Attorney-Approved Vehicle Repayment Agreement Form

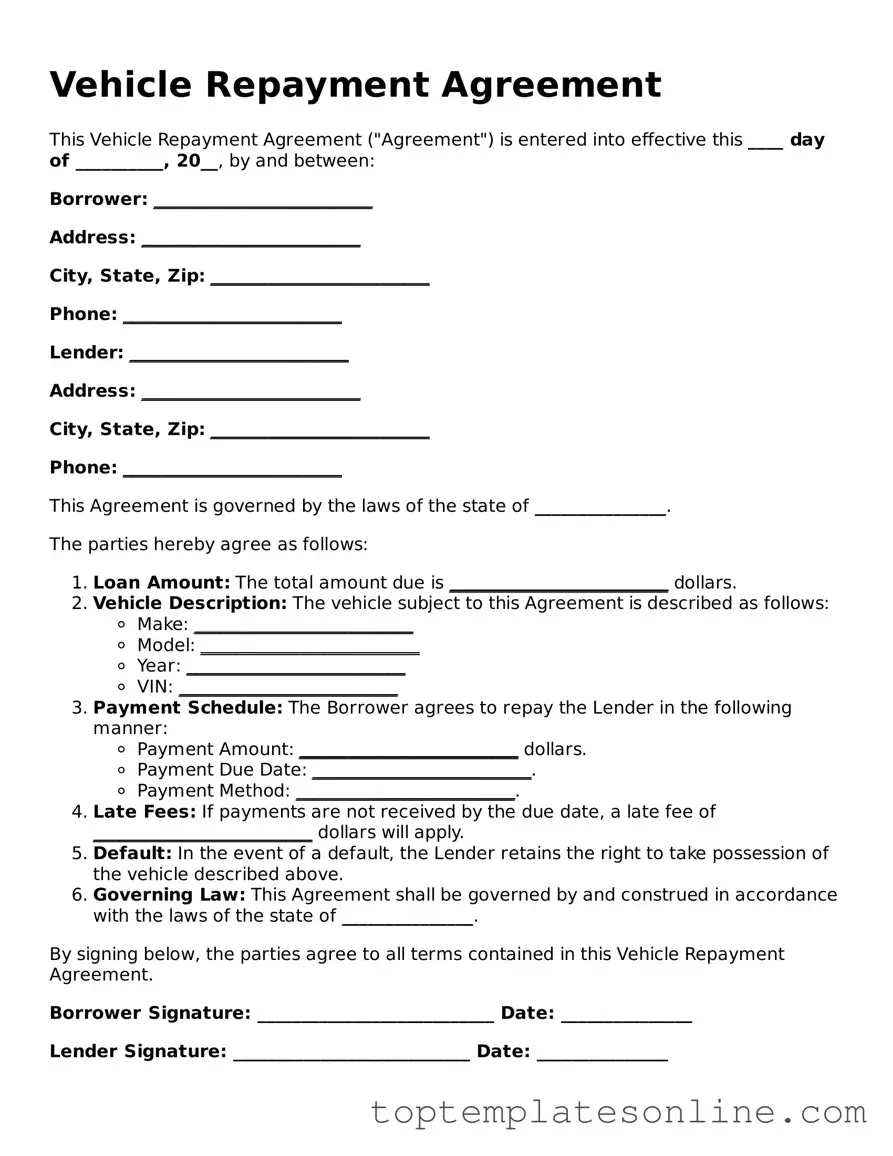

The Vehicle Repayment Agreement form plays a crucial role in the financial landscape for individuals and businesses alike, especially when it comes to acquiring vehicles through loans or financing. This document outlines the terms and conditions under which a borrower agrees to repay the lender for the vehicle. Key components of the form include the total amount financed, the interest rate, and the repayment schedule, which details how and when payments will be made. Additionally, it may specify any penalties for late payments, the rights and responsibilities of both parties, and what happens in the event of default. Understanding these elements is essential for anyone entering into a vehicle financing arrangement, as it ensures clarity and protects the interests of both the borrower and the lender. By clearly delineating expectations, the Vehicle Repayment Agreement form serves as a foundational tool in fostering transparent financial relationships.

