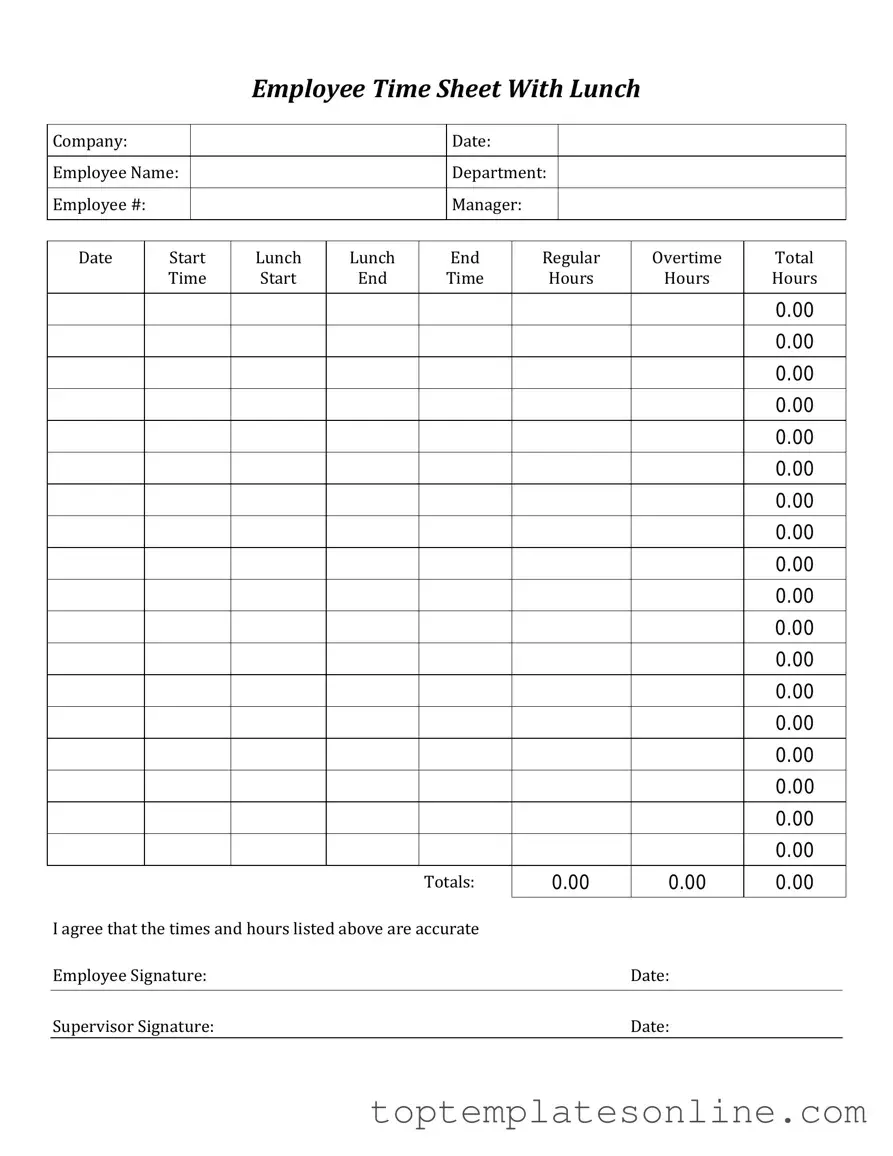

Fillable Time Card Form

The Time Card form is an essential tool for tracking employee hours and ensuring accurate payroll processing. This form typically includes sections for recording the date, start and end times of shifts, and total hours worked. Employees often use it to detail their breaks and any overtime hours, providing a clear record of their work schedule. Employers rely on the Time Card form to verify attendance and calculate wages, which underscores its importance in maintaining compliance with labor laws. By standardizing the process of timekeeping, the form helps prevent disputes over hours worked and fosters transparency in the workplace. Additionally, digital versions of the Time Card form have emerged, streamlining the submission process and enhancing accessibility for both employees and management.

Common PDF Templates

How Long Does College Credits Last - The form includes a section for official use only to track your request's progress.

Adp Paystub - The pay stub reflects the relationship between hours worked and compensation received.

For those navigating the complexities of starting a business, understanding the nuances of an LLC is critical. Utilizing a well-structured legal Operating Agreement template can provide clarity on member roles and operational guidelines.

Ucc 1-308 Meaning - It emphasizes the importance of understanding one's legal standing.

Common mistakes

-

Incorrect Dates: Many people forget to double-check the dates they enter. It's important to ensure that the start and end dates of the pay period are accurate. Missing or wrong dates can lead to payment delays.

-

Missing Signatures: A common oversight is forgetting to sign the time card. Without a signature, the form may be considered incomplete and could be rejected by the payroll department.

-

Wrong Hours: Entering the wrong number of hours worked is another frequent mistake. Always verify that the hours reflect actual work time. Inaccurate hours can result in underpayment or overpayment.

-

Omitting Breaks: Some individuals forget to account for breaks. It's crucial to include any unpaid breaks taken during the workday. Failing to do so can affect total hours and pay.

-

Using Incorrect Codes: Each job or task may have specific codes that need to be used on the time card. Using the wrong code can cause confusion and delays in processing your payment.

Guide to Writing Time Card

After you have gathered all necessary information, you are ready to fill out the Time Card form. This form requires specific details about your hours worked and any applicable breaks. Follow these steps to ensure accurate completion.

- Begin by entering your name in the designated field at the top of the form.

- Next, fill in the date for the time period you are reporting.

- Record your start time in the appropriate section. Make sure to use the correct format.

- Enter your end time in the next section. Again, use the same time format as before.

- If applicable, list any breaks taken during your shift in the designated area.

- Calculate the total hours worked. This should be done by subtracting your start time from your end time and accounting for any breaks.

- Write the total hours worked in the specified field.

- Review the completed form for accuracy. Ensure that all fields are filled out correctly.

- Sign and date the form at the bottom to certify that the information is true and accurate.

Documents used along the form

When managing employee hours and payroll, several forms and documents work alongside the Time Card form. Each of these documents serves a specific purpose, helping to ensure accurate record-keeping and smooth processing of payroll. Below is a list of commonly used forms that complement the Time Card.

- Employee Information Form: This document collects essential details about the employee, such as their name, address, and Social Security number. It helps the employer maintain accurate records for tax and benefits purposes.

- Durable Power of Attorney Form: This legal document allows an individual to designate another person to make financial and legal decisions on their behalf, ensuring that their affairs are managed according to their wishes, even if they become incapacitated. For more information, refer to NY Templates.

- Payroll Authorization Form: This form grants permission for payroll deductions, such as taxes or benefits. Employees must complete this to ensure their paychecks reflect any agreed-upon deductions.

- Leave Request Form: Employees use this form to request time off for vacations, sick days, or personal reasons. It helps employers track absences and manage staffing needs effectively.

- Overtime Approval Form: When employees work beyond their scheduled hours, this form must be completed to document the overtime. It ensures that employees are compensated fairly for extra work.

- Expense Reimbursement Form: Employees submit this form to claim reimbursement for work-related expenses, such as travel or supplies. It helps maintain transparency and accountability in spending.

- Direct Deposit Authorization Form: This document allows employees to authorize their paycheck to be directly deposited into their bank account. It streamlines the payment process and enhances convenience for everyone involved.

Each of these forms plays a vital role in the payroll process, ensuring that both employees and employers have clear and organized records. By using these documents alongside the Time Card form, businesses can maintain accuracy and efficiency in their payroll operations.