Attorney-Approved Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TOD Deed) serves as an important tool for property owners in the United States who wish to streamline the transfer of real estate upon their death. This legal instrument allows individuals to designate one or more beneficiaries who will automatically receive the property, bypassing the often lengthy and costly probate process. By executing a TOD Deed, property owners retain full control over their property during their lifetime, as the deed does not take effect until death. This means that the owner can sell, mortgage, or otherwise manage the property without restrictions. Additionally, the TOD Deed must be properly recorded in the appropriate jurisdiction to ensure its validity. Importantly, this form can be revoked or altered at any time before the owner's death, providing flexibility in estate planning. It is crucial for individuals to understand the implications of using a TOD Deed, including how it interacts with other estate planning tools and potential tax considerations for beneficiaries.

State-specific Information for Transfer-on-Death Deed Documents

Find More Types of Transfer-on-Death Deed Templates

What Is Deed in Lieu of Foreclosure - Homeowners should understand the tax implications of a Deed in Lieu of Foreclosure before proceeding.

New Jersey Quitclaim Deed Form - Utilizing a Quitclaim Deed effectively can save time and legal fees in property transactions.

For those looking to navigate the complexities of renting in Florida, the Florida Residential Lease Agreement is a crucial tool that helps clarify the legal responsibilities of each party. To ensure you have the correct documentation, you can find a reliable source for this form at Florida Forms, which serves as a valuable resource for both landlords and tenants in understanding their rights and obligations.

Correction Deed Form California - This form provides a legally binding solution to rectify property errors.

Common mistakes

-

Failing to include the full legal name of the property owner. This can lead to confusion and potential disputes.

-

Not providing the complete legal description of the property. A vague description may result in the deed being invalid.

-

Overlooking the requirement for notarization. Without a notary's signature, the deed may not be recognized by the court.

-

Not listing the beneficiary correctly. Ensure the beneficiary’s name is spelled accurately and matches their legal identification.

-

Failing to sign the deed in the presence of a notary. This step is crucial for the document’s validity.

-

Neglecting to check state-specific laws. Each state has its own regulations regarding Transfer-on-Death Deeds.

-

Using outdated forms. Always obtain the most current version of the deed to avoid legal issues.

-

Not informing the beneficiary about the deed. Communication can prevent misunderstandings later on.

-

Ignoring tax implications. Understanding how the transfer may affect taxes is essential for both the owner and the beneficiary.

-

Failing to record the deed with the appropriate county office. Without proper recording, the deed may not be enforceable.

