, such as past repairs, pest infestations, and other relevant information that could affect the buyer's decision.

- California Trailer Bill of Sale: This essential document facilitates the transfer of ownership for trailers in California, ensuring both parties have a clear record of the sale. For more information, refer to the Bill of Sale for a Trailer.

- Title Commitment: Issued by a title company, this document outlines the terms of the title insurance policy. It confirms the seller's ownership and identifies any liens or claims against the property that must be resolved before closing.

- Earnest Money Contract: This agreement details the deposit made by the buyer to demonstrate their serious intent to purchase the property. It specifies the amount, conditions for the deposit, and how it will be handled if the sale does not proceed.

- Closing Disclosure: Provided to both parties before closing, this document outlines the final terms of the loan, including all closing costs and fees. It ensures that buyers understand their financial obligations before finalizing the sale.

These forms are essential in ensuring a smooth transaction and protecting the rights of all parties involved. Familiarity with these documents can help buyers and sellers navigate the real estate process more confidently.