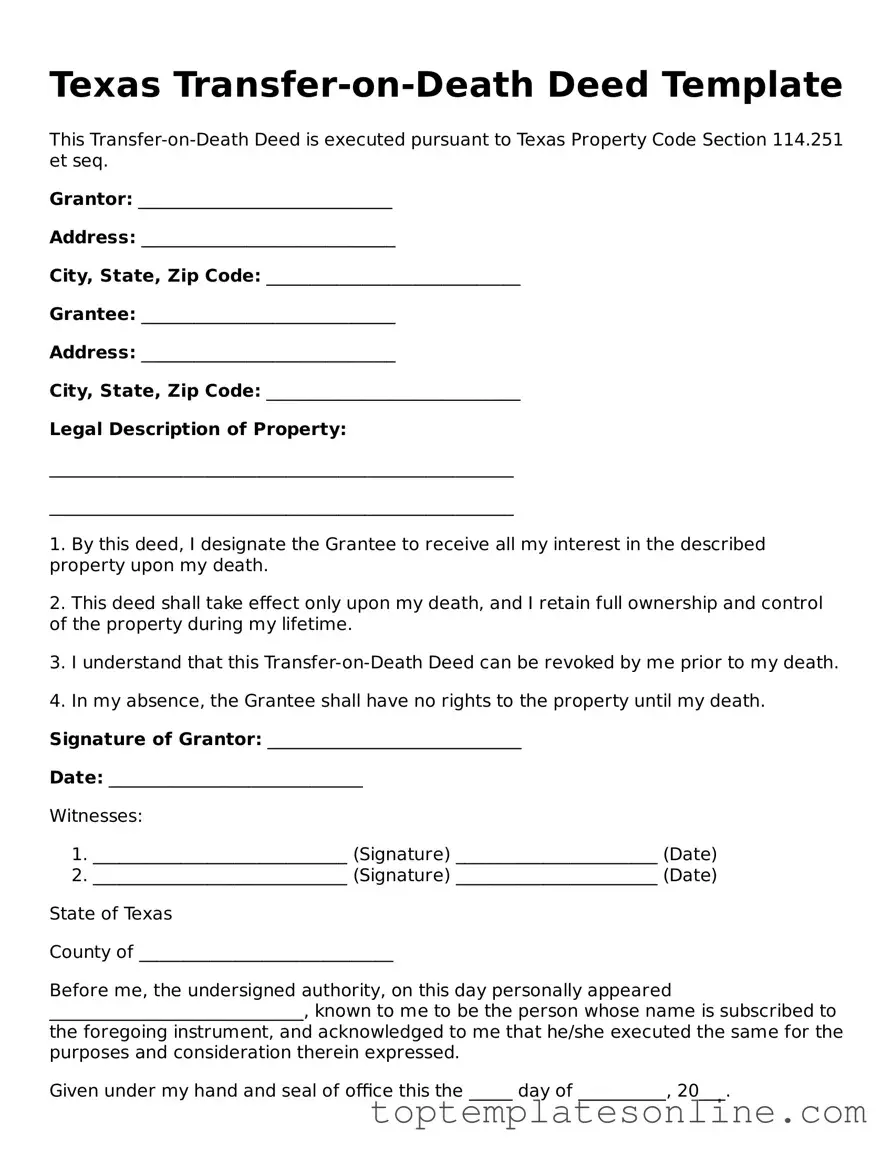

Blank Transfer-on-Death Deed Template for Texas State

In the state of Texas, planning for the future can take many forms, and one increasingly popular option is the Transfer-on-Death Deed (TODD). This legal document allows property owners to designate one or more beneficiaries who will automatically receive their real estate upon the owner's death, bypassing the often lengthy and costly probate process. By utilizing a TODD, individuals can maintain full control of their property during their lifetime, ensuring that their wishes are honored without the complications that can arise from traditional inheritance methods. The form requires specific information, including the property description and the names of the beneficiaries, and must be properly executed and recorded to be valid. Moreover, this deed can be revoked or altered at any time before the owner's passing, providing a level of flexibility that many find appealing. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone considering this option as part of their estate planning strategy.