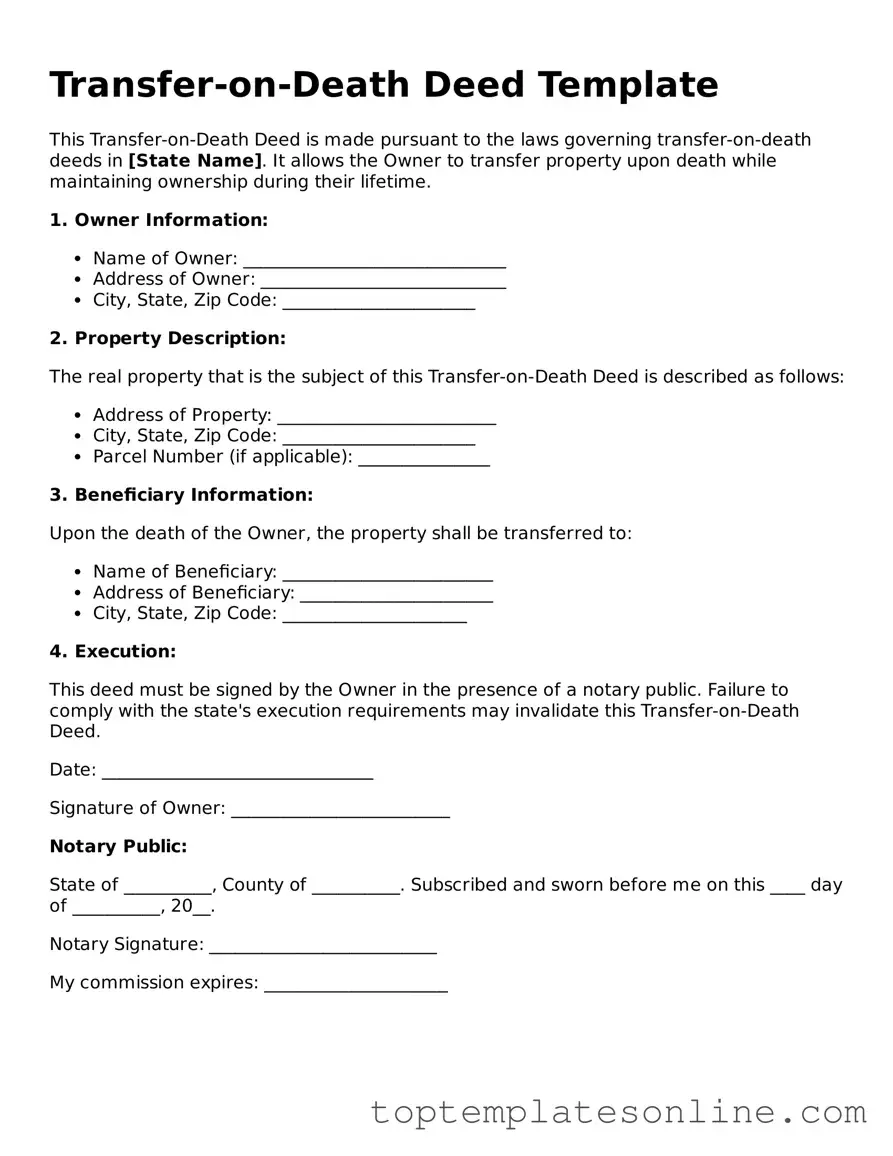

Guide to Writing Transfer-on-Death Deed

After obtaining the Transfer-on-Death Deed form, you will need to complete it carefully to ensure that it reflects your intentions accurately. Once you fill out the form, you will be ready to submit it according to your state's requirements.

- Begin by entering the name of the property owner at the top of the form. Make sure to include the full legal name.

- Next, provide the address of the property. This should include the street address, city, state, and zip code.

- Identify the beneficiaries by listing their full names. You may designate more than one beneficiary if desired.

- Include the relationship of each beneficiary to the property owner. This helps clarify the connection.

- Specify the percentage of the property each beneficiary will receive if there are multiple beneficiaries.

- Sign and date the form at the designated areas. Ensure your signature is clear and matches the name provided at the top.

- Have the deed notarized. A notary public will verify your identity and witness your signature.

- Finally, file the completed deed with your local county recorder’s office. Be sure to check for any filing fees that may apply.

Documents used along the form

A Transfer-on-Death Deed is a useful tool for passing property to beneficiaries without going through probate. However, there are several other forms and documents that may accompany this deed to ensure everything is in order. Here are five important documents often used in conjunction with a Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by addressing other personal property not covered by the deed.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance policies or retirement accounts. They specify who will receive the benefits upon the account holder's death, ensuring a smooth transfer.

- Access-A-Ride NYC Application Form: This document is crucial for eligible individuals to enroll in the Commuter Benefits Program and can be obtained from NY Templates.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person. It may be needed if there are questions about the rightful beneficiaries of the property covered by the Transfer-on-Death Deed.

- Property Title Documents: These documents prove ownership of the property. They are essential for confirming that the property being transferred via the deed is indeed owned by the grantor.

- Death Certificate: A legal document that confirms a person's death. It may be required to complete the transfer of property to beneficiaries after the grantor passes away.

Having these documents ready can streamline the process and provide clarity for everyone involved. It’s always a good idea to consult with a professional to ensure that all paperwork is properly completed and filed.