Common Templates

Employee Incident Report - Use this form to report any employee accidents that occur on the job.

To ensure a smooth transaction when buying or selling a motorcycle, it's crucial to use a well-prepared document. This is where the importance of a properly drafted motorcycle bill of sale form comes into play. For more information, see our guide on the vital motorcycle bill of sale documentation.

Geico Supplement Request - Consider reaching out for assistance if you find the process confusing.

Common mistakes

-

Inaccurate Information: One common mistake is providing incorrect personal or vehicle information. Ensure that names, addresses, and vehicle identification numbers (VIN) are accurate. Double-check for typos or missing details.

-

Missing Signatures: Failing to sign the form is a frequent oversight. All required parties must provide their signatures. This step is crucial for the agreement to be valid.

-

Not Reviewing Terms: Some individuals skip reading the terms and conditions before signing. Understanding the repayment terms, interest rates, and any fees is essential to avoid future disputes.

-

Ignoring Required Documentation: Submitting the form without including necessary supporting documents can lead to delays. Make sure to attach any required identification or proof of income as specified in the instructions.

Guide to Writing Vehicle Repayment Agreement

After you have gathered the necessary information, you are ready to complete the Vehicle Repayment Agreement form. This form is essential for establishing the terms of repayment for your vehicle. Follow these steps carefully to ensure accuracy.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your phone number and email address for contact purposes.

- Next, enter the vehicle identification number (VIN) of your vehicle.

- Indicate the make, model, and year of the vehicle.

- State the total amount owed on the vehicle.

- Specify the repayment amount you propose to make each month.

- Include the date you wish to begin repayments.

- Sign and date the form to confirm your agreement.

Once you have completed the form, review it for any errors. Ensure all information is accurate and legible. After that, submit the form as instructed to move forward with the repayment process.

Documents used along the form

The Vehicle Repayment Agreement form is an important document for those entering into a financing arrangement for a vehicle. It outlines the terms of repayment and the responsibilities of both parties. Along with this form, several other documents are commonly used to ensure clarity and legality in the transaction. Here’s a list of related forms and documents you might encounter.

- Bill of Sale: This document serves as proof of the sale of the vehicle. It includes details such as the buyer's and seller's information, vehicle identification number (VIN), and sale price.

- Loan Application: A loan application is completed by the buyer to request financing from a lender. It collects personal and financial information to assess the buyer's creditworthiness.

- Credit Report: A credit report provides a detailed account of a person's credit history. Lenders use this to evaluate the risk of lending money for the vehicle purchase.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes the loan amount, interest rate, and repayment schedule.

- Title Transfer Form: This form is used to transfer ownership of the vehicle from the seller to the buyer. It must be filed with the appropriate state agency to update vehicle registration records.

- Insurance Verification: Proof of insurance is often required before finalizing the vehicle purchase. This document confirms that the buyer has adequate coverage for the vehicle.

- Boat Bill of Sale: For those looking to buy or sell a boat in New York, the NY Templates has a comprehensive Bill of Sale template that outlines the necessary details to officialize the transaction. This document is crucial for a smooth transfer of ownership and helps protect both parties involved.

- Odometer Disclosure Statement: This statement certifies the vehicle's mileage at the time of sale. It helps prevent odometer fraud and is often required by law.

- Financing Agreement: This document details the terms of the loan, including the interest rate, payment schedule, and any fees associated with the financing.

- Payment Schedule: A detailed outline of when payments are due, the amount of each payment, and how long the repayment period will last.

Understanding these documents can help ensure a smoother transaction when purchasing a vehicle. Each plays a role in protecting both the buyer and the seller, providing clarity and security in the financing process.