Some Other State-specific Transfer-on-Death Deed Templates

Transfer on Death Designation Affidavit - Those in blended families often utilize this deed to clearly outline inheritance intentions.

For individuals looking to establish a limited liability company, understanding the necessary documents is critical. The intricacies of the managing team can be encapsulated through the process of completing an operating agreement for your LLC, which outlines the responsibilities and procedures essential for smooth operations.

How to Avoid Probate in Georgia - Execution of this deed typically requires a signature and may need witnesses or notarization, depending on the state.

Problems With Transfer on Death Deeds - This tool is useful for estate planning and reducing future complications.

Common mistakes

-

Incorrect Property Description: People often fail to provide a complete and accurate description of the property. This can lead to confusion or disputes later on.

-

Not Naming Beneficiaries: Some individuals forget to name beneficiaries or do so incorrectly. Each beneficiary should be clearly identified to avoid complications.

-

Improper Signatures: Failing to sign the deed or having it signed by someone other than the property owner can invalidate the document.

-

Missing Witnesses: In Texas, the deed must be signed in the presence of two witnesses. Omitting this step can render the deed unenforceable.

-

Not Recording the Deed: After filling out the form, it’s essential to record it with the county clerk. Neglecting this step means the deed may not be recognized when needed.

-

Failing to Update the Deed: Life changes such as marriage, divorce, or the death of a beneficiary should prompt a review and possible update of the deed.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Transfer-on-Death Deeds. Not adhering to Texas-specific regulations can lead to issues.

Guide to Writing Texas Transfer-on-Death Deed

After completing the Texas Transfer-on-Death Deed form, you will need to file it with the county clerk in the county where the property is located. Ensure that you follow the local filing requirements and pay any applicable fees. This step is crucial for the deed to be effective upon your passing.

- Obtain the Texas Transfer-on-Death Deed form from a reliable source, such as the Texas Secretary of State's website or a legal office.

- Fill in your name and address in the designated section as the grantor (the person transferring the property).

- Provide the name and address of the beneficiary (the person receiving the property upon your death).

- Clearly describe the property being transferred. Include the property's legal description, which can be found on the current deed or tax records.

- Indicate whether the transfer is subject to any conditions or limitations. If none, state that clearly.

- Sign the deed in the presence of a notary public. Ensure that the notary signs and seals the document as well.

- Make copies of the signed and notarized deed for your records and for the beneficiary.

- File the original deed with the county clerk's office in the county where the property is located.

Documents used along the form

When preparing to execute a Texas Transfer-on-Death Deed, several other documents may be necessary to ensure a smooth transfer of property upon the owner's death. Each of these documents serves a specific purpose in the estate planning and property transfer process. Below is a list of commonly used forms and documents that may accompany the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person wishes to distribute their assets upon their death. It can provide additional instructions that complement the Transfer-on-Death Deed.

- Durable Power of Attorney: A Durable Power of Attorney allows an individual to designate someone else to make decisions on their behalf regarding financial and legal matters, especially if they become incapacitated.

- Living Will: This document specifies a person's wishes regarding medical treatment in situations where they are unable to communicate their preferences, ensuring their healthcare decisions are honored.

- Beneficiary Designation Forms: Used for accounts like life insurance or retirement plans, these forms allow individuals to designate beneficiaries directly, which can work alongside a Transfer-on-Death Deed.

- Dirt Bike Bill of Sale: The NY Templates offer a legal document specifically designed for the sale and transfer of ownership of dirt bikes in New York, ensuring that all necessary information is accurately recorded.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person and can be useful in clarifying property ownership when no will exists.

- Property Deed: The original deed for the property being transferred may be needed to confirm ownership and verify the legal description of the property.

- Notice of Death: Filing a Notice of Death with the appropriate county office can formally notify authorities and interested parties of the property owner’s passing.

- Estate Inventory: An inventory of the deceased’s assets can help in understanding the overall estate and how the Transfer-on-Death Deed fits into the larger picture.

These documents, when used in conjunction with the Texas Transfer-on-Death Deed, can help facilitate a clearer and more efficient transfer of property, ensuring that the wishes of the property owner are respected and upheld. Proper preparation and understanding of these forms can significantly ease the transition for heirs and beneficiaries.